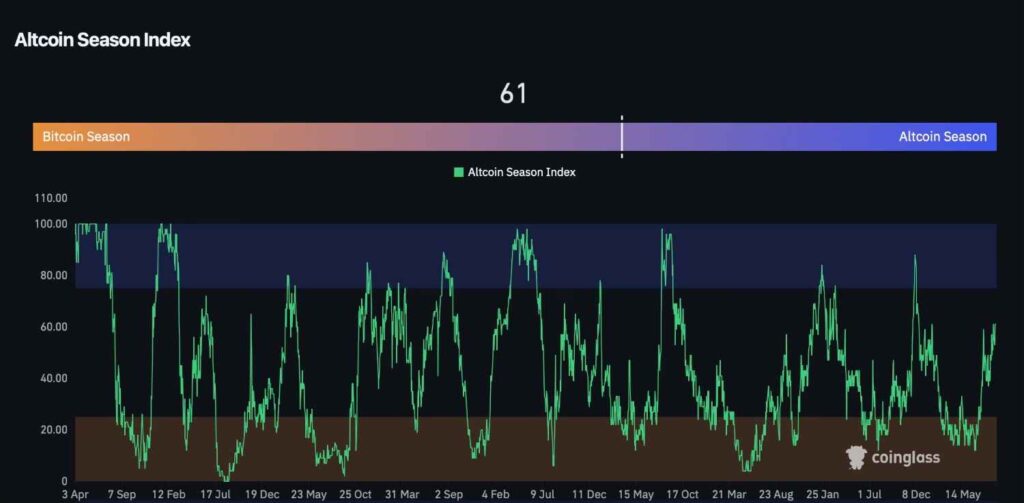

The crypto market is showing signs of a notable shift away from Bitcoin (BTC), as the Altcoin Season Index, a metric gauging the relative performance of alternative coins, climbed to 61 on Tuesday, September 2.

Should altcoins continue outperforming “digital gold”, the index could approach 75, traditionally viewed as the threshold of the so-called altseason, a period marked by capital rotation away from BTC.

Leading the charge is Ethereum (ETH), which has seen notable institutional favor over the past several weeks, with BlackRock alone reporting cumulative net inflows of $13.12 billion on August 29.

Ethereum whales have also been on the move. One of them caught market attention on September 2, acquiring 5,553 ETH, worth approximately $24.44 million, in just the last 40 minutes.

This purchase was a continuation of a larger buying spree that began on August 11. Since then, the whale has purchased a total of 18,447 ETH, worth $81.5 million, at an average price of $4,417.

Whale 0x4ED0 bought another 5,553 $ETH($24.44M) in the past 40 minutes.

— Lookonchain (@lookonchain) September 2, 2025

Since Aug 11, this whale has bought 18,447 $ETH($81.5M) at $4,417 avg, and 1,357 $WBTC($160M) at $117,547 avg, then deposited them into #Aave to borrow 114.2M $USDT.https://t.co/yKCGIiV30u pic.twitter.com/u6z3qoWkfT

Bitcoin price action

The aggressive Ethereum accumulation comes at a time when Bitcoin historically struggles.

September has long been known as a weak month for BTC, usually serving as a prelude to “Uptober”, a period in October characterized by more bullish developments and rebounds.

For instance, Bitcoin dropped 8% in September 2020, 7.3% in the same month of 2021, and then 3.10% in September 2022.

At the time of writing, the digital currency was trading at around $110,190, down some 10% from its August 14 peak above $124,000.

Given its historical weakness during the period and a somewhat mixed technical picture, some projections suggest the asset might drop to as low as $95,000 by the end of the month.

However, not all predictions are as pessimistic. BTC has posted two near-identical rallies of around 22% each since May, and corrections have repeatedly bottomed at predictable points, namely first at the 50-day moving average (MA) and then at the channel’s lower boundary.

On September 1, the crypto was testing its 20-week moving average, a level that has historically triggered major bull cycles.

If the pattern holds, some data suggests a 21% move higher, which could push BTC toward $130,000 in the coming weeks.

Featured image via Shutterstock