Apple (NASDAQ: AAPL) is grappling with an accelerating slowdown in iPhone sales, which plunged 5% during Q4 2024 while facing challenges in maintaining dominance in the competitive Chinese market.

Specifically, Apple’s global iPhone market share fell to 18% in 2024, with sales declining 2% despite a 4% growth in the overall smartphone market.

Apple also faces stiff competition in China from fast-growing local brands like Xiaomi and Vivo. At the same time, its new artificial intelligence (AI) feature, ‘Apple Intelligence,’ remains unavailable in the region, reducing its appeal.

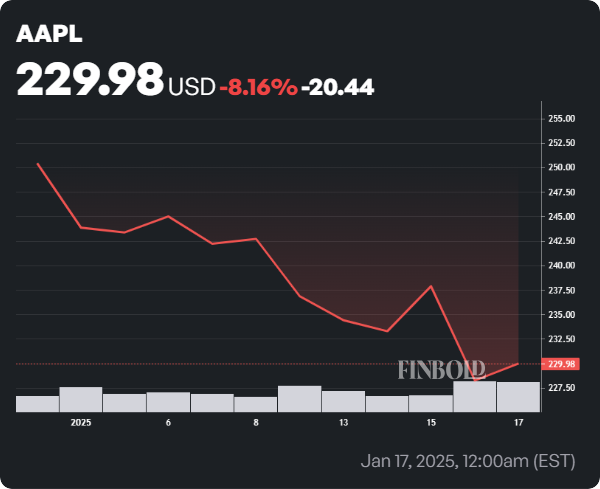

Amid challenges in the iPhone market, AAPL’s share price has experienced short-term volatility. In the latest trading session, the stock ended with modest gains of about 0.75%, closing at $229.98. Year-to-date, Apple’s share price has plunged over 8%.

Despite this volatility, an analyst at Evercore ISI has expressed optimism about the tech giant’s prospects, maintaining a ‘Tactical Outperform’ rating and setting a $250 price target.

In his analysis, Evercore’s Amit Daryanani highlighted that Apple is positioned to deliver solid results despite concerns about iPhone demand. He pointed to growth in emerging markets and strength in services and wearables, such as the new AirPods and Apple Watch, as key pillars of resilience.

“There has been some concern around industry data indicating iPhone weakness, which could help lower expectations and enable the stock to work on a weaker-than-expected guide,” Daryanani said.

The China wildcard

While China remains a ‘key wildcard,’ Daryanani noted that flat year-over-year revenue in the region during September 2024 highlights Apple’s ability to hold market share against a more competitive Huawei.

Notably, Huawei has struggled to secure sufficient smartphone chips, a factor that could work in Apple’s favor.

“We think Apple is positioned to deliver an in-line quarter with continued emerging market growth and strength from Services and Wearables (new AirPods and Watch). For the March quarter, we continue to expect a stronger-for-longer iPhone cycle that could drive growth ahead of seasonality, but China remains a key wildcard,” he said.

Looking ahead, optimism surrounds the upcoming iPhone 17, rumored to feature a new design and a new iPhone SE model set to launch in March 2025. These developments could boost investor sentiment and elevate June quarter estimates.

“We also think investors will begin to shift focus to the iPhone 17, which will reportedly unveil a new form factor, and this could be a positive for the stock. Apple should also unveil a new SE model in March, which would likely move June quarter estimates higher,” he added.

The analyst added that Apple’s gross margins are expected to remain in the 66-67% range for both the December and March quarters, providing stability amid a volatile market environment.

More iPhone sales trouble ahead

Despite progress in other areas, estimates suggest the company may continue to struggle with iPhone sales.

For instance, Apple supply chain analyst Ming-Chi Kuo projects iPhone shipments will drop 6% year-over-year in the first half of 2025, with a significant portion of the decline expected in the second quarter.

Indeed, the dynamics around the iPhone and the AI feature remain central to various analyst outlooks for the stock.

According to a Finbold report, Wedbush Securities’ Dan Ives believes the high number of users who have yet to upgrade their devices is bullish for the American giant.

On the other hand, KeyBanc analysts have warned that Apple faces multiple challenges, including Indonesia’s iPhone 16 sales ban and intense competition in China. Currency headwinds from a stronger U.S. dollar and weaker demand due to inflation also weigh on the company.

Featured image via Shutterstock