The most recent worldwide outage on Microsoft (NASDAQ: MSFT) based operating systems was caused by a faulty security update by CrowdStrike (NASDAQ: CRWD) on July 19, bringing multiple industries to a grinding halt and causing potentially $1.5 billion in insured losses according to the latest research from cyber analytics firm CyberCube on July 25.

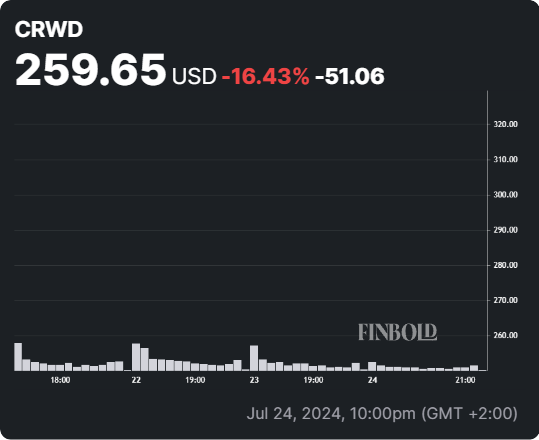

Subsequently, CRWD stock experienced strong losses, with a monthly drawback of 33.26%, and the previous five trading sessions carried the most damage at 26.50%.

Now, the pre-market shows a recovery of 0.18%, potentially causing the latest closing price of $258.14 to recover even further.

Picks for you

As losses seem to pile up in the recent trading sessions, Finbold decided to utilize the help of artificial intelligence (AI), specifically OpenAI’s latest release, ChatGPT 4-o, to potentially predict the price of this cybersecurity stock by the end of 2024.

AI forecasts recovery in the upcoming months for CRWD stock

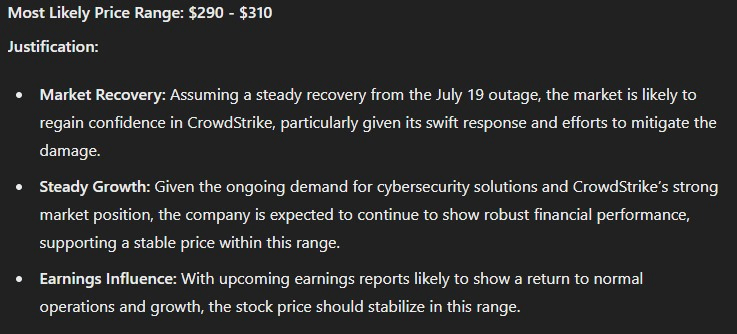

Assuming a steady recovery from the July 19 outage, CrowdStrike’s market confidence is expected to rebound, particularly due to the company’s swift response and efforts to mitigate the damage.

Given the ongoing demand for cybersecurity solutions and CrowdStrike’s strong market position, the company is likely to continue demonstrating robust financial performance, which should support a stable stock price in the range of $290 to $310.

Additionally, upcoming earnings reports are anticipated to show a return to normal operations and growth, further stabilizing the stock price within this range.

AI offers a bullish and bearish case scenario for CRWD stock

If the cybersecurity market continues to expand rapidly, driven by increased threats and regulatory requirements, CrowdStrike could see significant revenue growth, pushing its stock price into the range of $370 to $390.

Successful product launches and enhancements to existing offerings could further drive investor optimism and elevate the stock price.

Moreover, effective communication and reputation management following the recent outage could restore investor confidence, supporting a price increase towards the upper end of this range.

On the other hand, if the impacts of the July outage persist longer than expected, including potential customer loss or increased regulatory scrutiny, CrowdStrike’s stock price could remain under pressure, leading to a range of $240 to $260.

Concerns about the company’s high valuation could also contribute to downward pressure, particularly if the broader market becomes more risk-averse.

Additionally, increasing competition in the cybersecurity space could impact CrowdStrike’s market share and growth prospects, reinforcing a lower stock price within this range.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.