Over the course of a single week, the market capitalization of Solana (SOL) has become lighter by nearly $10 billion, leading cryptocurrency traders and investors to raise questions over what might have led to such a dramatic decline in the period of just seven days.

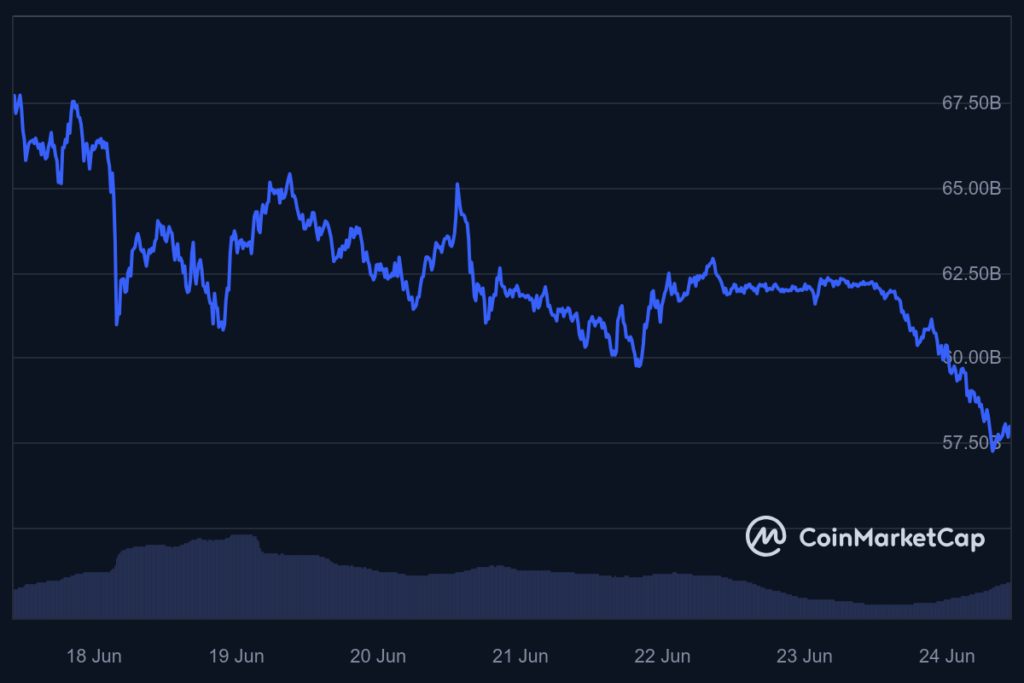

Specifically, the market cap of Solana, the currently fifth-largest asset in the cryptoverse by this indicator, has dropped from $67.69 billion seven days ago to $57.97 billion at press time, according to the most recent chart information retrieved by Finbold on June 24.

As it happens, the significant drop in Solana’s market cap coincides with the overall bearish sentiment in the general crypto sector that has prevailed during the last few days and weeks, but also the lack of onchain activity on the Solana network and stagnant demand from derivatives traders.

More recently, Shiba Inu (SHIB) marketing executive LucieShib has issued a major warning to members of the Solana community, especially to those participating in airdrops, that most of the celebrities’ accounts “posting SOL addresses left and right” might be fake.

Solana price analysis

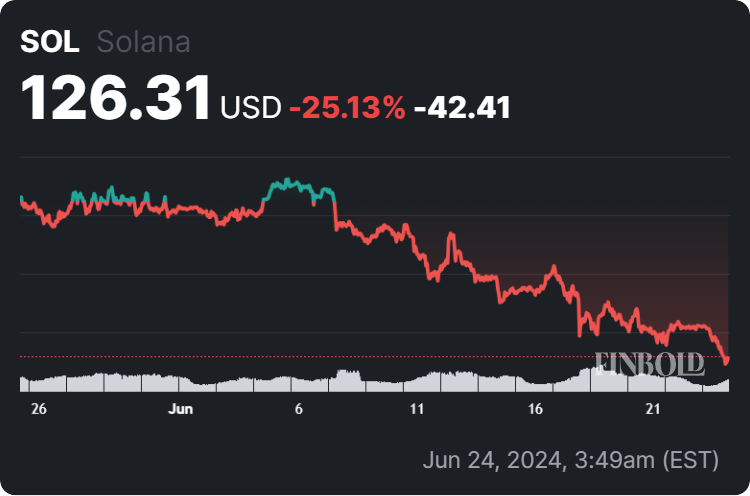

Indeed, the Solana blockchain dormancy, low appetite for leveraged positions, and a rise in scams could lead to the further demise of SOL’s market cap and price, which currently stands at $126.31, down 7.01% on the day, declining 13.18% across the week, and accumulating a loss of 25.13% on its monthly chart.

On the other hand, pseudonymous crypto market analyst CryptoCapo earlier this month informed his 90,000-strong Telegram subscriber audience of his beliefs that Solana, alongside the ‘Nvidia of crypto’ – Render (RNDR), is likely to enter an uptrend chart pattern soon, commenting that he had:

“Added more to the SOL and RNDR longs.”

Notably, his confidence might have something to do with experts projecting the possibility of a Solana exchange-traded fund (ETF) within years, pending regulatory approvals and market conditions, including professional crypto investor Brian Kelly and Bloomberg ETF analyst James Seyffart.

As Kelly explained in an interview with CNBC in late May:

“I think you’ve got to think about Solana as probably the next one, right? I mean, Bitcoin (BTC), Ethereum (ETH), and Solana are probably the Big Three for this cycle. (…) I think they’re the biggest beneficiaries from the [regulatory] change that’s going on.”

Meanwhile, Seyffart commented in an X post that this would “happen within a few years of getting a [Commodity Futures Trading Commission (CFTC)] regulated futures market,” but that “Congress & Market structure bills like FIT21 could make it happen quicker.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.