Investing in stocks can be exhilarating, especially when you witness rapid, exponential growth in the value of a particular stock. These meteoric rises, often referred to as parabolic stock trends, can be tempting for investors seeking quick gains. However, behind the tempting promises of high returns lie significant risks that every investor should understand before diving into such volatile territory.

What does a parabolic trend mean?

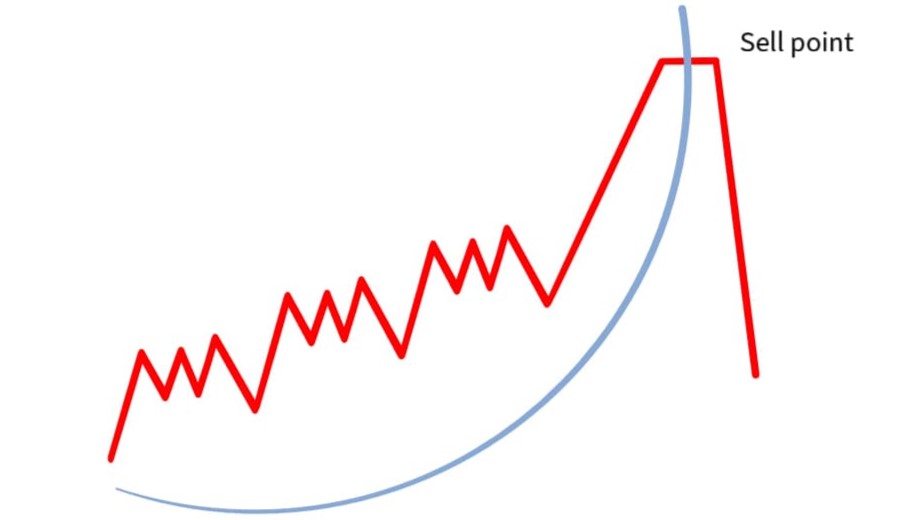

Parabolic stock trends are characterized by an exponential stock price increase over a relatively short period. This upward trajectory forms a curve that steepens as the price accelerates, resembling the shape of a parabola.

The allure of quick gains

One of the primary reasons investors are attracted to parabolic stock trends is the potential for rapid wealth accumulation. Witnessing others profit from such trends can fuel the desire to jump on the bandwagon in hopes of similar success. The fear of missing out (FOMO) can drive investors to overlook the inherent risks associated with these volatile movements.

Understanding the risks

While parabolic stock trends can yield impressive returns, they also pose significant risks that investors should carefully consider:

- Limited fundamentals: Stocks experiencing parabolic growth often lack fundamental support for their inflated valuations. Investors may overlook traditional metrics such as earnings, revenue, and cash flow, leading to investments based solely on speculative momentum;

- Increased volatility: Parabolic trends are characterized by extreme price fluctuations, making them highly volatile. Sharp price swings can trigger panic selling or buying frenzies, exacerbating market instability;

- Vulnerability to corrections: Parabolic stocks are prone to sharp corrections as prices reach unsustainable levels. A sudden shift in market sentiment or a negative catalyst can trigger a rapid decline, erasing gains accumulated during the upward trend;

- Speculative nature: Investments in parabolic stocks are inherently speculative, driven more by market sentiment and momentum than by underlying fundamentals. Speculative bubbles can form, leading to irrational exuberance followed by sharp downturns;

- Timing risk: Successfully timing entry and exit points in parabolic stocks is challenging. Investors may struggle to gauge the peak of the trend, risking substantial losses if they enter late or fail to exit before a correction occurs.

Case study: The rise and fall of XYZ Corp

Let’s consider a hypothetical example of XYZ Corp, a tech company whose stock recently experienced a parabolic trend:

| Month | Stock price (USD) |

| Jan | $50 |

| Feb | $100 |

| Mar | $200 |

| Apr | $400 |

| May | $800 |

In just five months, XYZ Corp’s stock price skyrocketed from $50 to $800, exhibiting a classic parabolic pattern. However, in June, concerns about overvaluation and slowing growth caused the stock to plummet back to $200, wiping out a significant portion of investors’ gains.

For a recent parabolic stock movement, we can take a look at Palo Alto (NASDAQ: PANW), which in February 2024 experienced a significant drop in its stock price, nearly 27%, marking its highest price plunge since being listed in 2012. This decline was mainly due to lowered revenue guidance, which disappointed investors especially after the stock had soared nearly 120% over 2023.

Key considerations for navigating parabolic trends

While investing in parabolic stocks can be tempting, it’s essential to approach such opportunities with caution. Consider the following strategies to navigate the risks associated with parabolic trends:

- Conduct due diligence: Research the company’s fundamentals, competitive positioning, and growth prospects before investing. Avoid solely relying on price momentum as a basis for investment decisions;

- Set realistic expectations: Understand that parabolic trends are inherently speculative and unsustainable in the long term. Set realistic profit targets and be prepared to exit positions if the trend begins to falter;

- Diversify your portfolio: Avoid putting all your eggs in one basket by diversifying your investment portfolio. Allocating capital across different asset classes and industries can help mitigate the impact of losses from individual stocks;

- Implement risk management strategies: Consider using stop-loss orders or trailing stops to protect your capital in case of a sudden downturn. Establishing clear risk-reward parameters can help you make disciplined investment decisions;

- Stay informed: Keep abreast of market developments, news, and macroeconomic factors that could impact the trajectory of parabolic stocks. Stay flexible and be prepared to adjust your investment strategy accordingly.

The bottom line

While parabolic stock trends may offer the allure of quick riches, they also carry significant risks that investors must carefully evaluate. By understanding the inherent volatility and speculative nature of these trends, investors can make more informed decisions and navigate the market with greater confidence.

Remember, prudent investing involves balancing potential rewards with calculated risks to achieve long-term financial success.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.