Palantir Technologies (NYSE: PLTR), a leader in data analytics and artificial intelligence (AI) software, has recently made significant strides that have caught the attention of investors and market analysts alike.

The company secured a substantial $1.5 billion contract with the U.S. military for its Tactical Intelligence Targeting Access Node (TITAN) initiative, boosting its market position and financial outlook.

As a result, Palantir’s stock has seen impressive gains in 2024, raising questions about its potential trajectory over the next 12 months.

Key developments and market momentum

Palantir’s revenue surged by 21% year-over-year to $634 million in Q1 2024, driven by its new Artificial Intelligence Platform (AIP) and robust performance in the U.S. commercial sector.

The company’s expansion into the U.S. government business saw an 8% quarter-over-quarter revenue increase, underscoring the critical role of its products in addressing contemporary global challenges.

In addition to the TITAN contract, Palantir recorded its sixth consecutive quarter of GAAP profitability, with a record GAAP net income of $106 million in Q1 2024.

The company has also seen a 69% year-over-year increase in U.S. commercial customers and notable deal conversions following customer boot camps, highlighting its expanding customer base and the increasing demand for its AI solutions.

Founded in 2003, Palantir has leveraged its expertise in AI to expand from government contracts to the public sector, opening new revenue streams.

One of the reasons for the bullish outlook on Palantir is its latest product, the Artificial Intelligence Platform (AIP).

Despite its straightforward name, AIP has generated considerable excitement. Unlike Palantir’s other products like Foundry, Gotham, and Apollo, AIP focuses on centralizing data flows, enabling businesses to make decisions based on the most current information available.

It also supports large language model integration, enhancing automation and workflow streamlining.

Challenges and market risks

Despite these successes, Palantir faces challenges, particularly in the international market. The company reported a sequential revenue decline in the international commercial sector due to tough market conditions in Europe.

Additionally, it anticipates a decline in revenue from strategic commercial contracts in Q2 2024. The international government revenue also declined sequentially, reflecting ongoing challenges in Europe.

Palantir plans to increase expenses from Q2 2024 onwards, which could impact profit margins if not managed effectively.

Moreover, the company’s outspoken stance on geopolitics has led to internal disagreements and departures, posing potential risks to its culture and public perception.

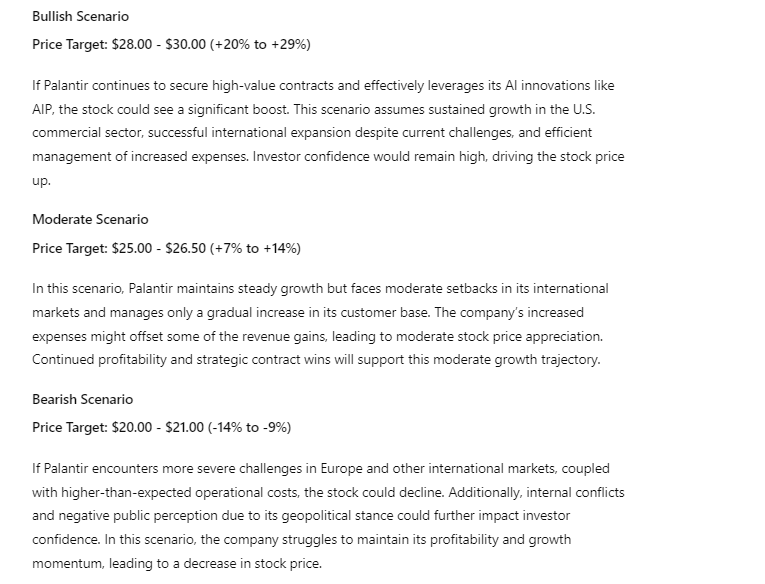

In light of these events, ChatGPT-4o, OpenAI’s most advanced AI tool, forecasts three potential scenarios for Palantir’s stock over the next 12 months.

Currently trading at $23.31 with a year-to-date increase of 40%, Palantir’s future price could vary significantly based on how it navigates market opportunities and challenges.

ChatGPT-4o Palantir stock prediction

Considering the above factors, ChatGPT-4o presented three potential scenarios for Palantir stock over the next 12 months.

In a bullish scenario, Palantir’s stock could reach $35 (+40%), driven by strong AI platform adoption, robust government contracts, and increased commercial sector demand.

In a moderate scenario, it could reach $30 (+20%), supported by steady revenue growth, balanced market conditions, and effective expense management. Conversely, in a bearish scenario, Palantir’s stock could fall to $25 (0%), impacted by persistent international market challenges, rising operational costs, and geopolitical risks.

While Palantir’s stock has strong growth prospects and improved profit margins, investors must consider its high valuation.

The company’s significant achievements and promising AI capabilities are counterbalanced by international challenges and high operational costs, making its future stock performance an intriguing topic for market watchers.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.