Although the previous quarter’s 13F filings revealed that some hedge funds–Duquesne Family Office, Appaloosa Management, and Maverick Capital—decided to divest from Nvidia (NASDAQ: NVDA), Ray Dalio, founder of Bridgewater Associates’ hedge fund, decided to double down.

Namely, as revealed in his August 14 Q2 holdings report-13F, Dalio bought up $722.9 million worth of NVDA shares, which now make up 4.2% of his portfolio as of June 30.

Dalio’s strategic investment in NVDA stock

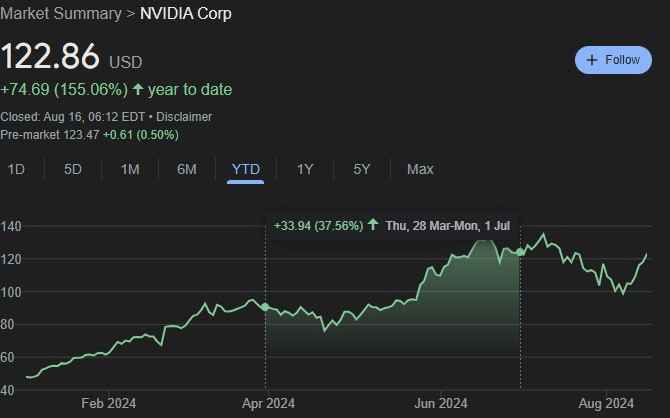

Looking at the overall performance of NVDA stock, its price chart tells the tale of significant volatility in recent times.

The semiconductor stock lost 25% of its value from July 10 to August 7, falling below $100 valuation at one point; however, in a little over a week, Nvidia shares added 24.21% to their value, allowing it to trade at $122.16 as of the latest close on August 15.

During the Q2 period, which spans from March 30 to June 30, Nvidia stock showed rare periods of weakness, with Dalio’s purchases occurring potentially on April 18 and June 16 to June 26, where in both instances, NVDA stock recorded drops in value larger than 10%.

Why did Dalio decide to double down on NVDA stock?

The answer probably lies in Nvidia’s dominance, as it captures by far the largest market share of the currently ongoing artificial revolution (AI), supplying microchips for data centers, training Large Language Models (LLMs), and providing infrastructure to large companies such as Meta Platforms (NASDAQ: META), Tesla (NASDAQ: TSLA), and others.

Therefore, Dalio’s bet on Nvidia is better interpreted as a bet on AI, as projections see the AI market growing to a staggering $826.73 billion in 2024, compared to the current $184.04 billion.

According to data obtained by Finbold, the estimated market share of AI is projected to surge to reach $1.87 trillion by 2030.

If projections come true, the old saying that has proved accurate previously, “while others dig for gold, sell shovels,” will reward Nvidia handsomely.

That is, if Nvidia staves off the competition and retains its large market share.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.