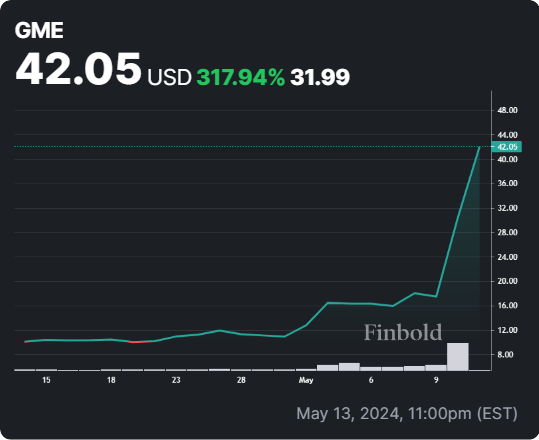

In what looks like a scenario from three years ago, GameStop (NYSE: GME) stock continues its surge, adding well over 70% in just one trading day, with gains of 30% extending in the pre-market, effectively doubling GME shares worth with $40 valuation.

Adding to the frenzy, Keith Gill, also known as Roaring Kitty, has emerged from a three-year hiatus on the X network. His series of cryptic posts have further stoked the hype around GME shares, with Andrew Tate advocating for their purchase openly.

Short sellers of GME stock have lost more than $1 billion in 24 hours, while Wall Street seemingly didn’t allocate much attention to this surge.

Analysts want to wait out the GME stock surge

After losing much of its strength and falling from its all-time high, GME stock has lost much of Wall Street’s attention. Most analysts have left the targets without updates for several months.

The latest update comes from Wedbush analyst Michael Patcher, who maintained his ‘underperform’ rating on March 27 and slashed the GME stock price from $6 to $5.6.

Analysts may only make judgments once there are new developments in the coming days. Alternatively, they might be relying on their assessment of GameStop’s core business, which appears bleak according to its latest earnings report.

In late March, GameStop announced job cuts to lower expenses and reported a decrease in fourth-quarter revenue due to increased competition from gaming industry e-commerce rivals.

Scenario from 2021 is repeating

Having learned their lesson from 2021, many online brokering platforms are starting to limit the orders on GME stock, whose trading has been halted multiple times in fear of upside volatility.

In 2021, r/WallStreetBets traders targeted Melvin Capital, a hedge fund deeply invested in shorting GameStop. Their onslaught caused Melvin significant losses, leading Citadel, headed by Ken Griffin, and Point72 to step in and provide nearly $3 billion in financial support to stabilize Melvin’s situation.

Whether this scenario repeats but in a different form remains to be seen.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.