Super Micro Computer (NASDAQ: SMCI) stock price is showing signs of sustaining its recent positive run as the company continues its governance overhaul.

Looking back, SMCI suffered a near-catastrophic crash, dropping about 60% in two weeks after being accused of accounting irregularities that came with repercussions such as the possible delisting from the tech-heavy Nasdaq.

A significant turning point came when the company appointed BDO USA as its new auditor following Ernst & Young’s unexpected resignation. This resignation raised concerns about the company’s financial practices after it failed to file its annual report on time in August.

Adding fuel to the turnaround, SMCI saw further upside after an internal investigation reported no substantial evidence of management fraud. The probe concluded there was no substantial evidence of fraud but revealed governance lapses, prompting structural reforms such as the search for a new CFO and strengthened financial controls.

Now, investors are oozing more confidence after a December 6 development, when SMCI secured an extension from Nasdaq to file its overdue annual and quarterly reports, extending the deadline to February 25.

To this end, the stock closed the latest trading session at $43.93, up 6.78% for the day. To highlight the impact of this recovery, SMCI share price has rallied by 106% over the past month.

In pre-market trading on December 9, SMCI stock price is up 10%, reaching $48.

When will SMCI hit $100?

Currently, SMCI is facing resistance at $50, which could serve as a key level for the long-term target of $100. To explore this potential, Finbold consulted OpenAI’s ChatGPT-4o to assess when the equity might return to $100, where it last traded in early April.

ChatGPT outlined that SMCI’s path to this target depends on strong growth, valuation, and market conditions.

The AI tool acknowledged that Super Micro operates in a high-growth sector driven by artificial intelligence (AI) demand, citing analyst projections of robust earnings in the coming years. At its current price, ChatGPT suggested that SMCI might be undervalued, indicating a potential upside.

Additionally, ongoing governance reforms are likely to boost investor confidence and contribute to the stock’s positive momentum.

ChatGPT predicted that SMCI could reach $100 within the next two to three years if current fundamentals persist. However, the OpenAI platform cautioned that economic or sector-specific setbacks might delay this trajectory.

SMCI’s stock stabilizing

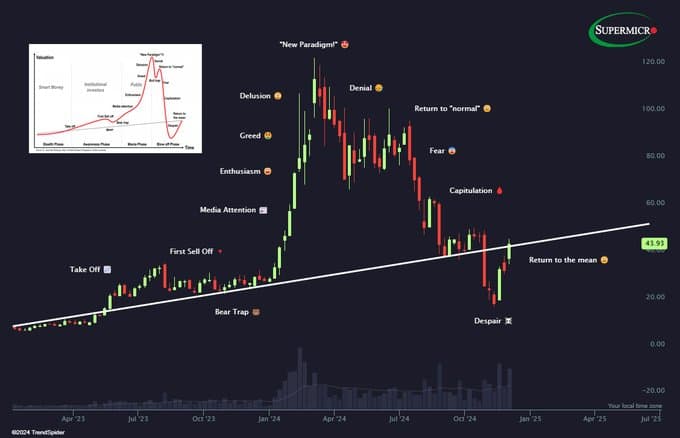

Moreover, the stock’s alignment with the ‘psychology of a market cycle’ hints at a return to normal trading patterns.

Specifically, analysis from charting platform TrendSpider shared in an X post on December 7 suggested SMCI may have bottomed out of its despair phase, marking the start of its recovery and stabilizing above the $40 support zone.

Taking all factors into account, SMCI has the potential to reach $100 if the company continues addressing its governance issues. Resolving these matters will significantly strengthen the stock’s position in the high-demand AI server sector.

Featured image via Shutterstock