Although recent concerns over American technology export restrictions have caused chip-making stocks like Nvidia (NASDAQ: NVDA) to decline in price, machine learning and artificial intelligence (AI) models predict it might yet recover as the month of July draws towards its conclusion.

Indeed, Nvidia stock has had mixed success in recent weeks, still benefitting from the AI craze that has pushed its price toward a new all-time high (ATH) but suffering from the current political climate that seems averse toward sharing advanced American tech with China.

NVDA stock prediction: $120 – $200

In this context, Finbold has consulted the OpenAI brainchild, ChatGPT-4o, for insights as to where the price of Nvidia stock could be on August 1, 2024, taking into account factors like the company’s growth, product announcements, historical performance, and expert opinions.

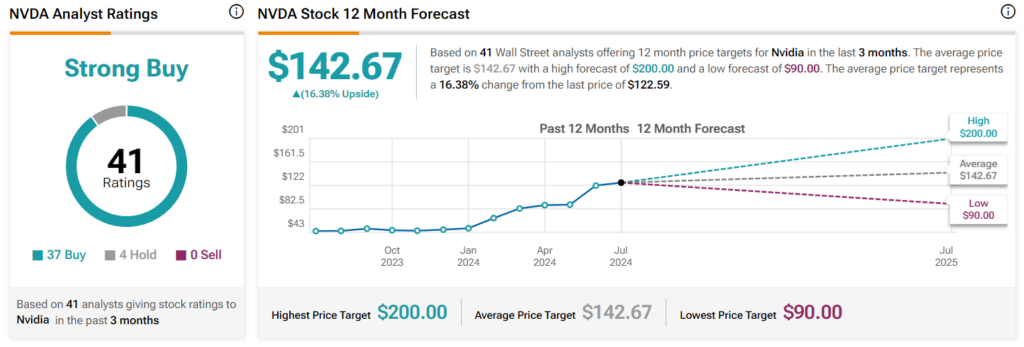

As it happens, the popular AI model has offered a “range of $120 to $150, with potential highs reaching up to $200 in more optimistic scenarios” by the above date, considering the “current market conditions, expert analyses, and Nvidia’s strong financial health.” In particular, as ChatGPT has pointed out:

“Nvidia’s introduction of new AI chips, specially tailored for the Chinese market, and the ongoing development of its AI ecosystem are seen as significant growth drivers. However, potential export restrictions on advanced technology to China could impact its market performance.”

On top of that, the chatbot has correctly observed that “most experts maintain a strong buy rating for Nvidia, suggesting confidence in its future performance,” which is in line with AI algorithms and predictive models, “forecasting continued growth and an optimistic outlook for the stock.”

Experts’ views on Nvidia stock

Elsewhere, Moor Insights & Strategy founder, CEO, and chief strategist Patrick Moorhead has suggested that there is still room for recovery of semiconductor shares like Nvidia, arguing that the belief among some investors that the AI race is coming to an end is simply inaccurate:

“This whole notion of AI coming to a screeching halt anytime soon is fiction.”

Moreover, Citi (NYSE: C) analyst Atif Malik is confident that the following weeks will witness positive catalysts for NVDA stock, including the prospect of its CEO Jensen Huang and Meta (NASDAQ: META) CEO Mark Zuckerberg discussing the future of AI at the upcoming SIGGRAPH 2024 conference.

It is also worth noting that Fundstrat’s managing partner and head of research, Tom Lee, has opined that Nvidia stock could soar 10 times from its current position as its revenues soar to $1 trillion by the end of this decade, observing that the tech giant’s earnings were in the $100 billion zone right now.

Nvidia stock price history

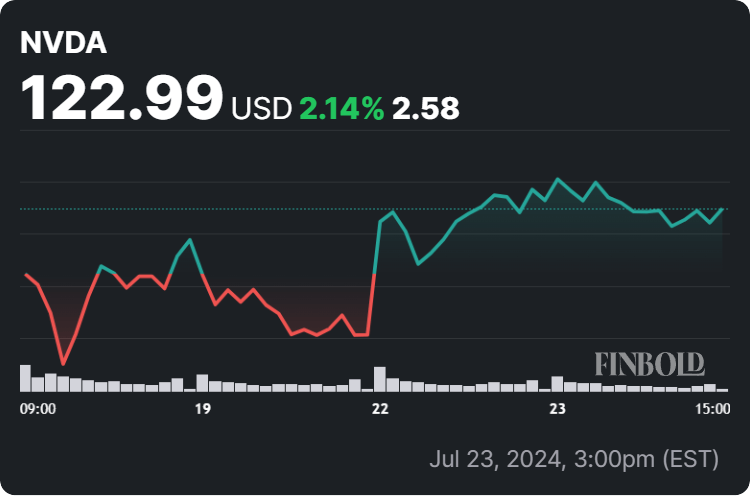

Meanwhile, the price of Nvidia stock at press time stood at $122.99, which represents a 0.76% decline on the day but nonetheless an increase of 2.14% across the past week, as well as a 1.92% growth over the last month, according to the most recent chart data retrieved on July 24.

Ultimately, the Nvidia stock price might still have room for recovery by August, as evident from the consensus between finance experts and AI models. However, the situation in the stock market might shift due to various factors, so doing one’s own research, keeping up with any NVDA news, and weighing the risks is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.