Rumble (NASDAQ: RUM), the video-sharing platform and cloud services provider, has been in the spotlight recently, partly due to its upcoming financial results for the fiscal quarter ending June 30, 2024.

These results are scheduled for release after markets close on Monday, August 12, 2024. As of now, Rumble’s stock is priced at $6.20, reflecting a one-month gain of over 6% and a year-to-date increase of over 37%.

This positive performance has been further bolstered by the recent announcement of a new Xbox app, which facilitates 24/7 streaming of live and on-demand content. This development added 1.3% to the company’s share price, demonstrating market confidence in Rumble’s strategic expansion.

Founded in 2013, Rumble has gained popularity as an alternative to mainstream platforms like YouTube, appealing to conservative audiences who advocate for free speech.

This appeal was significantly boosted when former President Donald Trump established an official account on Rumble after being de-platformed from other social media sites, leading to an increase in Rumble’s user base.

In the first quarter of 2024, Rumble reported revenue of $17.7 million. Despite this, the company remains unprofitable, ending the quarter with a net loss of $43.3 million.

Key engagement metrics also saw declines, with monthly active users (MAUs) falling from 67 million to 50 million and total minutes watched per month decreasing from 10.5 billion to 8.6 billion. These figures highlight the challenges Rumble faces in maintaining and growing its user base and engagement.

Challenges and opportunities

Rumble faces several challenges, including declining monthly active users and engagement metrics, sustained unprofitability with significant net losses, and increased competition from other video-sharing platforms.

However, the platform also has significant opportunities, such as the potential for increased ad revenue during the U.S. election cycle, expansion through new app launches and improved user experience, and strong backing from prominent investors and political ties.

One key factor driving recent interest in Rumble is its backing by prominent figures such as Republican vice-presidential nominee J.D. Vance. Vance’s association with Rumble has drawn considerable interest from investors, particularly those aligned with conservative values.

Investment firm Wedbush recently initiated coverage of Rumble with a “neutral” rating, citing significant upside potential as the platform works to improve monetization and average revenue per user (ARPU) trends.

In light of these events, ChatGPT-4o, OpenAI’s most advanced AI tool, forecasts Rumble’s potential stock price for the end of 2024.

ChatGPT-4o’s prediction on Rumble stock price

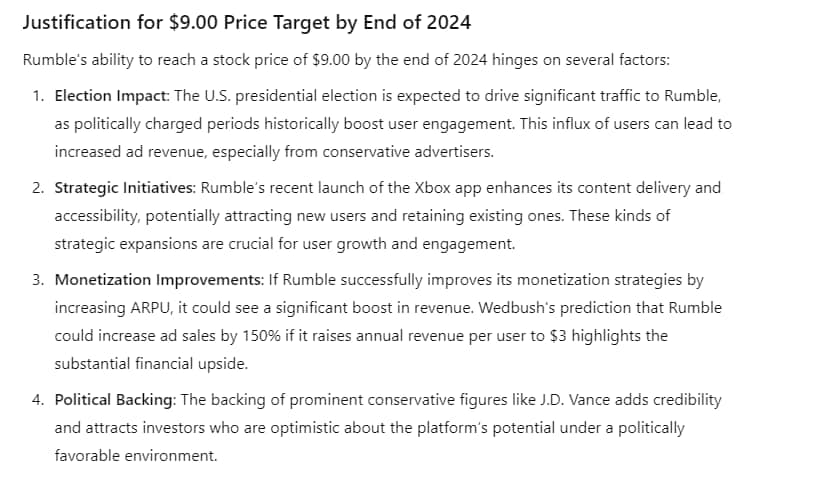

Considering the above factors, ChatGPT-4o predicts Rumble can hit $9 by the end of this year. Rumble’s ability to reach the $9 mark by the end of 2024 hinges on several factors.

First, the U.S. presidential election is expected to drive significant traffic to the platform, as politically charged periods historically boost user engagement.

Second, Rumble’s recent strategic initiatives, such as the launch of the Xbox app, enhance its content delivery and accessibility, potentially attracting new users and retaining existing ones.

Third, if Rumble can successfully improve its monetization strategies, particularly by increasing ARPU, it stands to significantly boost its revenue, making the $9 target feasible.

With a target price of $9 by the end of 2024, Rumble offers a compelling but speculative investment opportunity for those willing to navigate its inherent risks.

Investors should closely monitor upcoming earnings reports and user engagement trends to gauge the platform’s performance and potential for future growth.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.