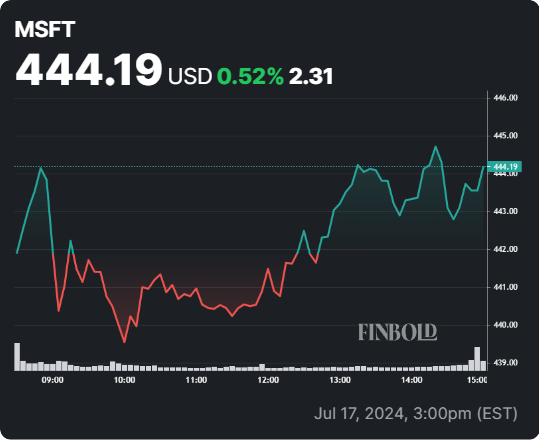

A recent drawback in large-cap tech stocks didn’t exclude Microsoft (NASDAQ: MSFT) stock, which retraced by 4.23% in the previous five trading sessions. However, it has already managed to reclaim some of the losses, as it has pre-market gains of 0.58% at the time of writing.

Despite a recent rotation from large-cap to small-cap stocks, experts see MSFT stock as one of the best picks for investors due to strong fundamentals, extensive market share, and growth prospects.

Wall Street weighs in on MSFT stock

The tech giant’s backing from Wall Street analysts is best evidenced by the recent price targets it received from notable institutions ahead of its Q2 earnings report on July 30.

In the most recent price target release on July 18, TD Cowen has maintained a positive outlook on Microsoft shares, raising the price target from $470 to $495 and reiterating a “buy” rating. The firm’s analysis highlights consistent performance in Microsoft’s Office 365 Commercial segment, forecasting a 14% growth in constant currency (cc).

Despite a 15% cc growth in the previous quarter, TD Cowen expects Microsoft to have an in-line quarter, with vendor consolidation and Average Revenue Per User (ARPU) growth through upgrades as beneficial factors.

A day before, on July 17, Bank of America raised its price target for MSFT to $510 from $480, citing strong performance in Azure cloud services and early success with the Copilot feature.

Analysts noted that Microsoft partners are performing well, with most tracking above or in line with expectations ahead of Q2 FY24 results on July 30. They forecast a 31.5% year-over-year growth for Azure, driven by an 8% contribution from AI workloads, surpassing the initial estimate of 30.5%.

Bullish stance on MSFT stock doesn’t stop there

On the same date, Citi reaffirmed its positive outlook on Windows maker by maintaining a “buy” rating and a $520 price target. Anticipation is building for Microsoft’s upcoming second-quarter results, with solid expectations for both revenue and earnings.

Despite the 11% share increase since the last earnings report, Citi believes the forthcoming results will showcase the company’s sustained growth, even if they are not a significant catalyst.

July 16 saw Mizuho Securities update its outlook on Microsoft stock, raising the price target to $480 from $450 and maintaining an “outperform” rating. This adjustment comes after Microsoft’s fiscal third-quarter earnings report, which showed total revenue of $61.9 billion, exceeding analysts’ forecast of $60.8 billion.

With a “strong buy” consensus from 35 analysts and an average price target of $504.12, reflecting a 13.66% upside, MSFT shares remain one of the Wall Street analysts’ favorite holdings.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.