Bill Gates is making strategic adjustments to his investment portfolio, signaling a continued shift away from longtime holdings and a cautious entry into new, more volatile territory.

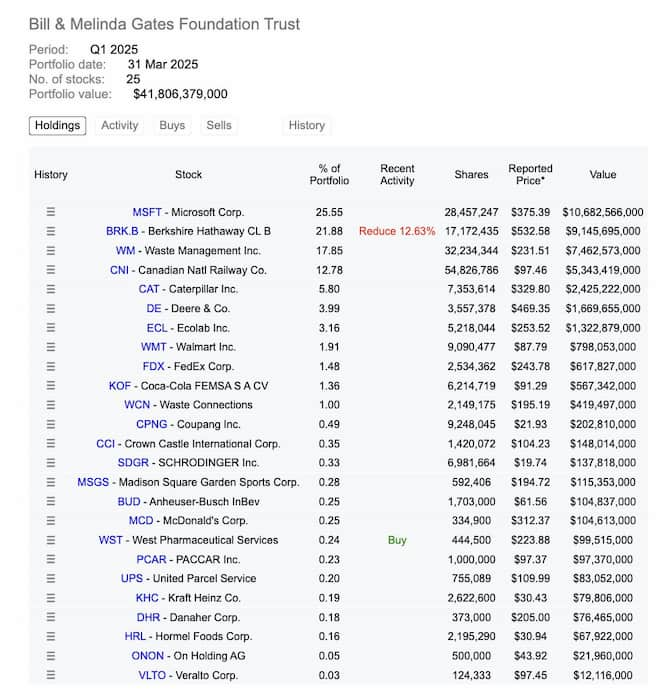

According to the Gates Foundation’s latest 13f filing with the U.S. Securities and Exchange Commission, the philanthropic trust sold 2.48 million shares of Berkshire Hathaway’s Class B stock in Q1 2025.

Based on the closing price of $507.33 per share on May 15, the sale was valued at approximately $1.25 billion (£939.89 million). This marks the third consecutive quarter Gates has reduced his stake in the conglomerate led by his longtime friend and business ally, Warren Buffett.

Despite the ongoing reduction, the Gates Foundation remains a major shareholder, still holding 17.17 million Class B shares of Berkshire Hathaway worth an estimated $9.15 billion (£6.88 billion). Altogether, Gates has now trimmed over 7 million shares across the last three quarters—a signal that the philanthropic trust may be rebalancing away from slower-growth, value-driven equities.

Notably, Berkshire Hathaway itself has taken a more conservative posture. Buffett declined to repurchase shares of his own company in late 2024, breaking a six-year streak. The move was widely interpreted as a signal that the legendary investor believed the stock was overvalued, in keeping with his disciplined value investing principles.

Bill Gates opens new stock position

While reducing exposure to Berkshire, Gates opened a new position during the first quarter: West Pharmaceutical Services. The foundation acquired 444,500 shares of the healthcare firm for approximately $99.5 million (£74.82 million).

The move drew attention given the company’s recent troubles. In February, West Pharma issued disappointing earnings and revenue forecasts for 2025, sending shares down nearly 40%. Moreover, the guidance cut came amid allegations that company leadership failed to disclose adverse operational developments, a charge that has now resulted in a class-action lawsuit.

Despite the legal cloud, most analysts maintain a bullish outlook on the stock, with price targets as high as $400 (£300.77) per share over the next 12 months. For Gates, who has long prioritized investments in global health initiatives, the entry into West Pharma could align with the foundation’s mission to support the development of vaccines and treatments for underserved populations. However, the rationale behind this specific allocation has not been publicly clarified.

Operational change by 2045 for Bill & Melinda Gates Foundation

Earlier this year, Gates confirmed that the Bill & Melinda Gates Foundation will wind down operations by 2045. He has pledged to donate 99% of his personal fortune within the next two decades, targeting maternal health, disease eradication, sustainable energy, and poverty alleviation.

While his philanthropic vision remains clear, his short-term investment strategy appears increasingly tactical, reducing exposure to high-valuation blue chips while selectively entering sectors that are both mission-aligned and opportunistically priced.

Whether his bet on West Pharmaceutical proves prescient—or premature—remains to be seen. But as always, Gates’ investment decisions continue to blend strategic philanthropy with a measured eye on market dynamics.

Featured image via Shutterstock