Bill Gates, best known as the co-founder of Microsoft (NASDAQ: MSFT), has also built a reputation as a savvy investor, with a portfolio that reflects his strategic and diversified approach.

As the first centibillionaire in 1999, Gates has maintained his wealth over the years, even after donating billions to the Bill & Melinda Gates Foundation, which focuses on global health and poverty reduction.

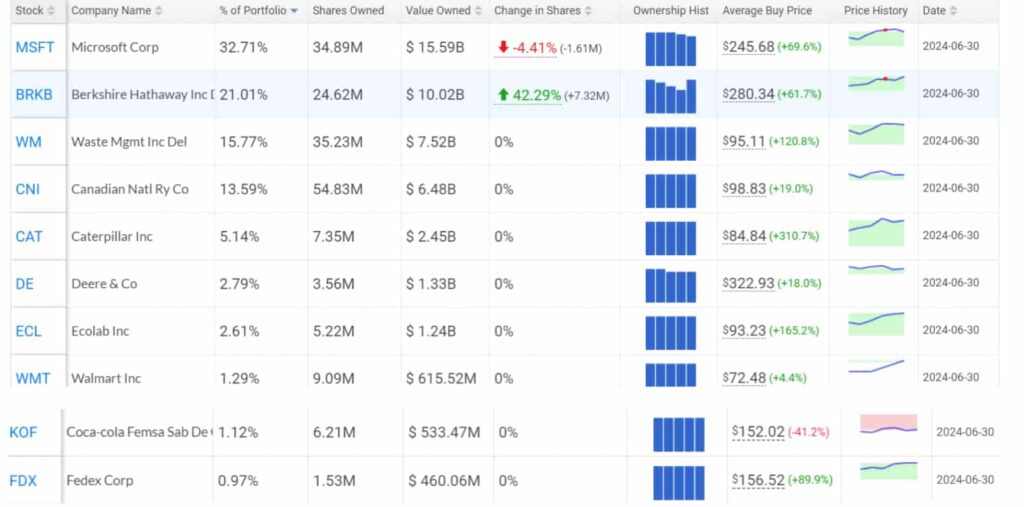

The latest 13F filings reveal the top 10 stock picks in Gates’ portfolio, providing insights into his investment strategy that spans technology, industrials, and consumer goods.

Picks for you

Bill Gates’s top 10 stock picks

At the top of his list is Microsoft Corp which remains his largest holding, comprising 32.71% of his portfolio with 34.89 million shares valued at $15.59 billion.

Despite a slight reduction of 4.41% in Bill Gates’s holdings, Microsoft still anchors his investment strategy. Berkshire Hathaway (NYSE: BRK.A, BRK.B) follows closely, making up 21.01% of the portfolio with 24.62 million shares worth $10.02 billion.

Gates has notably increased his stake in Berkshire by 42.29%, signaling strong confidence in Warren Buffett’s conglomerate.

Waste Management (NYSE: WM) is another significant holding, accounting for 15.77% of Gates’ portfolio, with 35.23 million shares valued at $7.52 billion. This is followed by Canadian National Railway (NYSE: CNI), which represents 13.59% of the portfolio with 54.83 million shares worth $6.48 billion, showing Gates’s belief in the essential nature of these services.

Industrial giants Caterpillar Inc (NYSE: CAT) and Deere & Co (NYSE: DE) also feature prominently, with Gates holding 7.35 million shares of Caterpillar valued at $2.45 billion and 3.56 million shares of Deere worth $1.33 billion.

Rounding out the top 10 are Ecolab Inc (NYSE: ECL), Walmart (NYSE: WMT), Coca-Cola Femsa Sab De Cv (NYSE: KOF), and FedEx Corp (NYSE: FDX). These holdings reflect his diversified investment strategy, blending stability with growth potential across various sectors.

The recent portfolio adjustments, particularly the increase in Berkshire Hathaway and the slight reduction in Microsoft shares offer a glimpse into Bill Gates’s evolving investment philosophy, making these top picks a point of keen interest for investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.