The ongoing artificial intelligence (AI) rally in the stock market has made companies such as Broadcom (NASDAQ: AVGO) real winners in terms of performance, guidance, and stock growth.

Broadcom stock received a significant price-target hike on July 11 from Rosenblatt Securities analyst Hans Mosesmann, who foresees the chipmaker and infrastructure software provider benefiting greatly from the ongoing artificial intelligence trend.

Mosesmann reiterated his buy rating on Broadcom stock and raised his 12-month price target from $1,640 to $2,400 according to sources. This adjustment comes just days before Broadcom’s 10-for-1 stock split, set to take effect on Monday.

At today’s stock market close, Broadcom will complete a 10-for-1 stock split, lowering the price of its stock from more than $1,700 to about $170. The stock will start trading at the new price as of the market open on Monday.

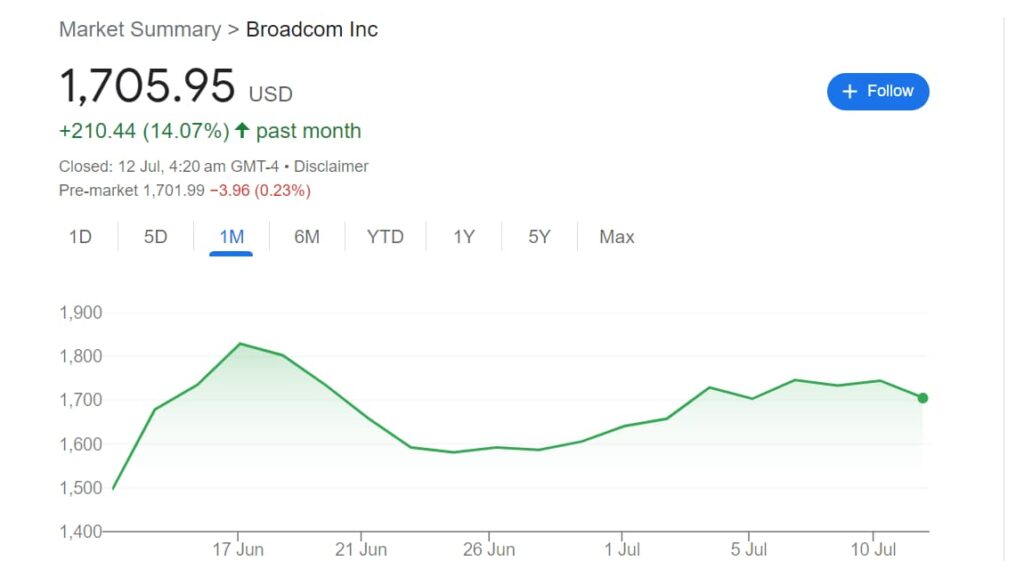

Despite the positive outlook, Broadcom stock fell 2.2% in 24 hours, closing at $1,705.95.

Strong sales forecast and AI integration

Mosesmann expressed optimism about Broadcom’s recently revised sales target for fiscal 2024, which has been increased to $51 billion.

This optimism is driven by strong AI chip sales and the successful integration of VMware (NYSE: VMW), a recent acquisition.

Broadcom produces custom AI workload processors, known as application-specific integrated circuits (ASICs), and also sells networking and switching chips for data centers.

Broadcom’s stock has shown impressive growth, nearly doubling in the past year due to increased AI customer demand. In the recent quarter, AI revenue surged 280% to $3.1 billion. Additionally, the acquisition of VMware has been a key growth driver.

Earlier, other analysts have also revised their price targets for Broadcom, anticipating strong performance in the upcoming quarter and throughout the year.

Tom O’Malley from Barclays raised his price target to $2,000, assigning a ‘buy’ rating. Similarly,Stacy Rasgon from Bernstein commended Broadcom for effectively mitigating risks in its core business while leveraging strong margins and an attractive valuation. He assigned an ‘outperform’ rating to the stock with a price target of $1,950.

Implications of the stock split and future outlook

The stock split will make it easier for investors with smaller budgets to purchase full shares rather than fractional ones. This increased accessibility could attract more investors, although the fundamental value of the company remains unchanged.

Rosenblatt Securities expects high-teens sales growth and $75 Non-GAAP EPS by FY26, driven by AI infrastructure networking/ASIC momentum and improved synergies in enterprise software.

The firm also expects continued strong demand for Broadcom’s AI-focused semiconductors, particularly in the networking and ASIC segments. Mosesmann highlights Broadcom’s competitive advantage in the AI sector due to its open standards approach, which has garnered support from major industry players.

In conclusion, Broadcom’s strategic moves, including its focus on AI and successful integration of VMware, along with the upcoming stock split, position the company for continued growth and investor interest. The revised price targets by analysts underscore the strong outlook for Broadcom amid the AI-driven market surge.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk