As March 2024 draws near, the performance of the S&P 500 Index is starting to reveal itself, with some stocks demonstrating notable growth while others show potential for valuation increases in the months ahead.

These stocks exhibit strong technical and fundamental indicators, complemented by the robust financials of their respective companies in sectors experiencing rapid growth.

Finbold analyzed year-to-date performance, future potential, and recent financial results to identify the top performers within the S&P 500 for 2024.

Eli Lilly And Co (NYSE: LLY)

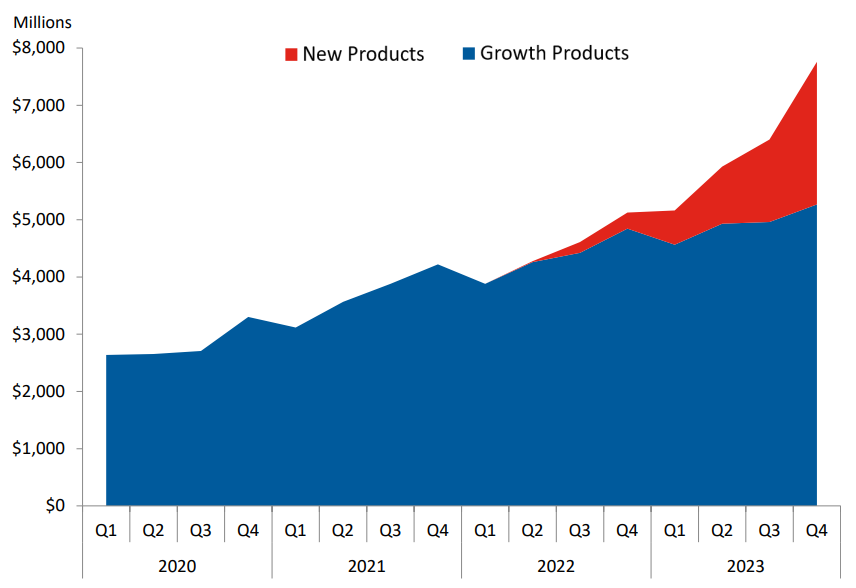

The pharmaceutical giant Eli Lilly’s (NYSE: LLY) stock has seen substantial growth in market capitalization, elevating it to the 9th position by market cap on the S&P 500 index. Since the beginning of 2024, LLY stock has added nearly 30% to its value.

What makes Eli Lilly an appealing long-term investment is its substantial growth potential. This is crucial for a stock to increase in value—it requires ample room for expansion.

Lilly boasts a diverse portfolio of products, with its major offerings being Mounjaro (for diabetes) and Zepbound (for weight loss). Collectively, these products have the potential to generate tens of billions of dollars in revenue. Furthermore, their prospects may improve further as researchers discover additional ways they can benefit patients.

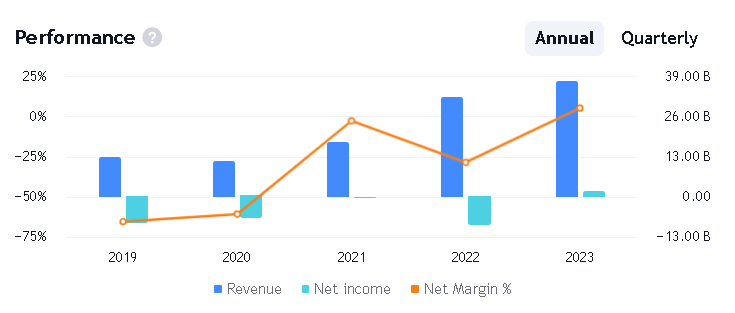

This year, the healthcare company anticipates generating over $40.4 billion in revenue, marking a minimum 18% increase from the $34.1 billion reported in 2023. That year, its revenue surged by 20%. However, Eli Lilly might only be beginning to tap into its long-term potential.

Ralph Lauren (NYSE: RL)

