With only seven days left until the end of the month, this could be the most bullish September in terms of Bitcoin (BTC) price since the inception of the maiden cryptocurrency, particularly as it mimics last year’s moves despite traditionally trading in the red during this time.

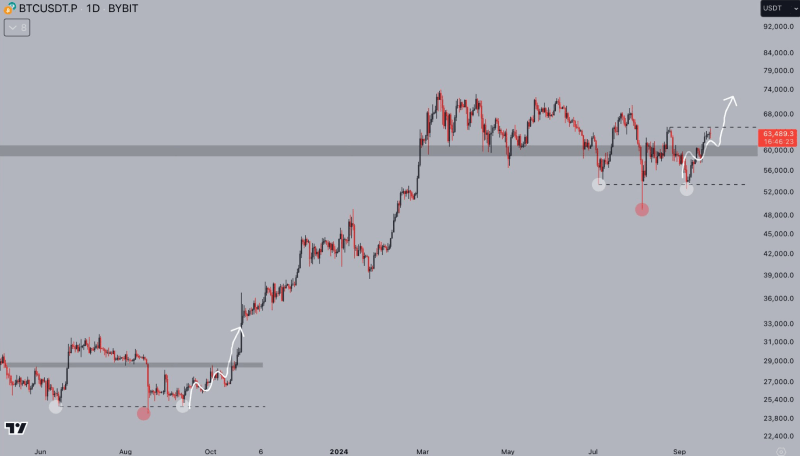

Specifically, Bitcoin has been moving very similarly to September 2023, including its higher lows laboring up toward the key level, and pushing beyond it could send BTC to a new all-time high (ATH) soon, according to the observations shared by crypto analyst Jelle in an X post on September 23.

As it happens, Bitcoin is trading well above its support zone at $52,000 (the first higher low) and $54,000 (the second higher low), where the price bounced off while moving towards the resistance level at $68,000 to $70,000, in similar price action t0 September 2023, when such structure led to a breakout above $28,000.

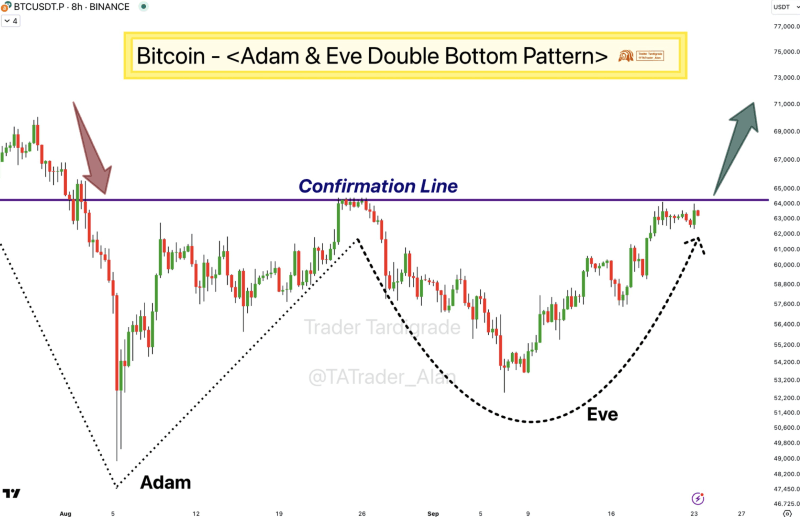

In terms of chart patterns, the largest asset in the crypto sector by market capitalization presently forming a double-bottom near the $53,000 price level typically suggests a bullish reversal is in store, and BTC might break out after consolidating within the current price ranges.

