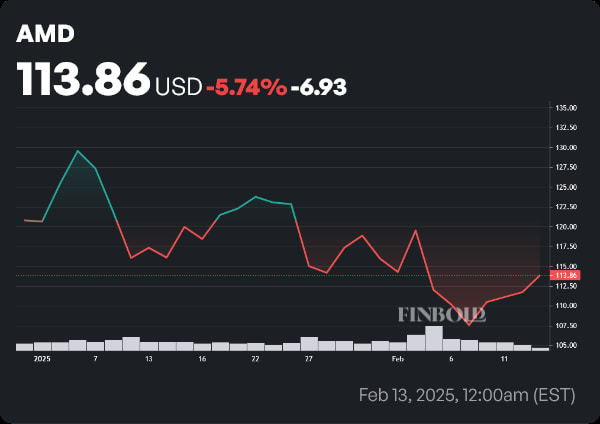

Advanced Micro Devices (NASDAQ: AMD) has been on a downward trajectory ever since reaching an all-time high (ATH) slightly above $200 in early March of 2024.

On February 4, the semiconductor company released its Q4 and FY 2025 earnings report. At first glance, one could assume everything went well. Both revenues and earnings per share (EPS) came in above analyst estimates — if just slightly.

However, one key area showed signs of underperformance. Unfortunately for AMD, that area was data center revenue — a segment many hold to be of life-and-death significance for the ailing chipmaker. In the immediate aftermath, the price of an AMD share crashed by 10.07%, down to $107.89.

By press time on February 13, the price of Advanced Micro Devices stock had somewhat recuperated, up to $113.86 — a mark that represents a 5.74% loss since the start of the year.

While analysts remain divided, it’s quite notable that even the bulls aren’t projecting much upside for AMD stock.

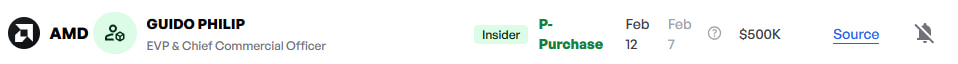

Then, on February 7, something unexpected happened. Finbold’s insider trading radar picked up what looked like a run-of-the-mill SEC Form 4 filing. A closer look revealed that it was not so ordinary after all — as it marked the first time in a long while that a company insider bought AMD stock instead of selling it.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Insider buys $500,000 worth of AMD stock

To be more precise, Philip Guido, the company’s chief commercial officer (CCO) bought 4,645 units of AMD stock at an average price of $107.56 apiece. Following the sale, he continues to hold 33,522 Advanced Micro Devices shares.

Insider purchases are generally bullish signs — but there’s an additional layer of significance here. Barring employee stock options being exercised, this is the first time that a company insider has bought Advanced Micro Devices stock in almost 13 years.

That’s not a typo — the last time an insider invested in the company by purchasing AMD shares on the open market was November 2012 — when chief executive officer (CEO) Lisa Su purchased 48,000 units of equity.

As potentially bullish as this latest development might seem, it’s important to put things into perspective. Looking at the bigger picture, it’s obvious that bearish sentiment is prevailing — even among insiders.

This was a $500,000 purchase. In December of 2024, Lisa Su sold roughly $10.9 million worth of AMD stock. In November, she sold approximately $11.5 million in equity. Earlier still, in September, she made another $11.5 million sale…you get the picture.

Ultimately, this acquisition only represents a vote of confidence from one man — no matter how clued into the internal workings of the chipmaker he may be. His vote of confidence may very well be warranted — but one $500,000 purchase is hardly enough for investors to base a bullish thesis on — particularly regarding AMD, a business that has been struggling considerably to capitalize on the strongest narrative in the market today.

Featured image via Shutterstock