Although the spot Bitcoin exchange-traded fund (ETF) rollout did not have the short-term desired effects on the general cryptocurrency market, the product’s performance can be considered remarkable.

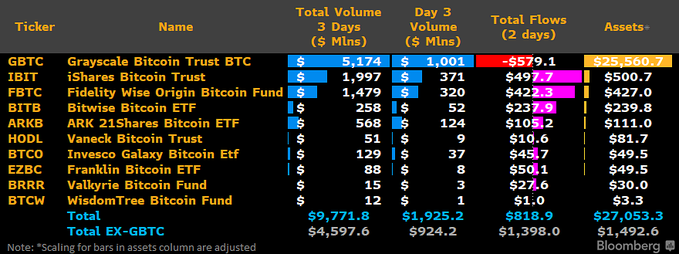

In particular, the ETFs accumulated a staggering $9.6 billion in trading volume within the first three days of their launch, according to data by Bloomberg Intelligence ETF analyst James Seyffart.

Based on the data, Grayscale Bitcoin Trust (GBTC) led in the first three days, accumulating $5.12 billion, followed by iShares Bitcoin Trust (IBIT) at $1.99 billion. Fidelity Wise Origin Bitcoin Fund (FBTC) ranked third at $1.46 billion.

Picks for you

Implication of high trading volume

To put the performance into perspective, Senior Bloomberg ETF analyst Eric Balchunas noted that the trading volume has outperformed the entire 2023 class of ETFs. It’s worth noting that the spot Bitcoin (BTC) ETF was approved on January 10.

In an X (formerly Twitter) post on January 17, Balchunas emphasized the difficulties of generating volume for ETFs, highlighting that in 2023, the 500 ETFs launched only achieved $450 million in volume.

“Let me put into context how insane $10 billion in volume is in the first 3 days. There were 500 ETFs launched in 2023. Today, they did a combined $450 million in volume. The best one did $45 million. And many have had months to get going.

As per the analyst, volume in ETFs has to form naturally in the marketplace and cannot be artificially created. It was noted that half of the 500 newly launched ETFs from the 2023 class did less than a million in volume on the same day, underscoring the challenging task of gaining substantial trading activity.

Impact of GBTC on ETF volume

A significant portion of the volume in the Grayscale product can be partly linked to the selling pressure primarily coming from holders of GBTC. Notably, a Finbold report indicated that James Lavish, a reformed hedge fund manager and managing partner at the Bitcoin Opportunity Fund, suggested that most of the volume resulted from selling by GBTC holders keen to convert to the spot ETF.

He highlighted that this selling pressure was partly why the ETF launch failed to meet expectations.

While the trading volume failed to impact the crypto market directly, it highlights a possible growing appetite among investors for exposure to cryptocurrencies within the traditional financial market.