Bitcoin’s strongest September

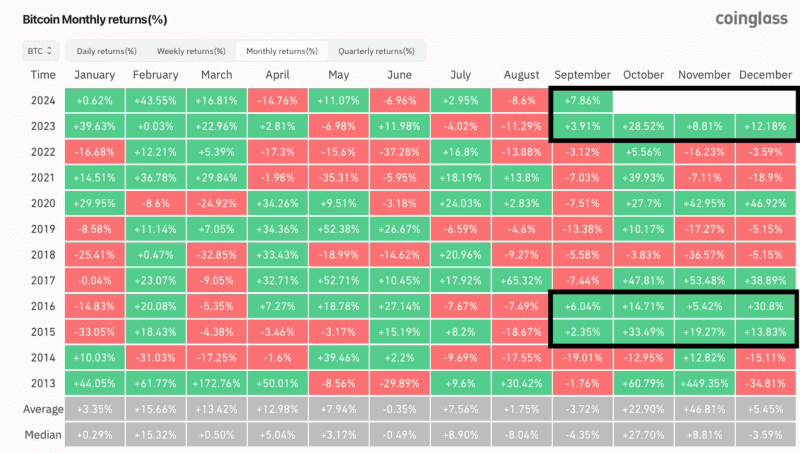

At the same time, Jelle highlighted that Bitcoin is “currently on track for the strongest September performance in its history,” and if it does close in the green, it could lead to the following three months also closing in the green, much like in 2015, 2016, and 2023, noting that Q4 looks “very promising.”

Indeed, Bitcoin has closed September in the red every year except in 2015, 2016, and 2023, and whenever it closed the month in the green, it would do the same in October, November, and December, as the table posted by the crypto expert demonstrates.

Bitcoin price history

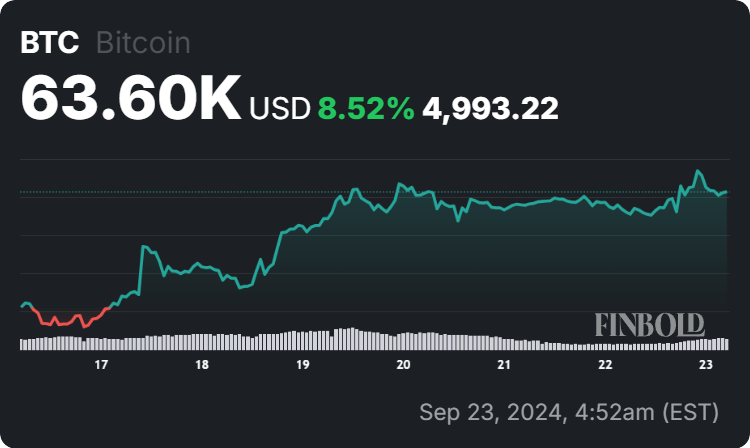

For the time being, Bitcoin is changing hands at the price of $63,600, recording a 1.30% increase in the last 24 hours, advancing 8.52% across the previous seven days, and reducing to 1.14% the losses from the past month, according to the most recent data.

Meanwhile, another crypto expert, Trader Tardigrade, pointed out that Bitcoin was holding the ‘Adam & Eve Double Bottom’ pattern and has neared the confirmation line, the breaking of which would lead to Bitcoin reversing to a higher time frame uptrend.

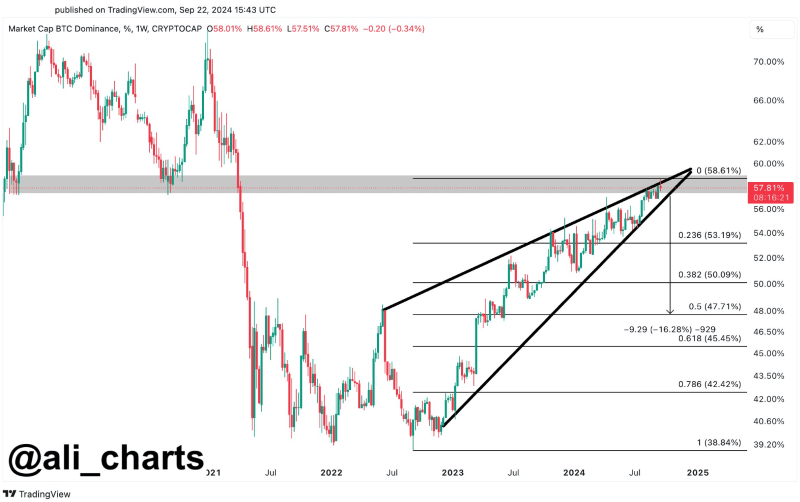

On the other hand, professional crypto trader Ali Martinez noted that Bitcoin’s dominance might be approaching a tipping point due to the rising wedge pattern, which is typically a bearish reversal pattern, and resistance at the 58.61% dominance level, suggesting altcoins might gain strength relative to Bitcoin.

All things considered, multiple signs indicate that Bitcoin might be looking at continued gains, going against the traditional red September and further into the traditionally green October, or ‘Uptober.’ However, things in this sector can easily shift, and making any definite Bitcoin price prediction is challenging, so doing one’s own research is critical.