The cryptocurrency market currently navigates in a slightly bearish momentum, with most cryptocurrencies accumulating losses in a downtrend. According to analysts, Bitcoin (BTC) could break from its six-month “reaccumulation” sideways range between mid-September and early-October if history repeats.

A historical analysis from Rekt Capital on X highlighted the chart pattern that uses the Bitcoin halving as a breakout baseline. As posted, the trader explained that BTC tends to break from consolidation between 150 and 160 days after the halving.

In 2020, Bitcoin took 161 days to start the bull run, leading to staggering highs of $69,000 in 2021. If this historical pattern plays out again this cycle, BTC could experience a major breakout by late September.

Commenting on the original post, other analysts confirmed Rekt Capital‘s price prediction, identifying the same historical behavior for Bitcoin.

Counterpoints of Bitcoin’s historical breakout pattern

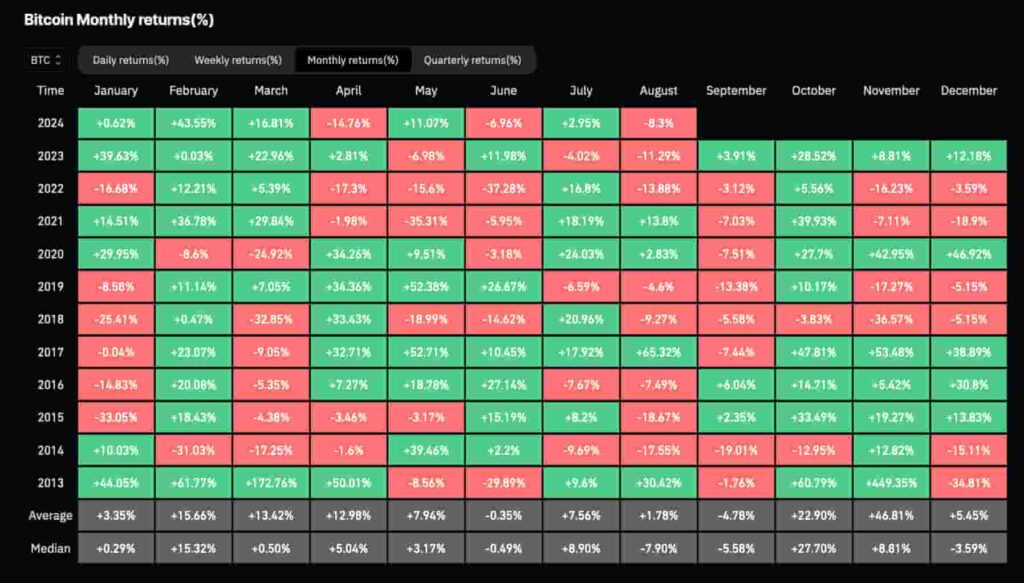

However, the analyst warns of another historical pattern that could delay the expected movement this cycle. September has been a historically losing month for Bitcoin, a victim of what the stock market calls the “September Effect.”

Finbold reported in detail on August 31 about this effect on BTC’s price throughout the years. As observed in the report, September has had the worst average and median returns for Bitcoin since 2013.

Moreover, this current cycle has, so far, played out differently from Bitcoin’s history as traditional finance giants joined the market. For the first time, BTC made a new all-time high before the halving – reaching $73,800 in March.

In closing, the Bitcoin halving pattern could indeed trigger a bull run in the following weeks, in September or early October, with the expected breakout from this consolidation range. Yet, history may not repeat, as demonstrated by this year’s deviation, surprising traders who are betting in patterns.

Traders and investors should constantly evaluate their moves according to the market’s upcoming information – remaining cautious with proper risk management.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.