After days of exhibiting a possible turnaround characterized by breaking key resistance levels, Nvidia’s (NASDAQ: NVDA) stock price is now showing weakness, and an expert is warning that more losses could be in store.

The projection, signaling a potential 50% drop in the chipmaker’s stock, is grounded in Nvidia’s formation of consecutive lower highs, diminishing trading volume, and crucial support levels indicated by Fibonacci retracement patterns, according to Alan Santana’s analysis shared in a TradingView post on September 27.

According to the analysis, Nvidia ended the September 26 session with its fourth consecutive lower high. This pattern often signals upcoming downward momentum, suggesting buyers are losing market control.

A notable aspect of this price behavior is the consistent reduction in trading volume since early March 2024, which has lasted over six months. Santana noted that declining volume during price drops tends to signify weaker market support, raising concerns for Nvidia bulls.

The previous low following Nvidia’s all-time high was on August 5, 2024, when the stock traded around $100. According to Santana, a lower low is expected next since a lower high occurred in the recent pullback.

NVDA stock next targets

From a technical analysis perspective, Santana leveraged the Fibonacci retracement, highlighting the stock’s critical support range for Nvidia’s potential decline.

The first target sits at the 0.618 Fibonacci level, where support is projected to emerge around $77. If the decline is not too severe, the price could stabilize between $83 and $77. However, if the downturn gains momentum, the next significant level would be the 0.786 Fibonacci retracement, placing support near $61—a drop of about 50% from Nvidia’s share price at the last market close.

Santana’s analysis could be viewed as doubling down on the continued projection of Nvidia’s stock collapse, with more analysts cautioning about NVDA’s future outlook.

Indeed, as reported by Finbold, Nvidia stock has failed to mount significant price movement in either direction, remaining essentially flat since the company’s 10-for-1 stock split in early June. Since the split, NVDA has underperformed the S&P 500 by about 7%.

At the same time, questions emerged about whether the stock’s AI momentum had fizzled after failing to replicate the market’s bullish growth, driven by the Federal Reserve’s interest rate cut.

However, investor confidence in Nvidia was recently boosted after it emerged that CEO Jensen Huang paused his sale of NVDA shares. The development saw NVDA breach the $120 resistance.

NVDA share price possible bullish reversal

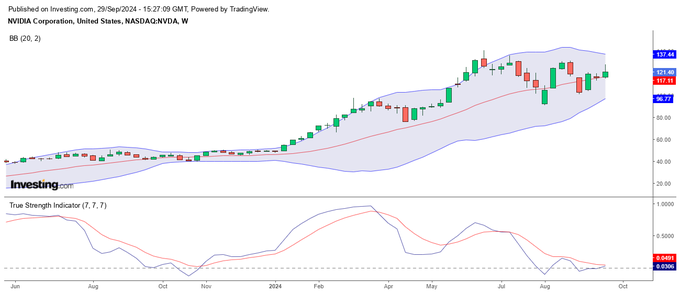

While Nvidia’s price action seems suppressed, the technology giant will likely have some reprieve after the third-quarter earnings report. To this end, analyst CyclesFan, in an X post on September 29, stressed that positive earnings and technical indicators suggest a potential bullish reversal. The expert noted that the True Strength Index (TSI) is showing signs of a possible bullish crossover, which could confirm that Nvidia made an intermediate-term low in August.

Despite this optimistic signal, the analyst cautioned that Nvidia will unlikely reach a new all-time high before the upcoming earnings report. Furthermore, the stock might still touch its lower weekly Bollinger Band (BB), which has been steadily rising, by mid-November.

NVDA stock analyst stock outlook

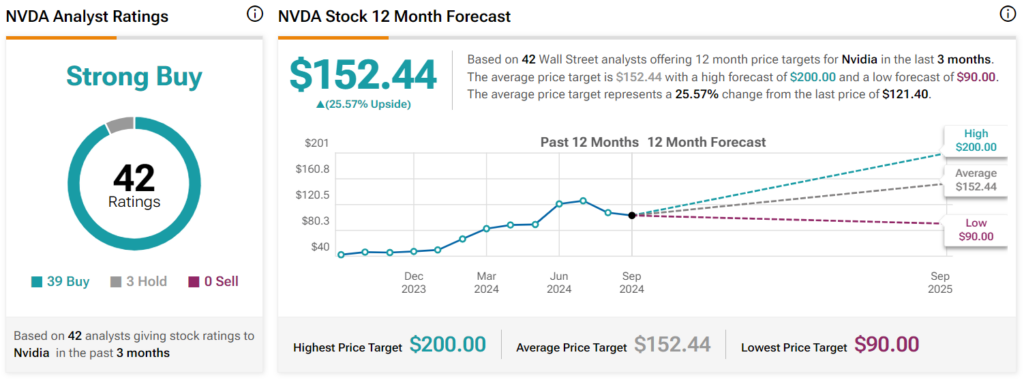

On the other hand, the bullish sentiment surrounding the stock is mirrored by a consensus of 42 Wall Street analysts over at TipRanks. According to the experts, Nvidia will likely trade at an average price of $152 in the next 12 months. The analysts have a high forecast of $200, while the lowest target is $90. Notably, the average target reflects an upside of over 25% from the stock’s last close of $121.

One of the analysts, investment banking giant William Blair, initiated its coverage of NVDA shares on September 18 and offered an ‘outperform’ rating for the stock. The bank’s analyst, Sébastien Naji, noted that Nvidia is likely to see further upside thanks to the company’s involvement in the AI space.

Meanwhile, Nvidia still has key fundamentals in store, especially with the planned release of the Blackwell line of chips amid growing demand. Additionally, historical analysis suggests that Nvidia will likely see more upside, considering that the stock has rallied months after the Fed’s rate cuts.

In conclusion, Nvidia’s stock faces uncertainty as technical indicators suggest a potential drop. Despite near-term volatility, investors need to exercise patience as Nvidia’s involvement in AI and release of new products could bolster long-term growth.