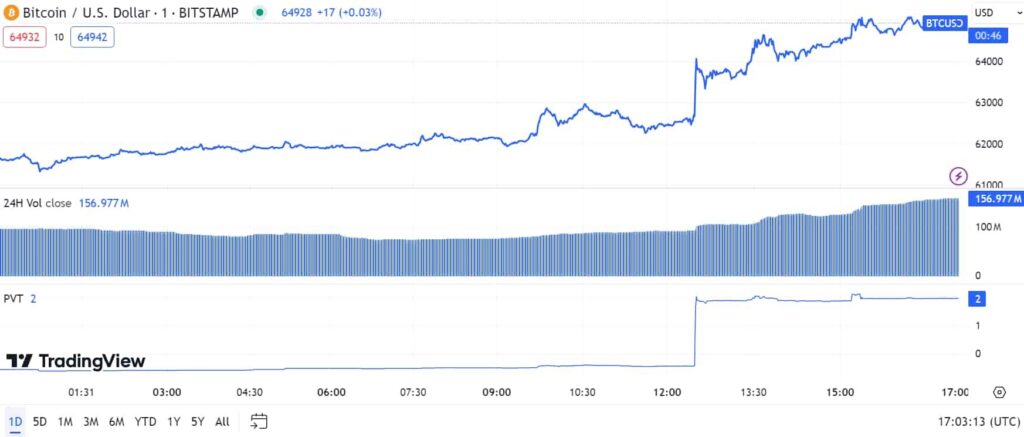

Bitcoin’s (BTC) price surged by $3,000 following the latest U.S. Consumer Price Index (CPI) report for April, which indicated a slowdown in inflation, boosting investor sentiment towards risk assets.

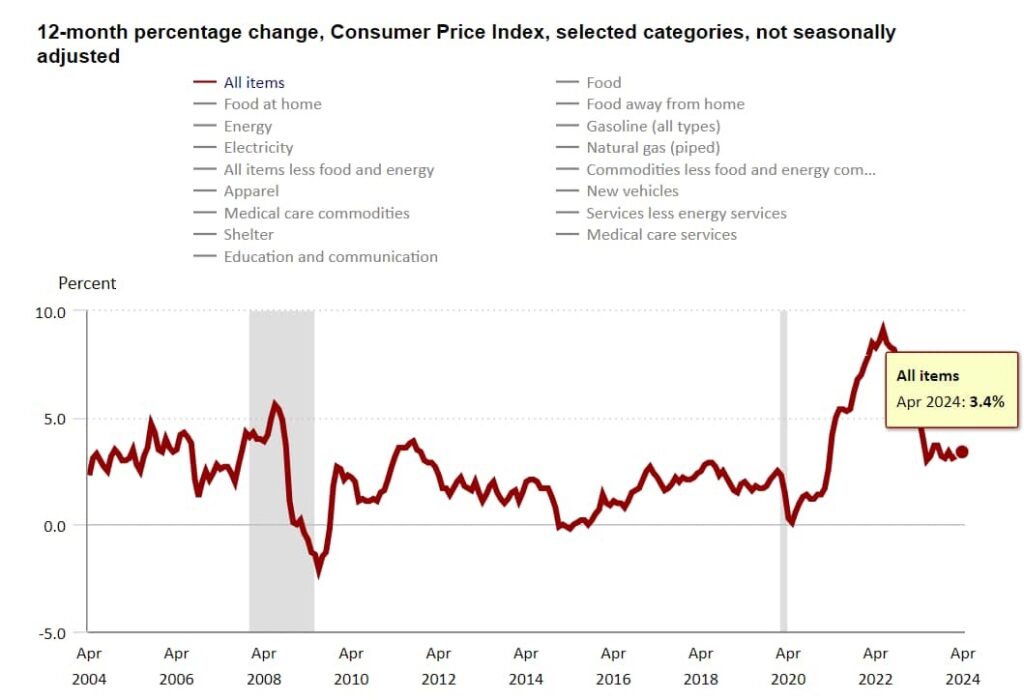

The U.S. Bureau of Labor Statistics reported a rise in consumer prices by 3.4% in April year-over-year, a decrease from March’s 3.7%.

This slower inflation rate has influenced a positive shift in market dynamics, with major stock indices reaching new highs and cryptocurrency prices, including Bitcoin and Ethereum (ETH), seeing significant upticks.

This data, provided by the U.S. Bureau of Labor Statistics, indicates a moderation in inflation, which is a positive signal for markets sensitive to interest rate changes. Month-on-month, the CPI rose by 0.3%, slightly below the expected 0.4%.

In this regard, data provided by capital market commentary platform The Kobeissi Letter, in an X post on May 15, pointed out that while the latest CPI data shows the first decline in inflation in three months, the PPI data reveals a third consecutive monthly increase.

Given these conflicting trends, the Federal Reserve is expected to adopt a “wait and see” approach regarding future monetary policy decisions.

U.S. CPI data and its Impact

Following the CPI release, major U.S. stock indices responded with significant gains. The S&P 500 rose by 0.48%, and the Nasdaq Composite Index (NASX) increased by 0.7%, both setting new records.

The tech sector, in particular, showed robust performance with the NASDAQ-100 Technology Sector Index climbing by 0.72%. These gains reflect growing confidence among investors that the Federal Reserve may adopt a more accommodative monetary policy in the near future.

The bond market reacted to the CPI data with a decrease in yields for both 2-year and 10-year U.S. government bonds, with the 10-year Treasury yield sliding seven basis points to 4.37%.

Additionally the U.S. dollar index (DXY) dropped 0.5%, and gold added 0.7%

BTC price analysis

BTC is now trading at $64,884.00, with a 1-day rise of around 6%. Analysts note that Bitcoin now faces a crucial technical barrier in the form of its 50-day moving average (DMA) at $65,166.

If Bitcoin’s price can break above this level and its May highs around $65,500, further short-term upside could follow. The next levels to watch would be the late-April highs around $67,000, with a retest of yearly highs in the $73,000 area as the subsequent target.

The latest U.S. CPI data has significantly impacted the market, with Bitcoin experiencing a notable price surge. Investors are optimistic about potential shifts in the Federal Reserve’s monetary policy, contributing to gains in both the stock and cryptocurrency markets.

As Bitcoin approaches critical technical levels, its performance in the coming days will be crucial for determining its short-term trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.