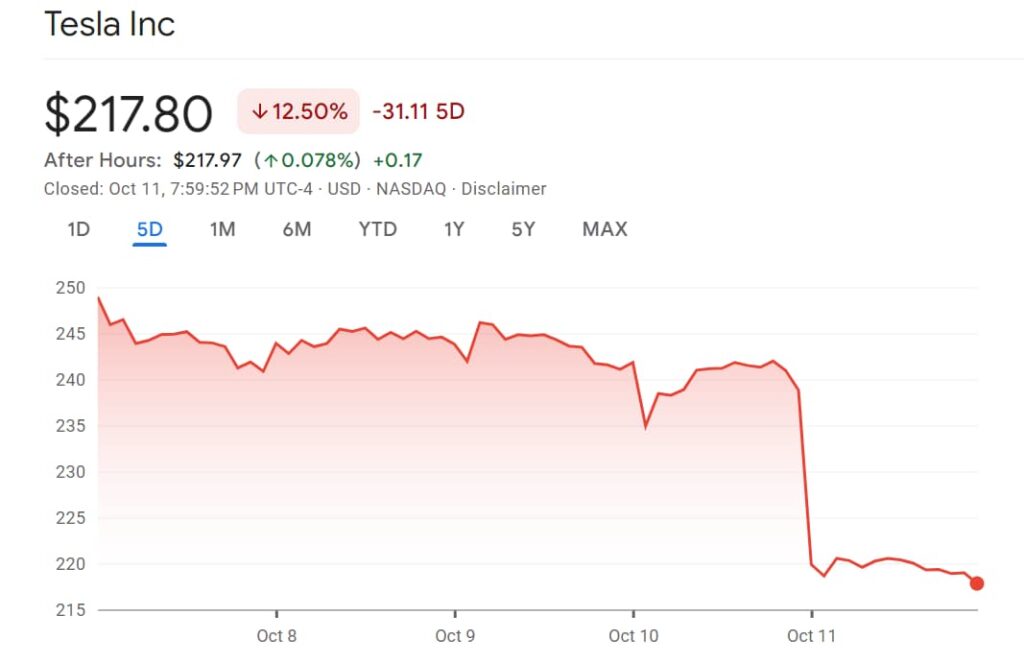

Electric vehicle (EV) manufacturer Tesla (NASDAQ: TSLA) saw its shares take a sharp 9% dive on October 11, wiping out $67 billion from its market value after the highly anticipated “We, Robot” event.

Investors were left underwhelmed by Elon Musk’s ambitious plans for a self-driving “Cybercab” fleet, which lacked the technical details they had hoped for. This disappointment triggered a steep decline in Tesla stock, making it the worst performer on the S&P 500 on October 11.

Some analysts, however, remain optimistic, predicting a potential rebound to $380, provided the company can regain investor confidence and address recent setbacks.

Investors unimpressed by Robotaxi and Robovan prototypes

Several analysts have shared an optimistic outlook on Tesla’s future, believing the Robotaxi event could positively impact the company’s long-term prospects, while others held mixed opinions, particularly after Tesla’s Q3 deliveries fell short of expectations.

During the event, Musk unveiled the Cybercab, a sleek, autonomous two-seater without a steering wheel or pedals, with production projected by 2026 and a sub-$30,000 price tag, pending regulatory approval.

Despite the excitement, the presentation, held at Warner Bros. Studios in Los Angeles, failed to provide critical specifics about the technology and production plans for Tesla’s self-driving fleet.

This lack of clarity and concrete milestones triggered a sharp sell-off, with some analysts, including those from Bernstein, calling the event “underwhelming and stunningly absent of detail.”

“Tesla’s robotaxi event last night was mostly “razzle-dazzle” with “little substance” – Wells Fargo

Alongside the Cybercab, Tesla introduced a prototype Robovan, designed to transport either 20 passengers or goods. While the concept was bold, it did little to reassure analysts that Tesla could meet its lofty goals.

The market responded harshly to this lack of substance, pushing Tesla’s stock below its critical 50-day moving average (MA50) and briefly testing the 100-day moving average (MA100), according to trading expert Tradingshot.

TSLA stock technical outlook

According to the analysis, Tesla’s sharp decline following the event aligns with a broader trend that has been playing out over the past several months. The stock was rejected by a long-term trendline of “lower highs,” a resistance level that has consistently triggered pullbacks since Tesla’s all-time high in November 2021.

This powerful resistance has triggered five significant rejections, causing the current downtrend. The most recent rejection occurred after the stock reached a high in late September 2024.

Despite the recent bearish action, there are signs Tesla could mount a recovery. The stock currently sits just above the MA100, which has acted as a strong support level in the past. Below this, the 200-day moving average (MA200) and the $195 to $203 support zone offer a final line of defense.

If Tesla holds above these levels, the potential for recovery remains strong. The analysis also suggests the formation of an upward channel, which could signal a broader bullish pattern.

If this channel holds, Tesla may rebound significantly. The key to this recovery lies in breaking through the lower-highs trendline, which has served as multi-year resistance.

Analyst eyes $380 target

If Tesla manages to break above this critical resistance, the analyst is predicting a rebound to around $380, marking a new higher high within the upward channel. This move would represent a strong recovery and renewed bullish momentum, driven by breaking the long-standing downward trend.

However, if Tesla fails to hold above the MA100 or falls below the $195 to $203 support zone, the stock could face further downside risks. Investors should closely watch these levels to assess Tesla’s next move.

Indeed, Tesla’s post-Robotaxi event drop may have disappointed investors, but the technical picture still offers hope for a rebound. The key lies in breaking through the long-term resistance trendline.

In summary, if Tesla can overcome this hurdle, a recovery to $380 seems possible. However, failure to hold key support levels could derail these prospects. Investors should pay close attention to Tesla’s price action in the coming days to gauge the likelihood of a rebound.