In an era where some investors prioritize stable income and reliable returns, artificial intelligence (AI) has identified three standout dividend stocks poised to shine in the latter half of 2024.

These companies have built a track record of resilience, consistent performance, and a commitment to rewarding shareholders through reliable dividend distributions.

In this line, Finbold turned to OpenAI’s latest and most advanced AI platform, ChatGPT-4o, to gather insights on the must-have dividend stocks for the second half of 2024.

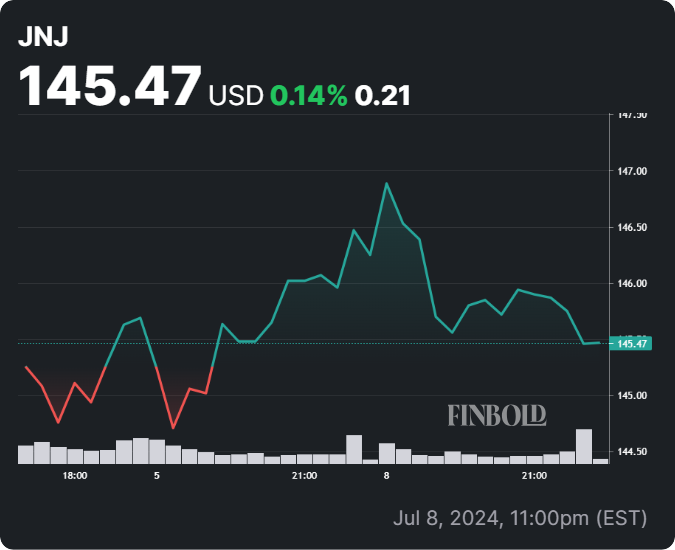

Johnson & Johnson stock

At the top of ChatGPT-4o’s list is Johnson & Johnson (NYSE: JNJ). The AI tool noted that the company stands out as a stalwart in the healthcare sector, offering a dividend yield of approximately 2.8%. Known for its diversified portfolio encompassing pharmaceuticals, medical devices, and consumer health products, Johnson & Johnson ensures consistent returns, making it a reliable choice for dividend investors.

In regards to stock performance, JNJ has shown bearish sentiments in 2024. By the close of markets on July 8, the stock was valued at $145, losing over 9% on a year-to-date (YTD) basis.

Procter & Gamble Co. stock

Second on the list is Procter & Gamble Co. (NYSE: PG), a leader in consumer goods with a dividend yield of around 2.5%. The AI platform acknowledged that with a portfolio spanning many globally recognized brands, Procter & Gamble generates strong cash flow, providing stability and consistent dividend growth. Its defensive business model further solidifies its appeal in uncertain market conditions.

Procter & Gamble has seen positive growth in 2024, with the equity surging over 11% YTD. By press time, the stock was valued at $166.52.

Coca-Cola stock

Third on the list is beverage giant Coca-Cola Company (NYSE: KO), with ChatGPT-4o noting that a dividend yield of approximately 3.1% is ideal for investors. Coca-Cola delivers steady cash flows and reliable dividend payments by leveraging its strong brand portfolio and extensive distribution network.

Additionally, the AI tool pointed out that the company’s adaptability to changing consumer preferences underscores its resilience and makes it a cornerstone in dividend-focused portfolios.

Coca-Cola has registered positive gains in 2024, with an increase of over 5% and a share price of $62 at the time of reporting.

Google Gemini Inisghts

Elsewhere, Alphabet’s (NASDAQ: GOOGL) Google Gemini AI platform offered insights on the three choice stocks. The platform noted potential advantages for investors looking for stability and reliable income, highlighting Johnson & Johnson, Procter & Gamble, and Coca-Cola as attractive options.

These established companies have long histories of paying dividends, suggesting lower risks of dividend cuts than newer firms. They also have a track record of consistently increasing dividends over time, making them appealing for income-oriented investors.

However, the tool noted that these companies might have downsides, including lower dividend yields and slower growth potential over time.

In summary, both AI platforms emphasized that selecting the right stock depends on individual investment goals and risk tolerance.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.