In this guide, we’ll look at dividend investing, why it may be a profitable investment strategy and the pros and cons of this type of investing approach. At the same time, we’ll go over some of the most common mistakes to avoid as a beginner and important things to consider when choosing a dividend stock.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Introduction to dividend investing strategy

Share price appreciation is the key thing most investors think of when they have to spell out their investing goals. However, dividend investors prioritize a company’s dividend yield over anything else, including price appreciation.

A dividend investing strategy is typically seen as a passive income investment strategy for older investors looking to live off dividends in retirement, but it can also be a profitable investment strategy for younger investors. Starting young can be advantageous as companies usually increase their dividend yield over time.

What is dividend investing?

Dividend investors usually invest only in companies with a dividend, and their goal is to create a substantial stream of passive income. With dividend investing, an investor can potentially profit off the dividend as well as share price appreciation.

Companies usually pay out a dividend every quarter after the board has approved it. To judge whether a company’s dividend is attractive, investors look at a company’s dividend yield. The dividend yield is calculated by dividing a company’s annual dividend per share by the current share price.

Investing for beginners:

- What is Investing? Putting Money to Work

- 17 Common Investing Mistakes to Avoid

- 15 Top-Rated Investment Books of All Time

- How to Buy Stocks? Complete Beginner’s Guide

- 10 Best Stock Trading Books for Beginners

- 15 Highest-Rated Crypto Books for Beginners

- 6 Basic Rules of Investing

- Dividend Investing for Beginners

- Top 6 Real Estate Investing Books for Beginners

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Is dividend investing worth it?

Many investors are attracted to dividend investing because it’s one of the few sources of true passive income. Ownership of shares entitles an investor to dividends, usually every quarter. There’s little else an investor has to do than purchase the stock and hold it long enough to receive dividends.

Another attractive aspect of dividend investing is that companies generally continue to pay out dividends throughout the economic cycle. If the market is in a downturn and share prices tumble, dividend investors still receive their dividends.

Adding to the stability, dividend-paying companies tend to be large, established companies with steady cash flows. These types of companies are usually much less volatile than smaller companies and therefore considered safer investments.

Although safer investments tend to come with lower average returns, dividend-paying stocks have outperformed the average market return [PDF] in the long run. So, dividend investing doesn’t necessarily mean giving up the chance of achieving above-average share price appreciation.

The pros and cons of dividend investing

The potential for double profits in share price appreciation and dividends is understandably an attractive benefit of dividend investing. This, to a certain extent, also protects you against bad markets, owing to the fact that dividend-paying companies usually offer reliable income streams.

