Nu Holdings (NYSE: NU) has captured a significant share of Latin America’s unbanked population, growing its customer base from 33.3 million in 2021 to nearly 110 million by the third quarter of 2024.

Operating as a fully digital bank, the company has thrived in markets like Brazil, Mexico, and Colombia, where traditional banking services remain inaccessible to many.

Despite delivering impressive Q3 earnings, Sao Paulo-based Nubank has faced macroeconomic challenges in Brazil, including inflation and rising interest rates, which have dampened investor sentiment and raised questions about the stock’s trajectory as 2024 nears its close.

Nevertheless, the company’s stock has surged by 77% this year and is currently trading at $14.42.

Strong Q3 performance amid challenges

In its third-quarter 2024 earnings, Nu Holdings reported revenue of $2.94 billion, a 56% year-over-year increase, while net income surged to $553 million, reflecting a return on equity of 30%.

The company’s average revenue per user grew by 25% to $11. Its operations in Mexico and Colombia have delivered impressive results, reflecting its ability to adapt to diverse markets effectively.

Nu has also maintained strong operational efficiency, with a low cost-to-serve per user of $0.80, highlighting its ability to scale profitably.

However, macroeconomic conditions in Brazil have cast a shadow over the company’s strong results.

Rising inflation has prompted the Central Bank of Brazil to hike its Selic rate by 50 bps to 11.25% in its November 2024 meeting, aiming to bring inflation back to target and support economic stability.

Key growth drivers of Nu stock

To sustain this expansion and enhance the customer experience, Nu recently launched advanced generative artificial intelligence (AI) tools aimed at personalized customer data analysis and strengthened cybersecurity measures.

Additionally, Nu introduced its cellular service, NuCel, broadening its offerings beyond financial services, boosting customer engagement, and enhancing retention.

The company’s ability to grow deposits and expand in Mexico and Colombia further solidifies its presence in international markets.

Financial data reflects robust growth

Key financial highlights include a gross profit of $1.348 billion, a 67% year-over-year increase, and a liquidity position with total deposits rising to $28.3 billion, up 60% year-over-year.

The company’s operating efficiency remained strong, with a low average cost to serve per active customer and an improved efficiency ratio.

Additionally, Nu Holdings’ asset quality showed resilience with a reduction in the 15-90 non-performing loan ratio.

Strategically, Nu Holdings has maintained its focus on international expansion and customer engagement, with successful growth in Brazil, where it surpassed 100 million customers, and continued expansion in Mexico and Colombia.

These efforts are supported by its scalable business model and data-driven approach to product development.

Moreover, interest from investors, including Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) and Cathie Wood’s ARK Innovation (ARKK) ETF, shows confidence in the company’s long-term prospects.

At a forward P/E of 28.13, Nu offers a balanced risk-reward profile for both growth-oriented and long-term investors

Challenges in the macroeconomic environment

Despite its strong fundamentals, Nu faces challenges in Brazil’s economic environment.

Rising inflation and interest rates not only compress margins but also reduce consumer spending, posing potential headwinds for its credit portfolio.

The slowdown in its credit card portfolio growth and the rising costs of international funding further amplify these risks.

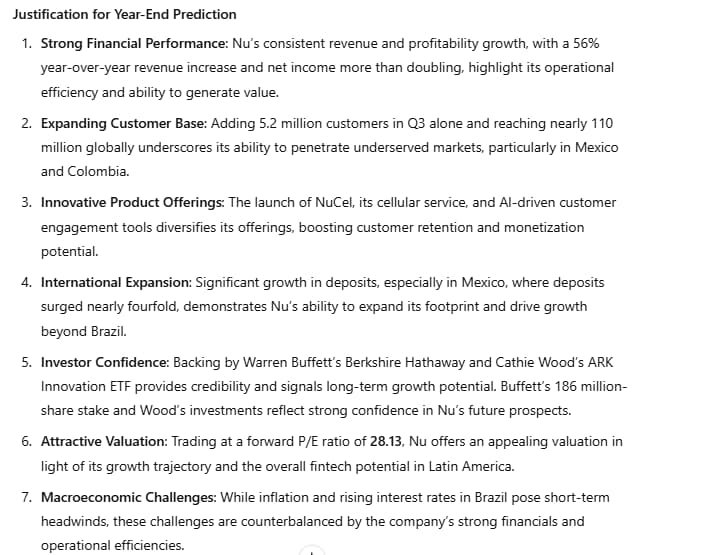

AI predicts Nu stock price for the end of 2024

One of OpenAI’s most advanced publicly available AI models, ChatGPT-4o, predicts that Nu Holdings’ stock could climb to $18 by the end of 2024, representing a 22% upside from its current price of $14.74.

This projection factors in the company’s strong Q3 performance, innovative strategies, and continued customer growth.

However, in a bearish scenario where macroeconomic pressures persist, the stock could consolidate between $13 and $14.

While short-term macroeconomic challenges in Brazil may affect the stock, the company’s strong fundamentals and long-term vision make it an attractive opportunity for investors looking to capitalize on the stock’s untapped potential.

Featured image via Shutterstock