Considering Bill Gates’ vast fortune attained as a technology executive and business magnate, it makes sense that he would invest in various stocks, particularly through the Bill & Melinda Gates Foundation (BMFG) he founded with his then-wife back in 2000.

Indeed, the charitable foundation, which the pair had set up with the goal of improving healthcare and minimizing poverty in countries around the globe, has a stock portfolio presently worth about $48 billion, with nearly 70% of it devoted to just three particular stocks.

#1 Microsoft (MSFT)

As the company’s founder, it is hardly surprising that Gates would own lots of Microsoft (NASDAQ: MSFT) stocks and is one of its largest shareholders, with his trust adding around 38 million MSFT shares worth about $8.9 billion in 2022 and making them a massive part of its stock portfolio.

Specifically, it was Gates who donated a large part of these shares to his foundation, which currently holds almost 35 million MSFT shares, taking up 32.71% of its portfolio, now worth close to $14.8 billion, taking into account the prices at the time of publication.

Meanwhile, the price of Microsoft stocks at press time stood at $433.19, reflecting a 0.46% drop on the day, moving up 0.09% across the week, rising 4.77% in the past month, and accumulating growth of 16.80% year-to-date (YTD), as per the latest charts.

#2 Berkshire Hathaway (BRK.B)

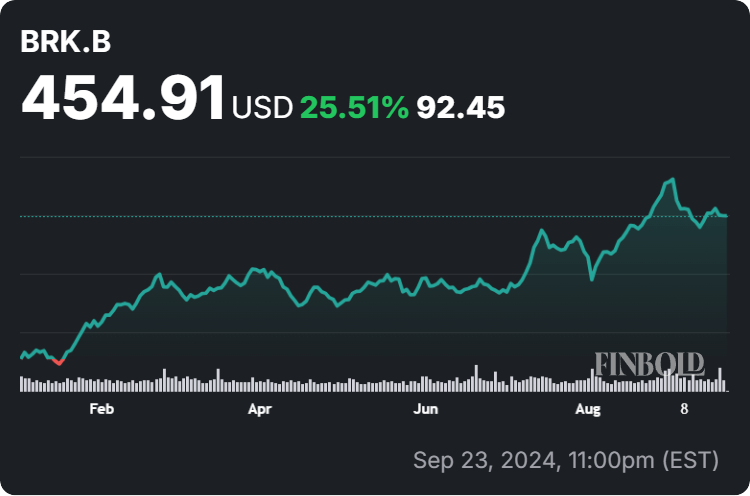

Furthermore, the fund’s second largest position is in Berkshire Hathaway (NYSE: BRK.B), at 21.01%. However, the interesting part is that a large chunk of it (9.9 million) recently came in the form of donations by none other than Warren Buffett, Berkshire’s CEO, bringing the total to 25 million BRK.B shares worth about $11.37 billion right now.

On top of that, Buffett has also served as a trustee for the Gates’ foundation until 2021, so this has probably influenced the trust’s investing practices. However, Buffett’s donation does not arrive with no strings attached – the Gates Foundation must spend everything he donates, plus an additional 5% of its net assets.

In terms of price, BRK.B stock is currently trading at $454.91, which indicates a decline of 0.41% in the last 24 hours, as well as being down 0.19% across the previous seven days, recording a minor loss of 0.09% over the month, and an accumulated advance of 25.51% since the year’s turn.

#3 Waste Management (WM)

Finally, Waste Management Inc. (NYSE: WM) stock is one of the unexpected assets for Bill Gates, especially at 15.77%, but the leading waste hauler and landfill operator has captured the technology billionaire’s attention enough to acquire over 35 million of its shares, worth around $7.3 billion at the moment.

Although the company’s second-quarter earnings results have somewhat fell short, its long-term prospects are robust, particularly as Waste Management remains ahead of its competitors in terms of landfill ownership, high-density route operation, and pricing power.

Presently, the price of WM stocks amounts to $206.57, recording a 0.17% increase on its daily chart, up 1.83% in the past week, down 0.63% in the last 30 days, and gaining 15.01% in 2024, according to the most recent data obtained on September 24.

Conclusion

All things considered, Bill Gates’ fund being heavily invested in these three stocks suggests its founder’s bullish sentiment in terms of their future performance. That said, it does not guarantee success, so doing one’s own research is critical when investing a large amount of money.