Palantir (NYSE: PLTR) has stood out in the AI-focused stock arena. 2024 was particularly impressive, with PLTR shares skyrocketing over 50%, exceeding analysts’ optimistic predictions.

One key factor propelling demand is Palantir’s unique go-to-market strategy, featuring ‘boot camps’ for potential AIP clients. These camps streamline the process, allowing customers to explore multiple real-world applications of AIP in just five days or less.

Additionally, securing government contracts, particularly with US military and security agencies, further solidifies Palantir’s position as a top player in the industry.

While Palantir has achieved significant successes, it’s important to note the challenges ahead. The industry is highly competitive, and a noticeable short-selling activity impacts PLTR shares. Furthermore, despite Palantir’s earnings surpassing expectations, its guidance fell short, resulting in a post-earnings slump in share prices.

Analysts revised their stock price targets for PLTR

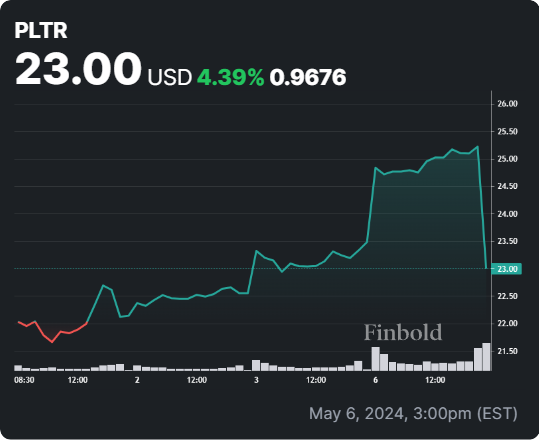

Palantir shares experienced a decline of up to 9% following the release of weaker-than-anticipated guidance by the defense technology firm.

In comparison to estimates by LSEG, the company’s performance stood at $0.08 adjusted earnings per share (EPS), matching the expected $0.08, while revenues amounted to $634 million, slightly surpassing the anticipated $625 million.

Wedbush analysts reiterated an ‘outperform’ rating and $35 price target for Palantir Technologies, anticipating another strong quarter driven by US commercial strength. They highlighted Palantir’s advantage in monetizing the growing enterprise spending with its AIP platform and customer boot camps.

On the other hand, Citi analysts raised Palantir’s price target to $23, acknowledging its improved US commercial momentum and profitability profile while maintaining a ‘neutral’ rating. They expect strength in Q1 US commercial but note potential seasonal weakness.

Monness, Crespi, and Hardt analysts upgraded Palantir to ‘neutral’ from ‘sell,’ citing the recent stock decline and the company’s potential to benefit from the long-term AI trend and volatile geopolitics, despite concerns about government-related contract revenue variability and valuation.

Lower-than-expected guidance might pose a problem for PLTR

For the current quarter, revenue is projected to range between $649 million and $653 million, falling short of the $653 million anticipated by LSEG.

Similarly, Palantir forecasted full-year revenue to be between $2.68 billion and $2.69 billion, below the LSEG consensus estimate of $2.71 billion.

Despite posting notable gains in the latest trading session, the market reacted negatively to Palantir’s guidance miss, as PLTR stock dipped by 9.48% in the pre-market, effectively erasing yesterday’s gains.

Despite beating expectations, the pre-market dip on the missed guidance has become a trend in the latest earnings season, with many companies falling victim to it.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.