Nearly two weeks after technology behemoth Apple (NASDAQ: AAPL) announced it was partnering with OpenAI to boost its artificial intelligence (AI) efforts, certain analysts have updated their Apple stock price targets for the next 12 months to reflect their expectations.

Specifically, Apple stock has received a positive push from those news, taking it from the previous trading in the $180-$190 zone and pulling it over the threshold of $200, after which it continued moving in an upward direction, adding more gains in pre-market.

AAPL price target 2025

Taking into account Apple’s recent successes, investment firm Rosenblatt Securities upgraded its rating for AAPL shares to a ‘buy’ from ‘neutral,’ as well as raising the price target from $196 to $260, citing the privacy-focused AI as a booster for Apple’s market share:

“Given that Apple has uniquely flagged Private Cloud Compute as core to its approach, building on a recent history of stronger advertising privacy safeguards in its app store and contrasted with AI privacy mishaps from rivals, Apple appears positioned to gain brand interest and AI market share from its out-of-the-gate focus on strong privacy.”

At the same time, Bank of America (NYSE: BAC) has reiterated its score of ‘buy,’ with a price target of $230, arguing that Apple’s move to integrate AI into its operating system and giving third-party developers access to its features could drive profit increases in its services segment.

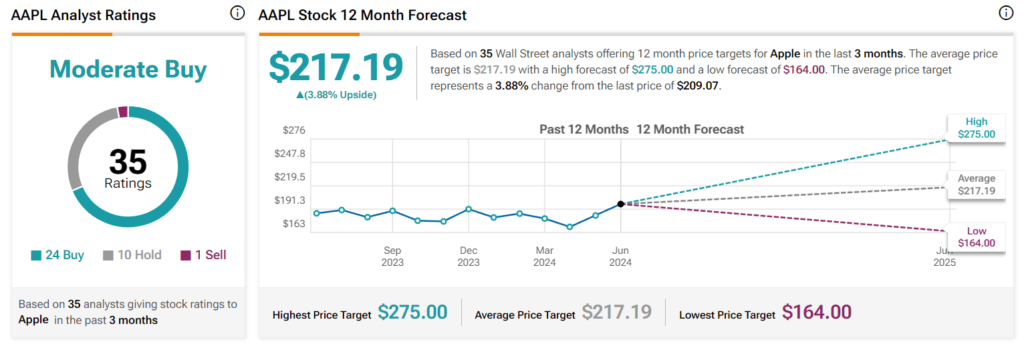

With the most recent updates, the average price target for Apple shares in the next 12 months stands at $217.19, suggesting a 3.05% increase from its current price, with the majority of Wall Street experts agreeing that AAPL is a ‘buy,’ with support from 24 of them, 10 suggesting a ‘hold’ and only one ‘sell’ call.

Apple stock price analysis

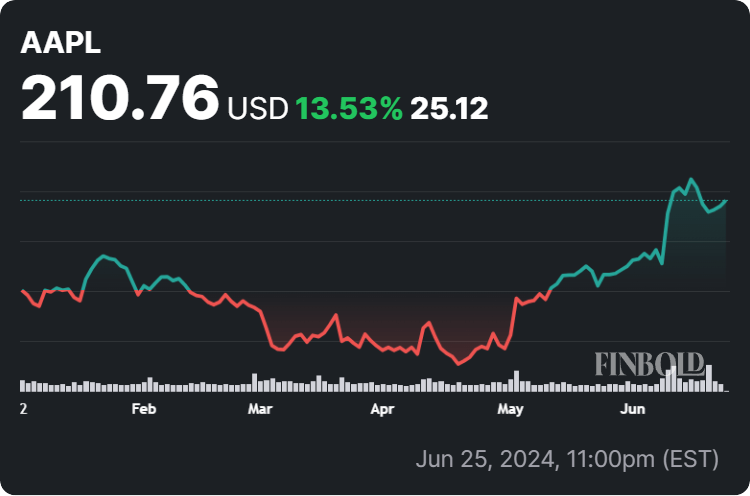

Meanwhile, the price of the popular blue-chip stock currently stands at $210.76, reflecting an increase of 0.77% in pre-market, while it moves to recover from the 1.74% loss across the week, advancing 10.93% in the last month and accumulating a gain of 13.53% since the year’s turn.

All things considered, experts seem to largely agree that things are looking good for the price performance of Apple stock in the next 12 months. However, trends can easily change in the stock market, so it is crucial to carry out one’s own research instead of relying on other people’s analyses exclusively.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.