Following the significant losses experienced by New York Community Bank (NYSE: NYCB) stock last week, which resulted in a substantial decrease in its value, it appears that another bank could be facing a similar situation.

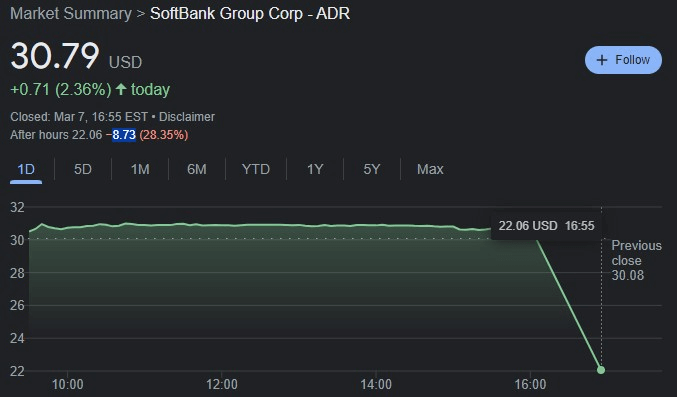

Specifically, Softbank Group (OTCMKTS: SFTBY) stock saw a decline of -28.35% in after-market trading, dropping from $30.79 at close to $22.06 in after-hours trading.

Are we seeing the beginning of a new banking crisis unfold before our eyes?

A possible catalyst for a plunge in the value of Softbank stock

The possible reason behind the plunge in Softbank stock valuation is that a big part of its debt matures today, incurring decreased reserves.

On March 1, SoftBank announced its 59th Unsecured Bond for ¥550 billion ($3.7 billion) targeting retails, with Aozora Bank acting as a trustee, the same bank that announced that it expects to post a net loss of ¥28 billion ($191 million) for the fiscal year ending March 31, compared with its previous outlook for a net profit of ¥24 billion, as revealed by JustDario on March 8.

Bank Term Funding Program (BTFP) expires on March 11

The Bank Term Funding Program (BTFP) is an emergency lending initiative established by the Federal Reserve in March 2023. It aims to provide urgent liquidity to US depository institutions following the significant bank failures of Signature Bank and Silicon Valley Bank, marking the largest collapses since the 2008 financial crisis.

Under the BTFP, eligible depository institutions, including US banks, savings associations, and credit unions, can access up to one year of loans. These loans are backed by collateral such as U.S. Treasuries, agency debt, mortgage-backed securities (MBS), and other qualifying assets.

Initially, on March 11, 2024, the BTFP will cease issuing new loans as a temporary emergency measure, which could further exacerbate the banking crisis.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.