Domino’s Pizza Inc. (NYSE: DPZ) has witnessed a remarkable turnaround, with its stock climbing to $472, marking a 7% increase over the past five days and a 13% rise over the past month.

The company has defied challenges in the restaurant industry, delivering a strong financial performance that has drawn significant attention from institutional investors.

With Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A, BRK.B) recently acquiring a 3.65% stake in Domino’s Pizza, the company’s scalable business model and robust cash flow generation have further solidified its position for sustained growth.

As 2024 draws to a close, investors are eagerly speculating on just how high Domino’s Pizza stock could climb.

To provide insight, Finbold consulted OpenAI’s ChatGPT-4o, which projects Domino’s Pizza stock price could reach $580 by the end of 2024, driven by several compelling factors.

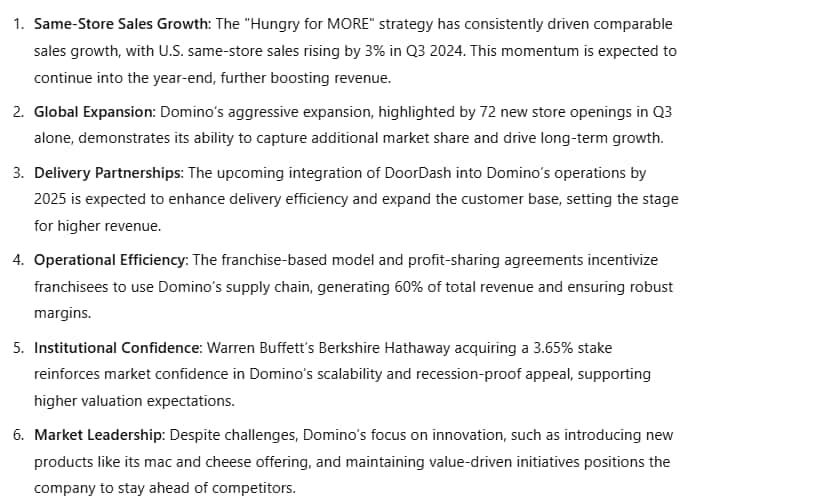

Key factors driving the stock price

The bull case for Domino’s Pizza was solidified after Warren Buffett’s Berkshire Hathaway acquired a 3.65% stake, amounting to 1.28 million shares valued at $567.7 million.

This marks a rare move by Berkshire during a period of significant divestments in other stocks, including Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC).

Buffett’s investment aligns with his strategy of selecting recession-proof businesses with strong brand equity. With its 99% franchised model, Domino’s Pizza generates high-margin royalty income while maintaining minimal capital expenditures, making it an attractive asset in volatile markets.

Domino’s Pizza’s supply chain operations, which generate 60% of total revenue, further strengthen the company’s bottom line by delivering ingredients and equipment to franchisees.

Franchisees are incentivized to use the supply chain through profit-sharing agreements, creating a seamless and efficient ecosystem.

Driving growth through innovation

Domino’s Pizza’s “Hungry for MORE” strategy has been a key driver of growth, focusing on value offerings and promotional pricing to boost customer loyalty and order volumes.

In Q3, U.S. same-store sales grew by 3%, while international comparable sales increased by 0.8%. The company also added 72 new stores globally during the quarter, further fueling revenue growth.

Additionally, Domino’s Pizza continues to innovate with new product launches, such as its mac and cheese offering and is expanding delivery partnerships, including plans to integrate DoorDash into its 2025 outlook.

While challenges like reduced spending among lower-income customers and rising competition persist, Domino’s Pizza remains focused on cost efficiencies and value-driven initiatives to maintain its market leadership and drive sustained growth.

AI prediction for Domino’s Pizza stock by year-end

Given these factors, AI-driven models predict that Domino’s Pizza stock could reach $580 by the end of the year.

This projection hinges on the assumption that Domino’s Pizza can effectively navigate ongoing challenges, including economic headwinds, shifting consumer spending patterns, and intensified competition.

The company’s ability to stay ahead through cost efficiencies, innovation, and value-driven initiatives will play a pivotal role in realizing this projected growth.

Investors should keep a close eye on upcoming developments, which could offer valuable insights into the company’s growth trajectory and strategic outlook.

Featured image via Shutterstock