Andrew Tate is one of the most controversial personalities worldwide and a die-hard Bitcoin (BTC) enthusiast. In a recent post on March 29, Tate revealed his Bitcoin dollar-cost averaging (DCA) strategy.

The former kickboxer and current social media influencer commented on X about his recurrent Bitcoin purchases since 2018. Notably, the post had already surpassed 2.5 million views by press time, giving a strong message to cryptocurrency investors.

“I bought my first bitcoin in 2018. Since then, I’ve been buying some bitcoin every single week without fail. And I’ve never, ever, not once – sold ANY. Do you understand?”

– Andrew Tate

How many Bitcoin purchases did Andrew Tate make?

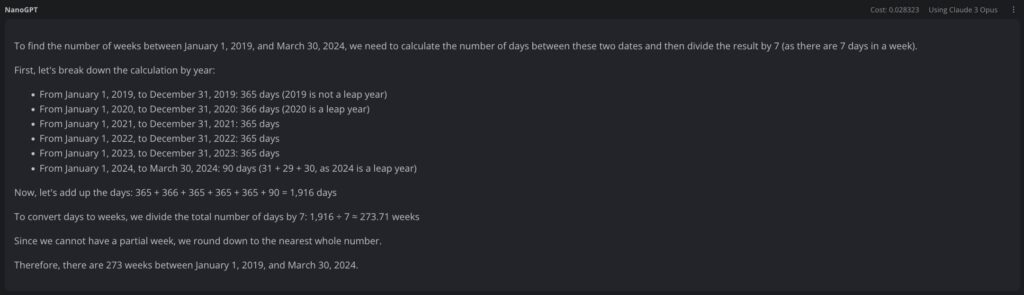

Interestingly, Andrew Tate has allegedly made at least 274 Bitcoin purchases in his life, if he bought BTC “every single week without fail” since 2018.

Finbold got to this number with Claude 3 Opus AI assistance. For that, we calculated the number of weeks from January 1, 2019, to March 30, 2024, resulting in nearly 274 weeks. It is impossible to know how many weeks in 2018 were part of Tate’s DCA strategy with the revealed information.

Andrew Tate and cryptocurrencies

However, this is not the first time the crypto market has hints about the influencer’s investments in cryptocurrencies.

In January 2023, the Romanian police seized millions worth of goods and assets as part of Tate’s criminal investigation. Among these assets, multiple sources report the seizure of 21 BTC, which, Reuters recently reported, are still under police custody.

Previously, The Guardian reported how Andrew Tate told his listeners “that he flipped a $600,000 bitcoin investment from March 2020, turning it into a $12 million profit.” This podcast episode was removed from the content platforms. On that note, it contradicts Tate’s recent sayings that he has never sold any of the purchased Bitcoin.

Additionally, the former kickboxer said, on March 18, this year, that he made $85 million on Pancake’s DeFi ecosystem in 2021’s bull run. This was a few weeks after Andrew Tate slammed crypto traders as the “biggest degenerate losers on the planet.”

What is a DCA strategy?

The Bitcoin dollar-cost averaging strategy lies in the idea that an investor must make recurrent BTC purchases, following a plan. Essentially, these purchases must happen according to the plan, independent of the price Bitcoin is trading at that time.

In particular, Andrew Tate’s self-reported Bitcoin DCA strategy set recurrent weekly purchases, supposedly going on for over five years.

By following this strategy, investors diminish the risk exposure to Bitcoin’s volatility. If the price goes down, they will lower their average cost in dollars, embracing further buying opportunities that surge. On the other hand, if the price goes up Bitcoin DCA investors have guaranteed earlier purchases at lower prices, increasing the ending reward.

Some experts consider the dollar-cost averaging strategy one of the most conservative and secure ways of getting exposure to Bitcoin. Nevertheless, it still has significant risks and results will vary according to the leading cryptocurrency price action.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.