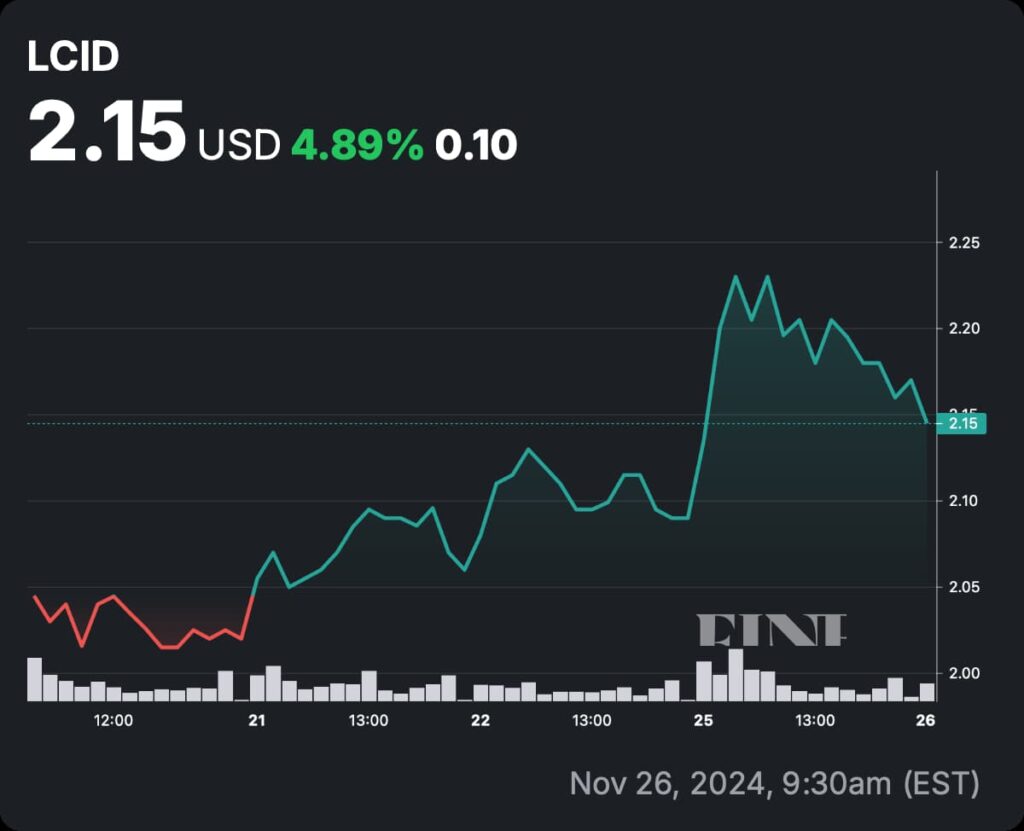

Over the past five days, Lucid Group (NASDAQ: LCID) stock has gained 4.89% but remains down 13.89% over the past month.

Lucid briefly fell below the psychological $2 level, sparking concerns among investors, but it has since clawed its way back into safer territory.

Despite this modest recovery, Lucid continues to trade near the lower end of its 52-week range, signaling broader challenges for the electric vehicle (EV) manufacturer.

Analysts set Lucid Motors price target

BofA Securities adjusted its price target for Lucid from $3.40 to $2.80 on November 21, maintaining a neutral rating. Analyst John Murphy noted that the adjustment reflects broader market pressures and challenges in Lucid’s ability to meet high growth expectations.

Elsewhere, RBC Capital Markets took a more bearish stance on November 19, slashing its price target from $3.00 to $2.00. The firm retained its “sector perform” rating, suggesting limited upside potential for the stock. RBC’s revised price objective represents a significant downside from Lucid’s current trading levels.

Finally, R.F. Lafferty, however, upgraded Lucid from a “hold” to a “buy” rating on November 11, setting a more ambitious $4.00 price target, believing in the company’s long-term potential despite its recent struggles.

LCID market sentiment and technical setup

The luxury carmaker’s current position in the market reflects mixed signals. While the S&P 500 Index is trading near 52-week highs, LCID shares lag, suggesting the company is underperforming relative to broader market trends. However, the LCID stock shows signs of consolidation with reduced volatility, which could present a setup for potential gains.

Recent activity from large institutional players, as indicated by the Effective Volume indicator, suggests renewed interest in Lucid stock. This metric, which analyzes high-volume transactions on a minute-by-minute basis, has pointed to increased participation by major players in recent days—a positive sign for investors watching for momentum shifts.

In terms of price range, Lucid has been trading between $1.93 and $2.55 over the past month—a notably wide band for the stock. Currently, Lucid shares sits in the middle of this range, facing potential resistance as it attempts to climb higher.

Lucid Group’s challenges

Lucid’s stock performance reflects broader uncertainties in the EV sector, including concerns about execution, competition, and market sentiment. While Lucid has shown the potential to scale up production and deliver on its promises, its ability to do so under current market conditions remains a question.

On the positive side, the recent uptick in institutional activity and reduced volatility could indicate a period of stabilization, offering an opportunity for investors willing to weather short-term challenges.

Yet, with the stock trading near its historical lows, much will depend on Lucid’s ability to deliver strong quarterly results and maintain investor confidence heading into 2025.

For now, Lucid presents a high-risk, potentially high-reward opportunity for investors who believe in the EV manufacturer’s long-term vision. However, caution is warranted, especially given the divergent opinions among analysts and the stock’s underwhelming recent performance.

Featured image via Shutterstock