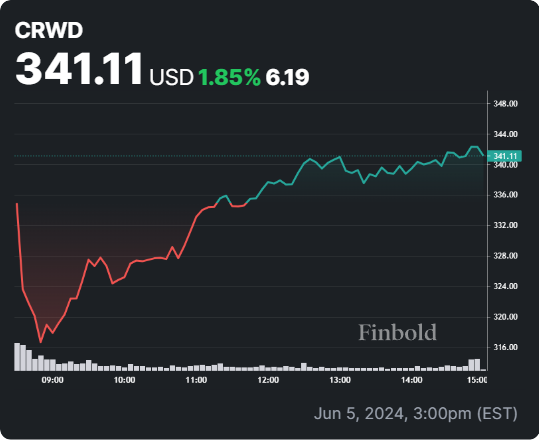

Cybersecurity company CrowdStrike Holdings (NASDAQ: CRWD) stock surged almost 12% on June 5 after the firm reported strong financial results for its fiscal first quarter of 2025.

In the past month, CRWD has traded within a wide range of $303.50 to $358.84, and it is currently trading in the middle of this range, with resistance above at $351.48.

Robust financials and outlook excite analysts

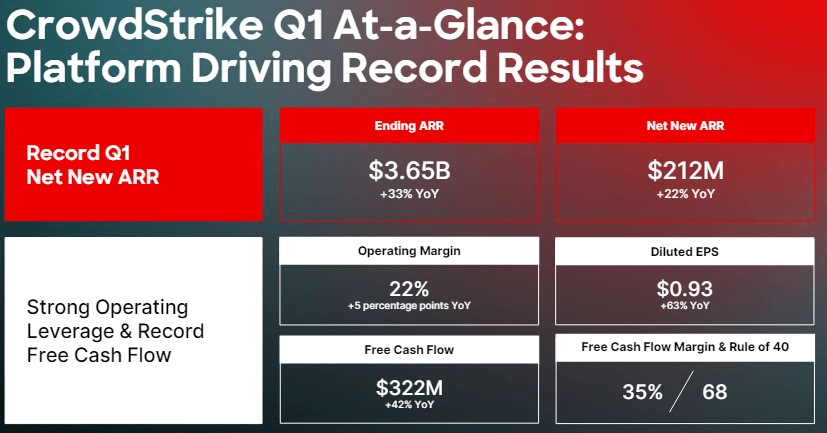

In Q1, CrowdStrike generated $921 million in revenue, a 33% year-over-year increase, surpassing the guidance of $906 million.

Picks for you

CrowdStrike’s management raised its full-year revenue guidance to about $4 billion, indicating an expected annual growth of approximately 31%, showing that growth will remain strong beyond Q1.

Additionally, the company reported a record free cash flow of $322 million in Q1, representing a 35% margin.

Wall Street is excited about CRWD stock

CrowdStrike’s recent performance and optimistic forecasts have generated significant market excitement as Wall Street’s largest analyst firms rushed to update their outlooks and price targets on CRWD stock.

Bank of America Securities’ analyst praised CrowdStrike for ‘defying the laws of gravity yet again,’ maintaining a positive outlook with a ‘buy’ rating and a $400 price target.

Meanwhile, Morgan Stanley analysts highlighted CrowdStrike’s potential inclusion in the S&P 500 index as another boost for the stock, retaining an ‘overweight’ rating with a $422 price target.

Oppenheimer analyst Ittai Kidron says the company provides modest guidance and expects much stronger results. He reinforced his confidence in CrowdStrike with an ‘outperform’ rating and increased the price target to $400.

Piper Sandler analyst Rob Owens maintained an ‘overweight’ rating with a $400 price target and views it as a testament to the firm’s industry leadership amid challenging market conditions.

Goldman Sachs analyst Gabriela Borges highlights the effectiveness of CrowdStrike’s Falcon Flex program, which offers flexible licensing agreements that have reduced sales friction and amassed significant deal value. Borges maintained a ‘buy’ rating and set the price target at $400.

Lastly, Wedbush analyst Taz Koujalgi maintained an ‘outperform’ rating but adjusted the price target slightly from $390 to $385, while commenting that ‘strength was driven by continued platform adoption and strong momentum in Cloud, Identity, and Logscale, along with better-than-expected results in Data Protection and Charolette AI.’

Overall, Wall Street is bullish about CrowdStrike’s prospects, as its average price target indicates a 16.90% upside from the latest closing price for CRWD stock, which was $342.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.