As a monumental event in the cryptocurrency sector – the fourth Bitcoin (BTC) halving – approaches, the Kingdom of Bhutan has decided to boost the nation’s Bitcoin mining capacity sixfold in an effort to offset the event’s potential revenue impact and maintain operational efficiency.

Specifically, the Himalayan country’s investment arm, Druk Holding & Investments (DHI), has announced it was teaming up with crypto mining firm Bitdeer, through a partnership that envisions the introduction of cutting-edge Bitcoin mining hardware, as Bloomberg reported on April 4.

What Bitcoin mining capacity upgrade entails

According to Matt Linghui Kong, Bitdeer’s chief business officer, the announced advancements will raise Bhutan’s mining capacity by 500 megawatts by the first half of 2025, bringing its total capacity to 600 megawatts, financed from the $500 million fund originating in May 2023.

At that time, the partners unveiled their plan to take advantage of the Kingdom of Bhutan’s plentiful hydroelectric power to support the mining of the flagship decentralized finance (DeFi) asset, and Kong said he expected the fund to close by July this year.

At the same time, DHI’s CEO Ujjwal Deep Dahal, pointed out that this increase will rely “on Bitdeer’s latest hardware to lower costs and improve computing power,” as the organization views blockchain technology as an essential ingredient to building “an innovation ecosystem for a startup economy.”

As a reminder, the upcoming halving of the largest asset in the crypto sector by market capitalization is part of its algorithm, which cuts the mining rewards in half roughly every four years, with the ultimate goal of capping the total supply of Bitcoin at 21 million.

Elsewhere, the expected mining reward halving hasn’t put off institutional investors, who have gradually increased their positions in the world’s largest publicly traded Bitcoin mining company, Marathon Digital Holdings, with just five of them owning as much as 22% of it, as Finbold reported on March 24.

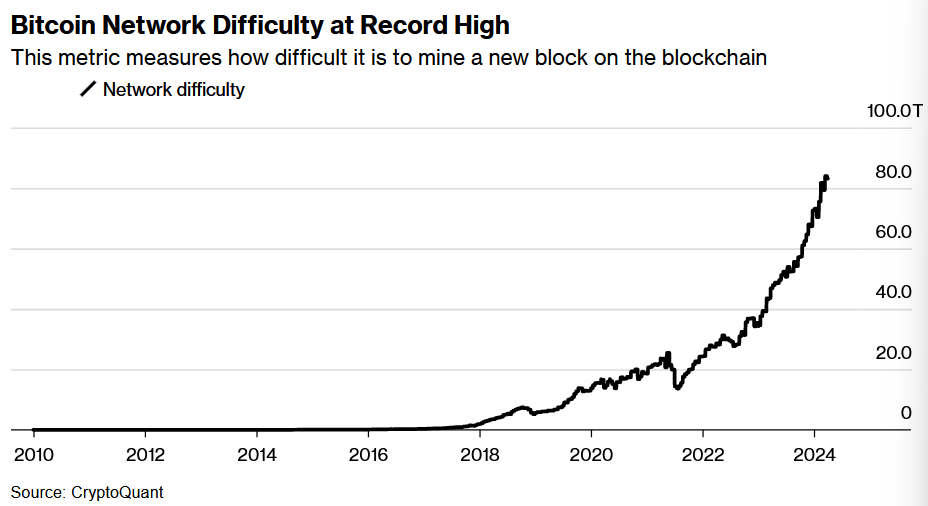

Meanwhile, the Bitcoin mining difficulty, or the amount of computing power required to add a new block to the chain, has recently reached record-high levels, leading to an increase in computing costs and somewhat offsetting the gains from the recent price rally.

Bitcoin price prediction

Indeed, Bitcoin was at press time trading at $66,519, recording a slight decline of 0.01% on its daily chart, adding up to the 5.21% drop across the previous week, and a 1.09% loss over the past month, according to the most recent price information retrieved by Finbold on April 5.

It is also worth mentioning that a number of crypto trading analysts have offered a BTC price prediction between $100,000 this year and a massive $1,000,000 in 2025 thanks to the influence of the Bitcoin halving 2024. That said, doing one’s own research is critical before investing a significant amount of money in the asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.