Following the major legal ruling in the Ripple and Securities Exchange Commission (SEC) case, attention has shifted to the value of XRP and its potential to rally toward $1.

In the ruling, the court imposed a $125 million civil penalty on Ripple but rejected the SEC’s attempt to classify XRP as a security, particularly in its secondary market sales.

Ripple’s Chief Legal Officer, Stuart Alderoty, emphasized that the SEC’s appeal would not alter XRP’s non-security status, noting that higher courts rarely overturn such decisions.

Notably, following the ruling, uncertainty remains over whether the US regulator will proceed with an appeal. This uncertainty has caused XRP’s price to pause in its recent momentum, struggling to establish a strong position above the $0.60 resistance. The SEC has 60 days from the final judgment date to file an appeal, so XRP will likely remain in limbo until early October.

AI predicts XRP’s price after possible SEC appeal

To assess how XRP might trade in the event of an SEC appeal, Finbold turned to OpenAI’s latest artificial intelligence (AI) tool, ChatGPT-4o.

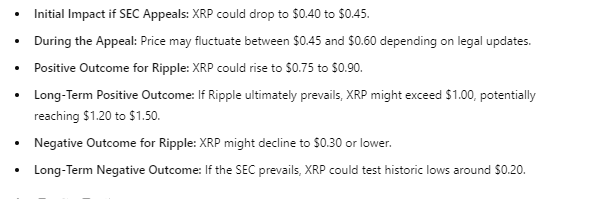

According to the AI model, should the SEC announce an appeal, the market is expected to react negatively, with XRP potentially experiencing a sharp drop in price to a range of $0.40 to $0.45. This decline would mirror past reactions during heightened legal uncertainty surrounding Ripple as investors respond cautiously to such developments.

As the appeal process unfolds, XRP is likely to encounter significant price volatility. ChatGPT-4o projected that the cryptocurrency could fluctuate between $0.45 and $0.60, with volatility largely dependent on the strength of the SEC’s arguments and Ripple’s counter arguments.

At the same time, the AI platform noted that if Ripple secures another legal victory, a bullish scenario for XRP could unfold, potentially driving the price to between $0.75 and $0.90. Increased regulatory clarity and investor optimism would contribute to this price appreciation as the market views XRP as a more secure investment.

Conversely, if the SEC’s appeal succeeds, XRP could decline steeply. The AI analysis suggested prices could drop to around $0.30 or lower. Such an outcome would reflect growing concerns about XRP’s future utility and adoption, especially if the legal environment becomes more restrictive.

XRP’s long-term outlook

Looking beyond the immediate aftermath of the appeal, the long-term price trajectory of XRP remains highly contingent on the final resolution of the legal battle.

If Ripple ultimately prevails, the AI platform predicted that XRP could rise above $1, potentially reaching $1.20 to $1.50, assuming broader market conditions remain favorable. However, if the SEC’s position is upheld, long-term bearish sentiment could push XRP below $0.30, possibly testing historic lows around $0.20.

XRP price analysis

As of press time, XRP was trading at $0.59, dropping by about 0.6% in the last 24 hours. During the weekly timeframe, the token rallied by 3.6%.

Meanwhile, as uncertainty around the SEC appeal lingers, investors should focus on XRP’s ability to maintain its price above the crucial $0.60 resistance zone.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.