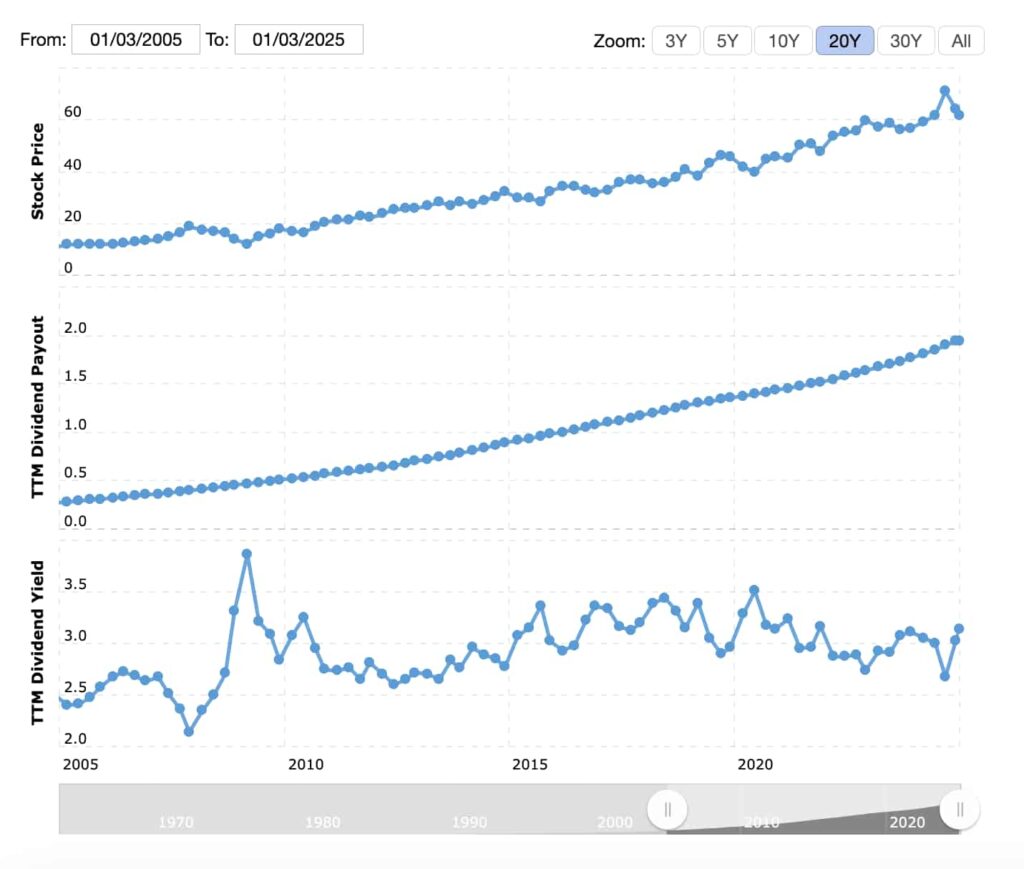

A company like Coca-Cola has been paying out quarterly dividends for decades now without interruption. Companies also tend to increase their dividend payouts every year, leading to a rising dividend yield and stockholders receiving more money without having to buy any extra shares.

Dividend-paying companies also tend to be companies with good fundamentals; otherwise, they wouldn’t be able to pay out a dividend in the first place. That makes these blue-chip dividend stocks reliable anchors in an investor’s portfolio. Blue-chip companies are large, well-established companies, and they are generally considered to be safer investments.

A few critical downsides to dividend investing also cause many investors to stay clear from this strategy. The lack of volatility in these blue-chip companies’ share prices can also be seen as negative. Investors looking for great share-price appreciation will likely be disappointed and will be better off looking at other stocks.

Another downside is possible sector concentration in a portfolio as many dividend-paying stocks are active in the same sectors. This can lead to trouble when a particular sector hits a rough patch that might even lead to dividend cuts. An example of this is oil giant Royal Dutch Shell cutting its dividend for the first time since the second world war during the Covid-19 pandemic.

Some of the main pros and cons of dividend investing are:

Pros

- Potential of double profits: share price appreciation and dividends;

- Companies usually increase their dividend yearly;

- Generally stable companies with good fundamentals.

Cons

- Limited upside potential for the share price;

- Possible sector concentration in portfolio;

- Companies can choose to cut or scrap dividend entirely.

Dividend investing for beginners: mistakes to avoid

Dividend investing beginners should keep in mind that it requires more than just sitting back and cashing cheques, and there are many things to take into consideration to do it successfully. Unfortunately, many of these things are often overlooked by beginners, leading to painful mistakes.

One of those mistakes is looking solely for a high dividend yield and not considering why the dividend yield is so high. Although a high dividend yield looks attractive at first glance, the reason why it’s so high might be more dubious. A high dividend yield often means a low share price, which in turn signals a lack of confidence among investors.

This problem is well-explained in one of Ryan Scribner’s YouTube videos, where he goes over a few examples of companies facing this problem. It turns out that often a very high dividend yield is a valuable signal a company might be about to cut or scrape its dividend entirely.

