A record-breaking 3,028 names have made it onto Forbes’ annual World’s Billionaires list — an increase of 247 compared to 2024.

More impressively, these individuals are worth over $16 trillion and surpass the GDP of every nation except the U.S. and China.

What are they investing in? Highly successful investors spread their wealth across various assets to diversify and mitigate risk, but sometimes, even they make daring moves. This time, it appears to be e-commerce.

Can e-commerce handle the tariffs?

Known for his focused investing strategy, Bill Ackman is a good example of someone governed by a long-term, value-driven sentiment.

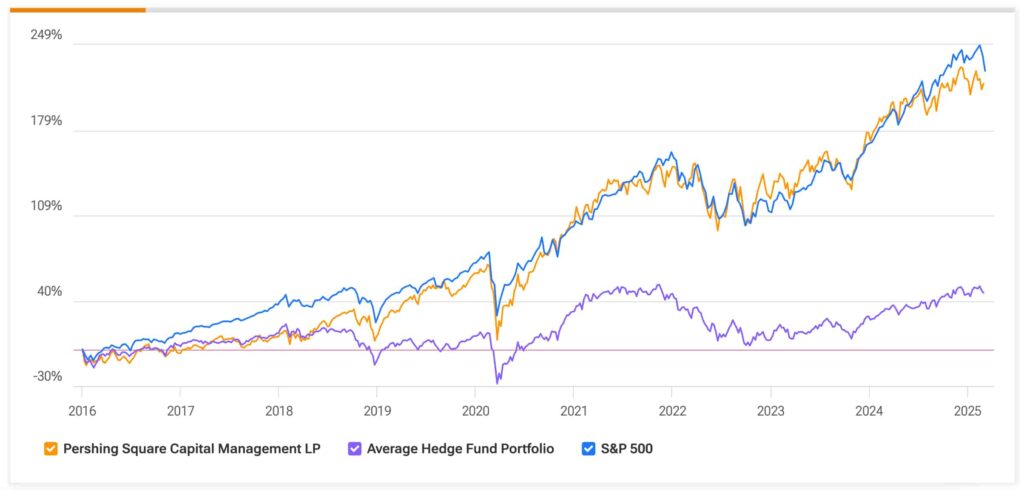

His philosophy is evident in Pershing Square’s (LSE: PSH) portfolio of just 11 stocks, which has still managed to returnover 134% over the last decade.

However, Ackman is also bold.

On May 22, Ackman disclosed his fund had acquired shares in Amazon (NASDAQ: AMZN) despite concerns about the impact of trade tariffs.

Indeed, Amazon shares tumbled 31% amid tariff fears last month. But Ackman’s team saw the dip as a major opportunity, believing the impact on Amazon’s retail earnings would be negligible.

With a market value exceeding $2 trillion, Amazon remains the dominant force not only in e-commerce, but cloud services, logistics, and digital ads, with consumer demand seemingly not going anywhere.

Pershing Square’s Chief Investment Officer cited Amazon’s diverse business model as ‘valuable’ according to the trust:

“And one of the things that makes Amazon really unique is it has these two disparate businesses, which we think individually are very valuable, but they share a very common and core framework.” –– Ryan Israel, Pershing Square Chief Investment Officer

Global e-commerce expansion and diversification

Ackman is not alone in their investments, as investors are eyeing opportunities in emerging e-commerce markets.

Ryan Cohen, for example, the King of Meme Stocks and GameStop (NYSE: GME) CEO, has invested substantially in Alibaba (NYSE: BABA). As per Reuters, his personal stake in the company has reached $1 billion.

Stan Druckenmiller, known for his success with Soros Fund Management and the Duquesne Family Office, has invested not only in Amazon (NASDAQ: AMZN) but also MercadoLibre (NASDAQ: MELI), often called the Amazon of Latin America.

MercadoLibre recently saw investments from Capital Research Global Investors as well, which now own over $4.1 billion worth of the company’s stock.

But why e-commerce? Well, the sector offers a promising blend of technology and retail.

What’s more, the diversified operations of companies such as Amazon add a lot of spice to the mix.

Pershing Square’s Ryan Isreal, for example, noted Amazon Web Services (AWS) as playing a key role in the ongoing artificial intelligence (AI) boom in the Q1 2025 Earnings Call.

In short, the leaders of the e-commerce sector suggest adaptability, which inspires investor confidence.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Featured image via Shutterstock