Although Apple (NASDAQ: AAPL) stock experienced a significant rally last week after the consumer electronics giant hinted at a possible shift in focus to incorporate the budding artificial intelligence (AI) technology in its devices, AAPL shares have almost entirely erased these gains.

Specifically, AAPL stock price has fully retraced all the advances triggered by Apple’s announcement last week that it would overhaul its Mac computer line to feature AI technology, according to the observations shared by markets analyst Barchart in an X post on April 16.

As a reminder, Apple is getting ready to modernize its entire Mac line with a new family of in-house processors designed to highlight AI capabilities – the M4 processor – just five months after launching its first Macs with M3 chips, as Bloomberg reported on April 11.

Apple stock price prediction

Commenting on the development’s potential influence on the future price of Apple shares, Anthony Saglimbene, the chief market strategist at financial services and wealth management company Ameriprise Financial (NYSE: AMP), pointed out that:

“Any announcement that pushes AI into consumer hardware could be very beneficial for Apple. (…) However, the impact is yet to be determined.”

On top of that, Apple is also looking to make AI-focused upgrades to its iPhone 16 lineup this fall and, as Finbold reported earlier, JPMorgan (NYSE: JPM) analyst Samik Chatterjee explained in a client note on April 11 that:

“Hedge fund investors are increasingly warming up to the opportunity of the AI upgrade cycle, but the uncertainty still pertains to whether the upgrade cycle starts with iPhone 16 in September 2024 or iPhone 17 in September 2025.”

As he added, “the increasing appetite from investors” is largely the result of “interest in participating in the cyclical upsides associated with the AI on-device led upgrade cycle, with investors taking the cue from the 5G-led upgrade cycle,” Investor’s Business Daily reported.

Why is Apple stock down?

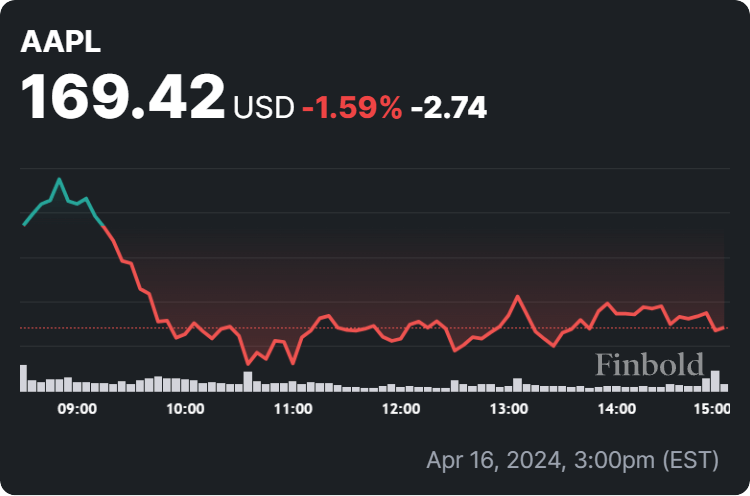

Meanwhile, Apple stock was at press time changing hands at the price of $169.42, which suggests a decline of 1.59% on the day, a modest climb of 0.28% across the past week, and a 2.26% drop over the previous month, according to the data retrieved on April 17.

So, why is Apple stock down today? Notably, one of the reasons could be Laura Martin, a senior analyst at the investment bank and asset management firm Needham & Company, lowering (albeit still bullish) estimates for Apple to reflect iPhone sales concerns and weakness in China.

All things considered, the recent price action represents a significant hit to Apple’s efforts but it might only be a temporary weakness, and its AI-focused developments could spell improvement toward the year’s end, which is why doing one’s own research is critical before investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.