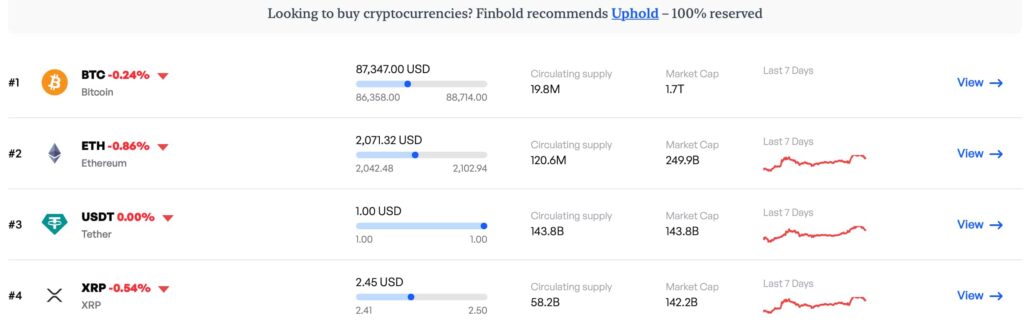

XRP is riding a wave of renewed optimism as its price hovers at $2.45.

With a market cap of $142.2 billion, XRP is inching closer to overtaking Tether (USDT) as the third-largest cryptocurrency by market capitalization, a gap of just $1.6 billion, according to the latest Finbold data.

This surge in attention comes on the heels of a landmark development: the U.S. Securities and Exchange Commission (SEC) has officially dropped its long-standing lawsuit against Ripple Labs, a move that one analyst says could propel XRP to new heights, forecasting a $10 price tag by 2030.

XRP’s price performance in the last year

XRP has been a standout performer in the crypto market over the past year, boasting a remarkable 287% price increase, outperforming 94% of the top 100 crypto assets, including heavyweights Bitcoin and Ethereum.

The token’s resilience is currently trading position above the 200-day simple moving average, a key technical indicator of long-term strength, although it only has 16 green days in the last 30 (53%).

In the short term, XRP has posted gains of 1.17% in the past 24 hours and 7.56% over the last seven days, with a 24-hour trading volume of $2.8 billion. Despite sitting 38% below its all-time high of $3.92, the token’s recent momentum suggests it’s poised for a potential breakout.

The SEC’s decision last week to abandon its legal battle with Ripple Labs has erased a major cloud of uncertainty that has loomed over XRP since 2020. The lawsuit, which alleged that Ripple’s sales of XRP constituted an unregistered securities offering, had long been a drag on the token’s price and adoption. With this regulatory overhang now lifted, traders and analysts are recalibrating their expectations—and the consensus is increasingly bullish.

Ryan Lee, an analyst at Bitget, highlighted the significance of this shift.

“The resolution of the SEC lawsuit marks a turning point for XRP,” Lee noted. “A breakout from the current $2.35–$2.55 range could lead to extensive moves in either direction, but the upside potential is substantial.”

He pointed to $2.50 as a critical level to watch, suggesting that a sustained move above this threshold could set the stage for long-term targets as high as $10 by 2030.

Ripple’s strategic moves amplify the bull case

Beyond regulatory clarity, Ripple’s ongoing efforts to expand its ecosystem are fueling speculation about XRP’s future. The company’s push to promote adoption of its RLUSD stablecoin—a dollar-pegged asset designed to complement XRP’s cross-border payment capabilities—could significantly boost demand for the token.

While $10 by 2030 represents a more than 300% increase from today’s $2.44, XRP’s recent performance and favorable market conditions lend credence to the prediction. The token’s $142.12 billion market cap positions it just shy of Tether’s third-place ranking, and continued growth could see it leapfrog USDT in the near future.

With daily trading volume up 6.36% to $2.8 billion and a year-long track record of outperforming the broader market, XRP appears to have the momentum to sustain its upward trajectory.

Featured image via Shutterstock