Broadcom Inc. (NASDAQ: AVGO) has garnered considerable attention for its strong market presence across the semiconductor and enterprise software sectors.

Following its $69 billion acquisition of VMware in 2023, Broadcom has solidified its position as a leader in multi-cloud solutions and AI infrastructure.

As the Q4 earnings release on December 5 approaches, investors are closely watching to see if Broadcom will close the year with new highs amid rising AI demand.

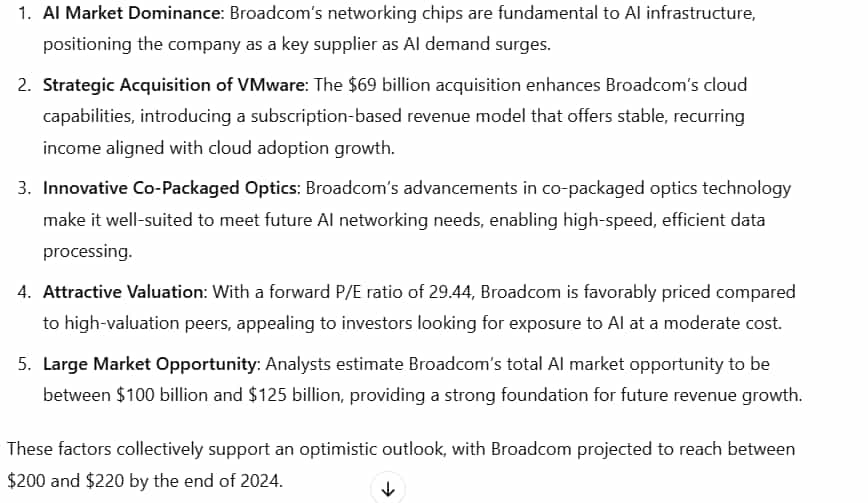

To offer a clearer outlook, Finbold consulted OpenAI’s ChatGPT-4o, which predicts that Broadcom’s stock price could reach between $200 and $220 by the end of 2024, driven by several key factors.

Currently, Broadcom is trading at $174, reflecting a 2% loss over the past month but a year-to-date gain of over 59%.

Key factors driving Broadcom’s stock price -AI market demand and partnerships

Broadcom’s growth is supported by strong demand in the AI and semiconductor markets, particularly as major tech firms, including Apple (NASDAQ: AAPL), Alphabet Inc. (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN), integrate Broadcom’s networking solutions.

Bank of America estimates Broadcom’s AI market opportunity to be between $100 billion and $125 billion, showing its strategic role in the AI-driven semiconductor industry. Additionally, Broadcom’s co-packaged optics technology further enhances its appeal for future networking needs.

Broadcom’s networking chips already form the backbone of AI infrastructure, with the company’s influence poised to expand further.

The VMware acquisition has expanded Broadcom’s revenue streams by introducing a subscription-based model, aligning with recurring revenue expectations from cloud and multi-cloud customers.

Although some VMware customers have expressed concerns about potential price increases and late fees, the acquisition is projected to deliver long-term value

Broadcom’s Q3 earnings showcased a 47% year-over-year revenue increase, reaching $13.1 billion and surpassing Wall Street’s expectations. However, due to a one-time non-cash tax provision, Broadcom reported a net loss of $1.87 billion, causing some short-term stock volatility.

Broadcom’s ability to maintain strong financial performance despite macroeconomic challenges will likely influence its stock price through year-end.

Valuation and competitive position

Broadcom’s forward P/E ratio of 29.44, coupled with a PEG ratio of 1.48, as retrieved from StockAnalysis, suggests a balanced growth outlook and a reasonable valuation, particularly when compared to other AI-driven peers like Nvidia (NASDAQ: NVDA), which have a higher valuation.

Broadcom’s relatively lower P/E ratio appeals to investors seeking exposure to the AI market at a more moderate price, blending growth with value. Analysts are confident in Broadcom’s growth trajectory, setting a 12-month price target of $189, representing a 7.5% potential upside.

ChatGPT prediction for Broadcom stock price

ChatGPT projects Broadcom’s stock price to reach between $200 and $220 by the end of 2024. This prediction is based on Broadcom’s strong positioning in the AI and semiconductor markets, driven by its networking chips, which are foundational to AI infrastructure.

While Broadcom’s stock shows strong upside potential, challenges like macroeconomic headwinds, regulatory risks, and potential valuation adjustments may lead to short-term price fluctuations.

Overall, Broadcom is well-positioned for gains. Investors should watch for further developments, particularly around the next earnings report, which could provide crucial insights into Broadcom’s future.

Featured image:

Below The Sky – October 29, 2024. Digital Image. Shutterstock.