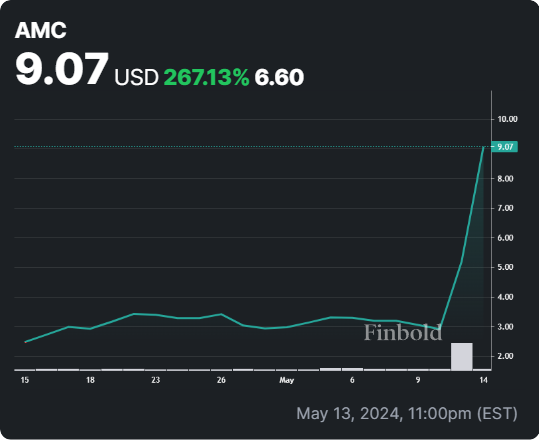

Although all attention has gone to GameStop (NYSE: GME) stock and its rapid surge, another meme stock has posted even more significant daily gains above 78% – AMC Entertainment (NYSE: AMC).

Its surge has been attributed to a market-wide surge in meme stocks, with gains of 68.59% extending into the pre-market and moving AMC share price above the $9 threshold.

Whether this rally will gain the strength of the meme frenzy back in 2021 remains to be seen in the upcoming days; however, there is no debate that AMC is starting to turn traders’ heads, as Jim Cramer, host of CNBC’s Lighting Round, weighed in with his opinion, that the company may look to sell some shares itself ‘taking advantage of the gain.’

And Cramer was right, as the company completed a shares dilution on May 13.

Analysts’ start to give opinions on AMC

Analysts swiftly adjust their AMC stock price targets as market sentiment shifts. B. Riley has assigned a ‘neutral’ rating and set a price target of $8 for the stock. Separately, Wedbush has reduced its price target on AMC Entertainment from $4 to $3.50 while maintaining a ‘neutral’ rating, according to a report released on May 9.

The most recent update comes from Citi, which revised its AMC Entertainment model. As shares in the cinema chain operator continue to surge, Citi analysts have raised their price target on AMC stock from $3.10 to $3.20 while reiterating their ‘sell’ rating.

The long-term effects of the COVID-19 pandemic on the movie theater industry influence Citi’s ‘sell’ rating. The widespread closures of theaters globally have led to a significant decline in global box office revenues.

Citi highlights the industry’s challenges, including the proliferation of multiple streaming services and the potential decrease in the strategic importance of movie exhibitors.

AMC stock surge couldn’t have come at a better time for the company

Despite a meme-stock surge, AMC utilized a fundraising method called at-the-market offering, allowing it to create and sell new shares opportunistically.

This move aims to secure long-term capital, though it dilutes existing shareholders. Tuttle Capital Management CEO Matthew Tuttle sees the strategic advantage in selling shares amidst a market frenzy.

As of May 8, AMC could raise $125 million through this program. Since March, it has already generated $124 million, selling 38.5 million shares at an average price of $3.22.

AMC has a history of equity offerings to tackle its $4.5 billion debt. Despite short-term stock fluctuations, AMC prioritizes managing debt and securing its financial future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.