In the first quarter, Tesla’s (NASDAQ: TSLA) shares dropped by over 40% due to growth challenges. Analysts have lowered their expectations for Q1 earnings.

Tesla faced significant hurdles in the first quarter, including fierce competition from Chinese rivals and decreased consumer demand, leading to a sharp decline in its stock value.

Price reductions in late 2023 further squeezed profit margins, and revenue growth slowed. As anticipated, Tesla’s fiscal 2024 first-quarter earnings have suffered a significant drawback, prompting further reassessment.

What do analysts predict for Tesla in 2024 after missed Q1 targets?

On April 23, Tesla reported a notable 9% decrease in first-quarter revenue, marking its most significant decline since 2012. The electric vehicle company missed analysts’ estimates, facing the impact of ongoing price cuts.

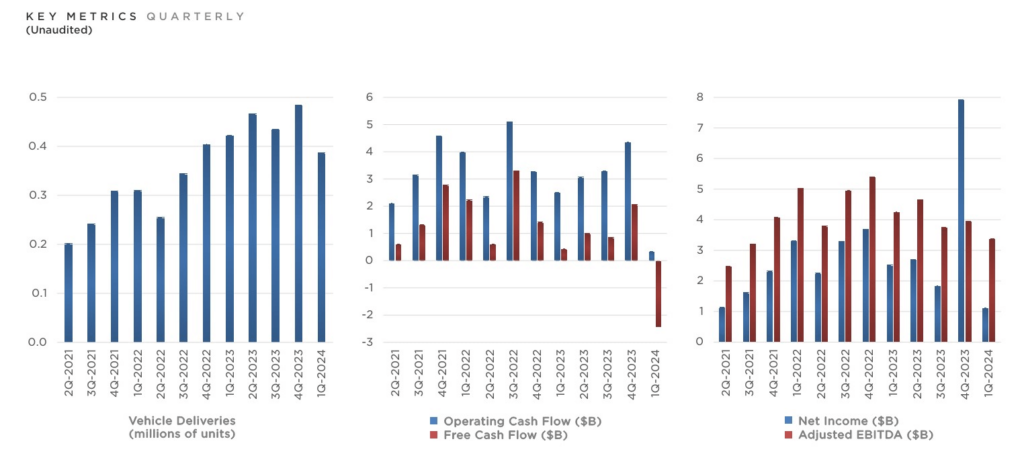

Revenue dropped from $23.33 billion the previous year to $25.17 billion in the fourth quarter. Net income declined by 55% to $1.13 billion, or $0.34 per share, from $2.51 billion, or $0.73 per share, a year ago.

This sales decline exceeded the company’s previous drop in 2020, attributed to disrupted production during the COVID-19 pandemic. Tesla’s automotive revenue also fell by 13% year over year to $17.38 billion in the first quarter of 2024.

While analysts have yet to react to Tesla’s Q1 earnings miss, Bank of America analyst John Murphy has already set the tone. He expressed concerns about weaker EV fundamentals and sentiment in the previous period, with investors focusing on demand and future growth plans.

Wedbush analyst Daniel Ives emphasized the significance of Tesla and CEO Elon Musk’s first-quarter conference call. Ives cautioned that if the call fails to provide a new strategy outlook, ‘darker days’ could lie ahead.

UBS lowered Tesla’s price target to $147 from $160, maintaining a Neutral rating. They noted better-than-expected first-quarter auto gross margin but expressed caution about Tesla’s focus on autonomy.

Canaccord reduced Tesla’s price target to $220 from $234 but kept a Buy rating. They cited new information clarifying Tesla’s earnings outlook and changes in its next-gen vehicle rollout plans.

Truist cut Tesla’s price target to $162 from $176, maintaining a Hold rating. They highlighted slightly below-consensus first-quarter results but noted positive surprises in new auto products and AI development. They expressed concerns about recent price cuts and management changes.

Tesla stock went against the odds in the pre-market

Despite falling short of analysts’ targets, TSLA stock has unexpectedly gained 11%, pushing its share price to $160.60.

This marks a welcome trend reversal from the previous five trading sessions, during which TSLA shares lost 8.21% of their value.

Tesla’s stock surged despite missing analysts’ targets, possibly due to its plan to accelerate the launch of new, more affordable vehicles while fully utilizing its current manufacturing lines.

Tesla aims for over 50% growth in production before investing in new manufacturing lines.

Additionally, Tesla showcased screens of a Robotaxi-based ride-hailing service, although the promise of a self-driving vehicle still needs to be fulfilled.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.