After Palantir surpassed analysts’ expectations in terms of its earnings for the second quarter of 2024 and the company delivered its first artificial intelligence (AI) prototype to the United States Army, the price of Palantir (NYSE: PLTR) stock has reacted quite bullishly, although AI models remain cautious.

As it happens, Palantir has sent the first Tactical Intelligence Targeting Access Node or TITAN, months after it secured a $178 million contract as part of the U.S. military’s connect-everything-everywhere campaign, which aims to collect data from space, air, and land, and parse it through AI.

At the same time, analysts from Citi (NYSE: C) have referred to the recent strong Palantir earnings and even stronger guidance raise to the full year as “impressive, especially against a choppy software demand backdrop,” expecting PLTR stocks to “trade up significantly.”

Buy or sell? AI weighs in on Palantir stock forecast

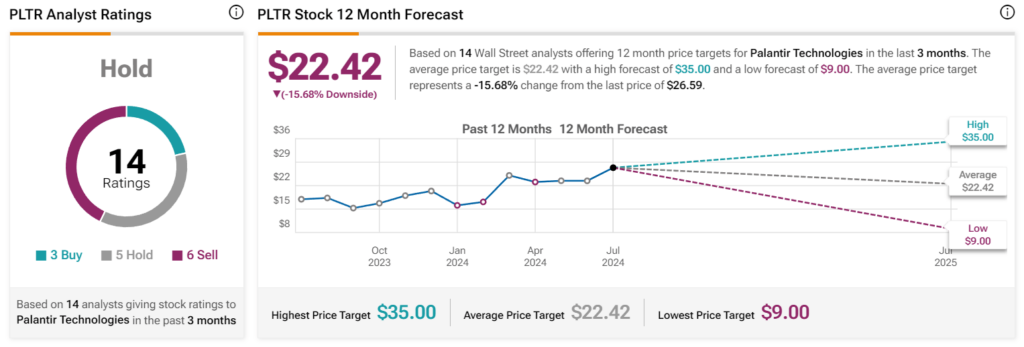

That said, the OpenAI brainchild ChatGPT-4o views things a bit differently, having noted that analysts have mixed opinions about the future performance of Palantir stock, referring to the average analyst rating of ‘hold’ and price targets that range from $9 to $38, but also highlighting that:

“More optimistic predictions place the stock as high as $52.67 by September 2024, with expectations for further growth into 2025.”

Indeed, GPT-4o has correctly drawn its conclusions from the latest TipRanks data that assembles Wall Street analysts’ predictions regarding the future performance of Palantir stock price provided in the past three months, which sees the ‘hold’ score and an average price target of $22.42.

Meanwhile, Meta AI Llama 3.1 model has observed “an upward trend” from PLTR shares, “recently reaching a 52-week high,” after “beating Wall Street estimates” on its growth, “largely driven by the increasing demand for its artificial intelligence (AI) software services, particularly in the commercial sector.”

“Analysts have been bullish on Palantir, with D.A. Davidson analyst Gil Luria raising the price target to $28 per share from $24. [Wedbush analyst Dan] Ives flags Palantir as a Q2 winner, expecting the stock to rise.”

However, Llama 3.1 chatbot has still acknowledged that “some analysts consider the stock overvalued, with 6 out of 14 analysts recommending a ‘sell,’” as it also referred to the TipRanks information, arguing that the analysis makes it “difficult to make a definitive ‘buy’ or ‘sell’ recommendation.”

Palantir stock price history

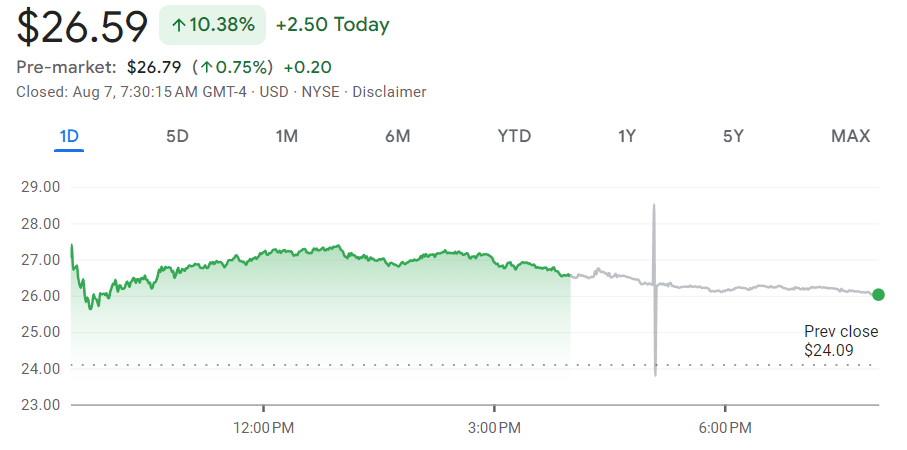

For the time being, the price of Palantir stock stands at $26.59, reflecting an increase of 10.38% on the day – up 0.75% in pre-market – although declining 1.59% in the past week and accumulating a loss of 4.01% on its monthly chart, while still holding onto the 60.37% gain this year, as per data on August 27.

All things considered, Palantir seems intent on cementing its leadership position in the generative AI revolution, securing it by developing data-centric AI solutions for the U.S. government and enterprises, and the recent market sell-off has not negatively affected its long-term upside potential.

As such, and adding up to the exceptional quarterly PLTR earnings and optimistic analyst remarks, Palntir’s shares could quite possibly be a ‘buy.’ That said, doing one’s own research is critical when investing, as trends in the stock market can easily and unexpectedly change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.