Ethereum (ETH) is currently showing signs of recovery after a recent sell-off phase. This has led to a notable rebound, suggesting the potential for a continued uptrend.

The launch of five spot Ethereum exchange-traded funds (ETFs) on the Chicago Board Options Exchange (CBOE) marks a significant milestone for the cryptocurrency market.

These five spot Ethereum ETF products, including 21Shares Core Ethereum ETF, Fidelity Ethereum Fund, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF, will begin trading on July 23.

This launch has generated considerable excitement among investors, as industry experts predict significant price movements for Ethereum driven by the influx of both institutional and retail capital.

Finbold has leveraged ChatGPT-4o, OpenAI’s advanced and recent AI chatbot model, to offer insights into how Ethereum is likely to trade by August 1, considering key factors influencing Ethereum’s future price trajectory.

Key factors influencing Ethereum’s price

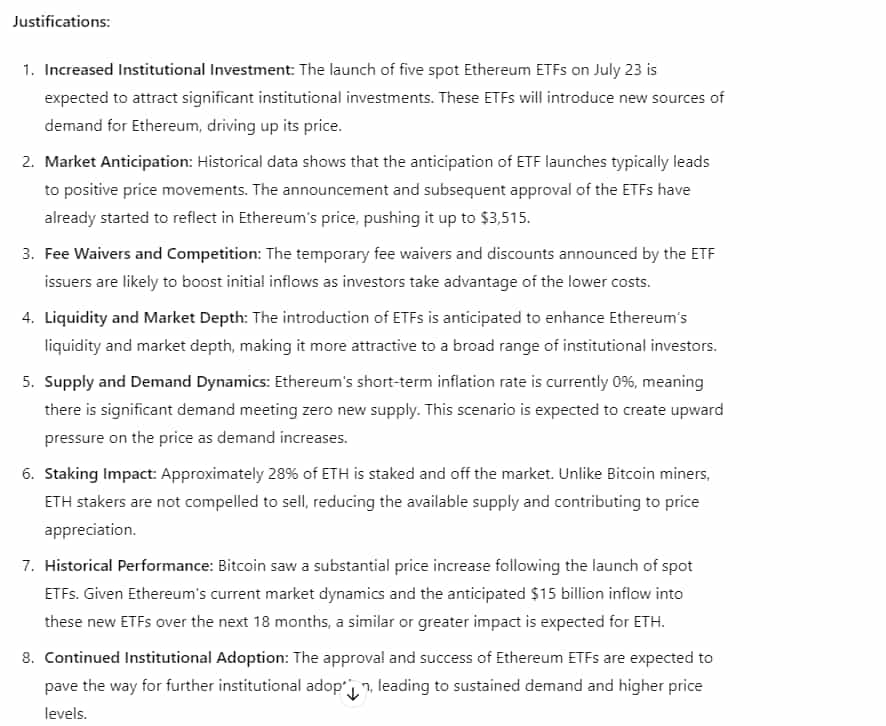

ChatGPT-4o highlighted several factors likely to impact Ethereum’s price. Ethereum’s transition to Proof of Stake (PoS) has eliminated new ETH issuance, creating a scarcity effect that increases the value of the existing supply as demand rises.

The introduction of Ethereum ETFs will attract significant interest from both retail and institutional investors, pushing prices higher in the short term.

Fee waivers by ETF issuers are expected to drive initial inflows into these ETFs, further boosting demand. Continued institutional adoption is projected to bring approximately $15 billion in net inflows over the next 18 months.

With 28% of ETH staked and no forced selling pressure from miners, the reduced market supply supports long-term price stability and growth.

Additionally, United States Securities and Exchange Commission (SEC) approval signals a favorable regulatory environment, boosting investor confidence and encouraging broader market participation.

Bitcoin’s (BTC) price surge following its ETF launch sets a precedent, suggesting similar substantial price appreciation for Ethereum.

ChatGPT-4o Ethereum price prediction

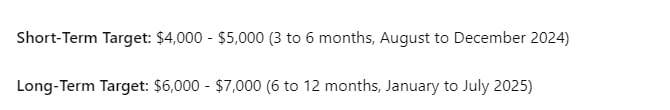

Given these factors, Ethereum’s transition to proof-of-stake, initial ETF demand, fee waivers by issuers, sustained institutional adoption, reduced market supply, regulatory approval, and historical precedent, the environment is primed for Ethereum’s price to reach $4,500 in the short term.

In the long term, Ethereum could reach $6,500 as institutional adoption and market integration drive sustained growth.

Ethereum price analysis

Currently, ETH is priced at $3,490.63, with a 2% increase in the past 24 hours and a 10% increase over the past seven days.

In light of the upcoming ETF launch, AI predictions suggest significant price movements for Ethereum by August 1.

Investors and traders should closely monitor these developments, as the expected influx of capital and the positive regulatory outlook are likely to drive Ethereum’s price to new heights.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.