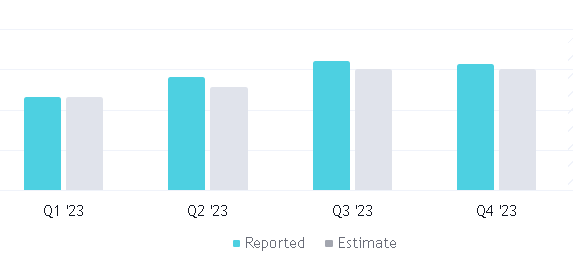

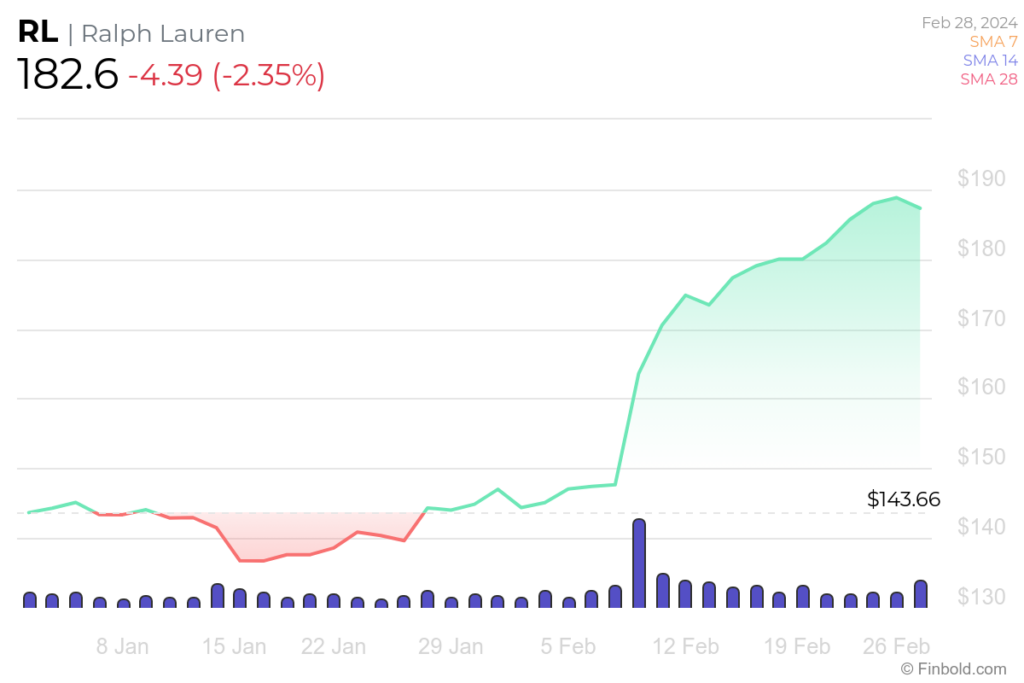

The fashion industry stands out as a sector offering growth and expansion opportunities for major players. Ralph Lauren (NYSE: RL) stock witnessed a surge following the holiday season, driven by robust sales figures that surpassed expectations.

Particularly notable was the strong performance of the company’s direct-to-consumer business, which contributed to a 25.04% year-to-date growth in RL stock.

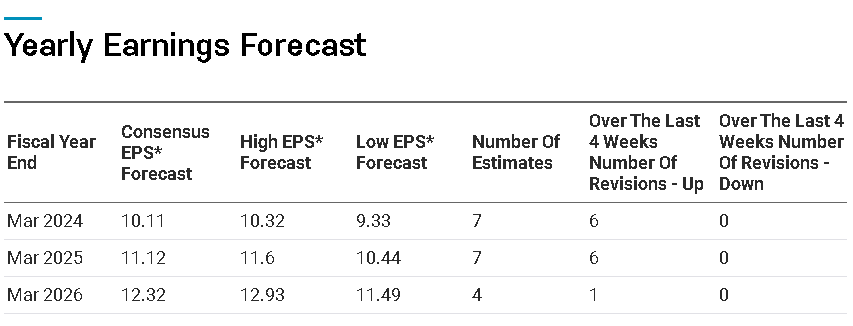

Looking forward to the full fiscal year 2024, Ralph Lauren reaffirmed its guidance for revenue growth in the low-single-digit range.

However, the revised guidance now centers around 2% growth, compared to the previous range of 1% to 2%. Additionally, the company reiterated its guidance for operating margin to expand year over year, aiming for a range of 12.3% to 12.5%.

This represents a modest improvement and upward adjustment, underscoring Ralph Lauren’s strong performance during the critical holiday season. This achievement is notable, especially considering the ongoing macroeconomic uncertainty and elevated inflationary pressures that have impacted numerous other fashion and apparel companies in recent quarters.

Uber Technologies (NYSE: UBER)

Uber’s (NYSE: UBER) main business is ride-hailing, but it faced a downturn during the pandemic when economic activity slowed. During that challenging period, the company’s delivery platform, led by UberEats, stepped up and filled the gap effectively, a trend that persists.

However, by the midpoint of 2023, the ride-hailing segment officially regained its status as the primary source of gross bookings, surpassing delivery once again. This momentum continued throughout the year, culminating in the fourth quarter, where the ride-hailing segment achieved a record-high $19.3 billion in gross bookings.

Strong performance was also reflected in UBER stock in 2024, growing by almost 35% since January 1.

The largest expense in Uber’s operations is its 6.8 million drivers, accounting for a significant portion of the company’s costs. Out of the $137.8 billion in gross bookings in 2023, $62 billion was paid to drivers.

After accounting for payments to restaurants, grocery stores, and other partners involved in customer orders, the total bookings translated to $37.2 billion in revenue for the year, yielding nearly $1.9 billion in profit.

Uber is gearing up to transition to self-driving cars and trucks, which could substantially reduce its expenses. The company currently has 10 autonomous partnerships spanning all segments, and as of the fourth quarter, tens of thousands of autonomous rides had already been completed.

The pharmaceutical, fashion, and transportation sectors are projected to sustain their rapid growth in the coming years. Industry leaders like Eli Lilly, Ralph Lauren, and Uber are well-positioned to capture a significant portion of the revenue generated by these expanding industries.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.