After Nvidia (NASDAQ: NVDA) eclipsed Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT) to become the most valuable company in the world by market capitalization, several Wall Street analysts have updated their price targets for the shares of the leading artificial intelligence (AI) chipmaker.

Indeed, Nvidia’s continuous climb has culminated in it reaching the market cap of $3.335 trillion, surpassing Apple’s $3.285 trillion and Microsoft’s $3.317 trillion, while the price of NVDA stock has demonstrated strength as well, as it kept growing alongside, hitting a new all-time high (ATH) of $135.

NVDA stock prediction

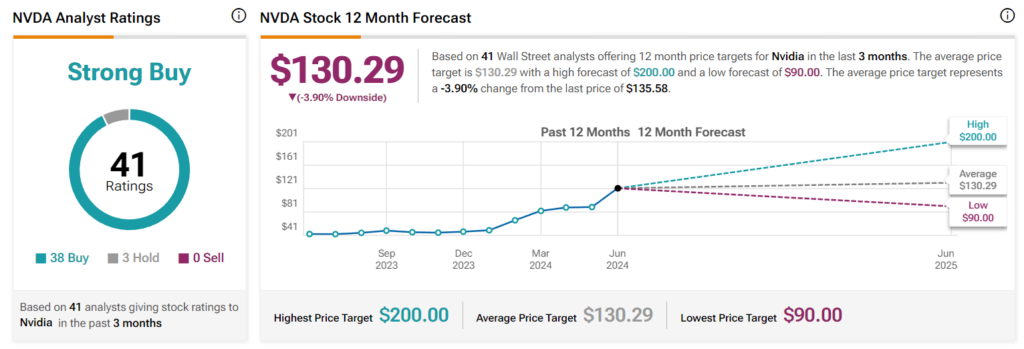

In this context, a number of financial experts have raised their Nvidia stock price targets for the next 12 months, maintaining the ‘strong buy’ score for it, albeit still not moving the expectations beyond the average price of $130.29, despite some of them seeing a further climb to $200.

Among the experts that have raised their price targets on NVDA shares is Tigress Financial analyst Ivan Feinseth, who has recently increased his expectations for Nvidia stock’s price by $71.50 – from the previous $98.50 to the current $170 – for the next 12 months, maintaining its ‘buy’ rating.

At the same time, Wells Fargo (NYSE: WFC) has updated his Nvidia stock target price, increasing it from $125 to $155, and Wedbush estimated that over the next year, the race to a $4 trillion market cap in the technology sector would continue to revolve around Nvidia, Apple, and Microsoft.

At the same time, Rosenblatt Securities went all-bullish on NVDA stock, raising its Nvidia price target from $140 to $200, projecting Nvidia to achieve $5.00 earnings per share (EPS) or more by 2026 and arguing that:

“We see Nvidia’s Hopper, Blackwell, and Rubin series driving ‘value’ market share in one of Silicon Valley’s most successful silicon/platform product cycles.”

Nvidia stock price history

For now, the NVDA stock is changing hands at the price of $135.58, which indicates an increase of 2.92% on the day, adding up to the weekly gain of 5.14%, as well as the 43.05% advance on its monthly chart, as it grew a whopping 181.47% this year alone, as per data on June 19.

It is also worth noting that market expert Louis Navellier has shared his view that despite NVDA’s already-staggering rise, the AI company’s stock has significantly more room to grow and that it will soon target an unprecedented market cap of $5 trillion, as Finbold reported on June 7.

All things considered, Wall Street analysts’ views regarding the future performance of Nvidia shares seem to be growing bullish, albeit not many of them have yet jumped on the bandwagon of increasing their price targets for the next 12 months, but current developments might push them in this direction.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.