The stock price of electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) has suffered a downturn recently, coinciding with a period in which the company fell short of Wall Street estimates for quarterly profit and revenue.

This sell-off has also emerged amid the controversy surrounding CEO Elon Musk and his relationship with the EV maker’s board. Notably, reports surfaced alleging that Musk and the Tesla Board were involved in taking illegal drugs together.

Following these reports, Wall Street has raised concerns regarding the potential lack of significant oversight on Musk.

Picks for you

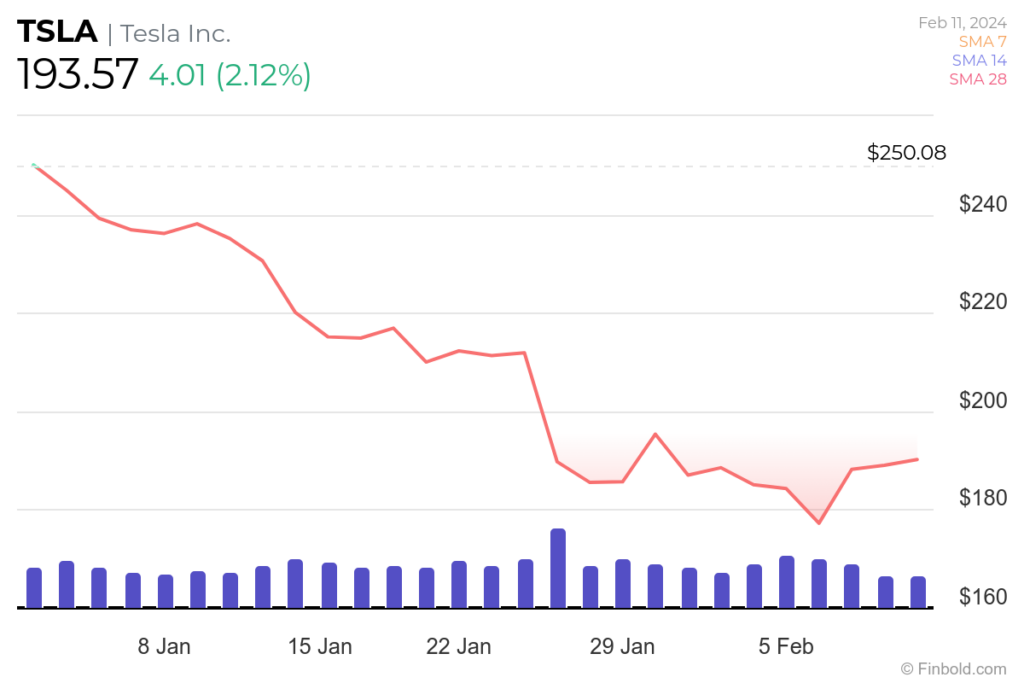

The downside has seen Tesla’s stock plummet by over 22% year-to-date. As of the market close on February 9, the TSLA stock was trading at $193.57, reflecting gains of over 2% within 24 hours. It’s worth noting that the stock is attempting to recover after hitting a year-low of $182 on January 25.

AI predicts Tesla’s stock price

With the recent stock downturn, investors are keenly observing how the equity will likely perform for the remainder of the year. Notably, monitoring TSLA becomes more imperative as Tesla has hinted at a potential slowdown for the rest of the year.

In the Q4 2023 results, Tesla acknowledged its growth may decelerate, citing its current navigation through two major growth waves.

In line with this, Finbold consulted artificial intelligence (AI) predictions from CoinCodex to gauge where Tesla might trade by the end of 2024.

As of February 11, the data retrieved from the tool projected that TSLA is likely to trade at $232 on December 31, 2024. This projection indicates an increase of almost 20% from Tesla’s current price.

At the same time, according to data gathered from 34 Wall Street analysts at TipRanks, Tesla stock has some upside in the next 12 months. The projection is based on TSLA’s performance over the past three months.

According to the analysts, the average 12-month price target is $220.26, indicating a 13.79% change from the last recorded price. The high forecast is $345, while the low forecast is $23.53. In this line, most analysts at 17 have a ‘hold’ rating on Tesla stock.

Tesla fundamentals

Despite implementing measures to maintain its dominance in the electric vehicle market amid intensifying competition, Tesla’s stock is grappling with bearish sentiments. Notably, in 2023, Tesla achieved a delivery milestone of 1.8 million units after implementing price reductions in crucial markets across Europe and China.

The most recent price reduction applies to Model Y cars in the U.S., extending until February 29. This comes shortly after the carmaker slashed Model Y prices in Germany.

This strategic move aimed to counter the increasing competition from Chinese players like BYD and traditional automakers. However, these price cuts have adversely impacted Tesla’s profit margins.

On a positive note, analysts forecast that Tesla is poised to retain a crucial position in the electric vehicle market, allowing the company to sustain its dominance.

In particular, Pierre Ferragu, an analyst at New Street Research, anticipates that Tesla will deliver 8.4 million vehicles by 2030. This projection implies an average annual growth rate of approximately 25% over the next seven years.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.