Watch the video: THE #1 DIVIDEND INVESTING MISTAKE by Ryan Scribner

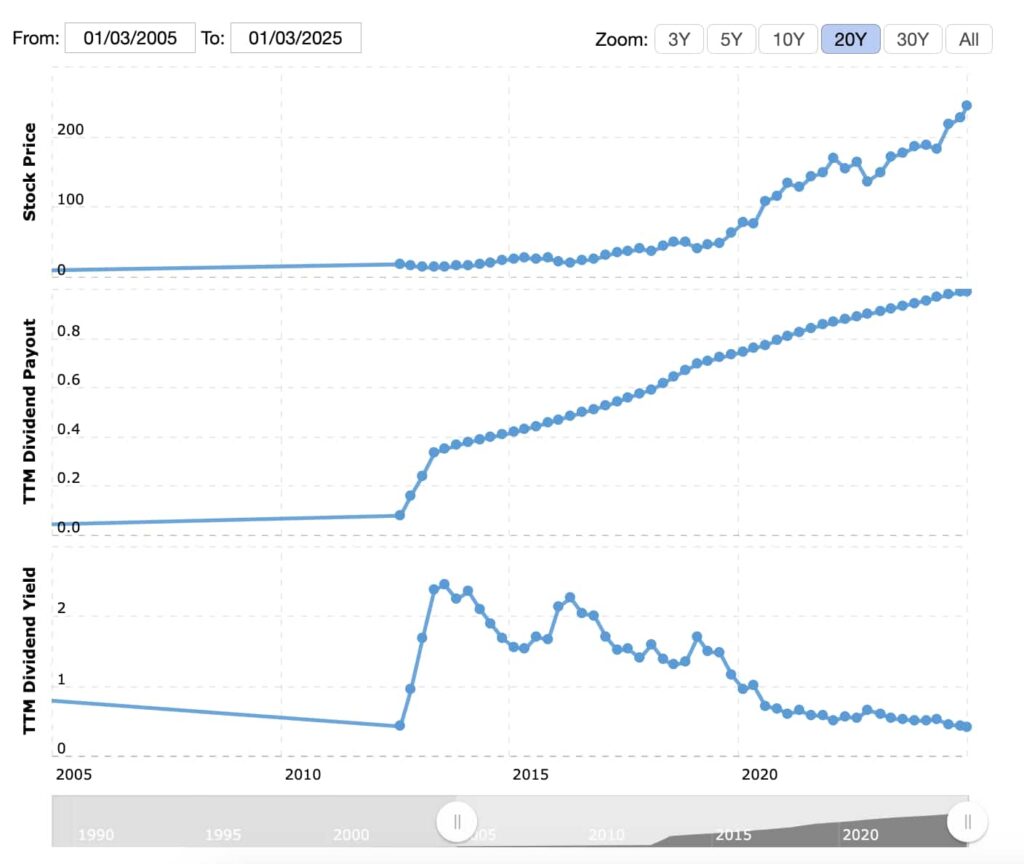

On the other hand, ignoring a company with a low dividend yield can also be a costly mistake, especially for young investors.

A low dividend yield today doesn’t tell investors anything about the future. Apple’s current dividend yield of 0.4% (as of January 2025) might seem lackluster, but the company’s 3-year stock dividend growth is almost a whopping 20%.

Apple has the potential to become a strong dividend payer in the future if its growth rate continues at this pace. Thus, it is critical to stay up to date with news about the business and its financials in order to have a clear picture of what is going on.

In any case, it’s a task that investors must do since it’s critical to determine how long a company’s dividend is sustainable.

How to choose the best dividend stocks?

To separate the wheat from the chaff, a few things are more important than anything else when evaluating a dividend stock:

- Low debt ratio;

- Good and sustainable cash flow;

- High margins;

- Good valuation;

- The sector/industry.

A low debt ratio, for example, is crucial for a company’s ability to continue paying out dividends. When a company’s debt ratio gets too high, the company might decide to pay off debt instead.

Furthermore, a company’s capacity to pay dividends is not only determined by its debt ratio. One cannot maintain dividend payments in the absence of strong and consistent cash flow in the business. As a result, dividend-paying equities are often issued by businesses with large profit margins.

High margins are unlikely if a company lacks profitability, so choosing companies with good earnings growth is essential. A good example of a company that meets these requirements is Johnson and Johnson, but that doesn’t necessarily mean it’s a good buy.

A company can have outstanding financials, but buying it at a high valuation can still lead to a bad return. A common way to value companies is the P/E ratio, which is calculated by dividing the share price by the earnings per share. A low P/E ratio indicates a stock isn’t expensive, but it’s important to compare its P/E with other companies in the sector and the general market to validate this.

The sector or industry a company is active in is something an investor can’t afford to overlook. During the Covid-19 pandemic, for example, some pharmaceutical companies saw a sizable increase in revenues. This led some to either increase their dividend or pay a one-off bonus dividend to their shareholders.

Is investing in dividend stocks right for me?

Investing in dividend stocks can be a good strategy for patient investors looking to build a passive income stream. It’s a relatively low-risk strategy since dividend-paying companies are usually large, well-established companies with a good balance sheet. A benefit of this is its protection against bad markets, especially since dividend payments usually continue during market turmoil.

For investors looking to capture great share price appreciation, dividend investing might not be the best strategy. Dividend-paying companies don’t offer the same share price appreciation potential as some of the smaller, more speculative companies. That explains why many young, risk-hungry investors looking for high returns tend to prefer other investing strategies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on dividend investing

What is dividend investing?

Dividend investing is an investing strategy that focuses on stocks that pay out dividends. Companies pay out this distribution of stock or cash to reward their shareholders and keep them on board. Investors generally use this strategy to build a passive income stream and to profit off stocks in two ways: price appreciation and dividends.

How to find a proper dividend stock?

To find a good dividend stock, investors have to pay special attention to a company’s financial situation. A low debt ratio, combined with a good cash flow, is essential for a company’s ability to keep paying out dividends. Ensure the company has high margins and check whether the stock is overvalued or priced at a discount. On top of that, it’s important to understand whether the sector or industry, in general, is thriving or falling out of grace.

What are the common mistakes to avoid when investing in dividend stock?

A prevalent mistake investors make is focusing too much on stocks with a very high dividend yield. Although attractive at first glance, this often goes hand in hand with a low share price. That’s a potential signal that investors don’t have much confidence in a company, leading to an even lower share price. Ignoring companies with a low dividend yield, on the other hand, can also be a mistake as some of these companies can become great dividend-payers in the future.

What are the benefits of dividend investing?

One of the main benefits of dividend investing is the potential to benefit from stocks in two ways. On top of the potential price appreciation, investors receive a dividend from companies whose stock they own. These companies usually increase their dividend yearly, leading to more passive income for the investor. An added benefit is that dividend-paying companies are traditionally stable and well-established companies with low volatility.

How are dividends taxed?

Your dividends are taxable and realized the same way as your other earnings. However, there are exceptions, and the dividend tax rate depends on several factors. For example, the type of dividend and the account holding the investment (e.g., a tax-deferred Roth IRA, traditional IRA, or 401(k)). Another tax-exempt exception is if you earn lower than the three lowest federal income tax brackets (in the US).

[coinbase]