This guide will examine what bonds are, their different types, how they work, and the pros and cons involved with this particular investment product.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

What are Bonds?

When investors buy bonds, they lend to the issuer (the debtor), which may be a government, municipality, or corporation. In return, the debtor promises to pay the bondholders (creditors) a specified interest rate during the bond’s life and to repay the principal, i.e., the face value of the bond, at an agreed-upon time when it matures.

Investors purchase bonds because they provide a safe, stable and predictable income stream and can offset the dangers posed by volatile but higher-yielding stocks and other riskier portfolio assets. Additionally, bonds are attractive to investors since they provide regular interest payments until their original capital is returned.

Bonds are fixed-income investments, a class of assets and securities that pay out a set level of cash flows to investors, usually in the form of fixed interest or dividends.

Recommended video: Investing basics: Bonds

Beginners’ corner:

- What is Investing? Putting Money to Work

- 17 Common Investing Mistakes to Avoid

- 15 Top-Rated Investment Books of All Time

- How to Buy Stocks? Complete Beginner’s Guide

- 10 Best Stock Trading Books for Beginners

- 15 Highest-Rated Crypto Books for Beginners

- 6 Basic Rules of Investing

- Dividend Investing for Beginners

- Top 6 Real Estate Investing Books for Beginners

- 5 Passive Income Investment Ideas

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Bonds: Key terms

The essential bond features include:

- Face value: Otherwise referred to as par value, face value is the dollar value of the bond at maturity. Furthermore, it is the reference amount for calculating interest payments due to bondholders. Most commonly, bonds have a face value of $1,000;

- Premium: When a bond is purchased for more than its face value;

- Discount: When a bond is purchased for less than its face value;

- Maturity date: The date on which the bond will mature, and the issuer will pay the holder the face value of the bond. Bonds can have short (1-5 years), medium (5-10 years), or long-term (10+ years) maturities;

- Coupon: The fixed interest rate the bond issuer pays its bondholders, expressed as a percentage. For instance, a 3% coupon rate means that bondholders will receive 3% x $1,000 face value = $30 every year;

- Coupon dates: The dates the bond issuer makes coupon payments. Although coupon payments can be made at any interval, the standard is semiannual;

- The issue price: The price at which the bond issuer initially sells the bonds. In most cases, bonds are issued at face value;

- Duration: The sensitivity to changes in bond values as market interest rates fluctuate. Duration expresses how much a bond’s price will increase or decrease with a change in interest rates. Experts believe that a bond will fall 1% in price for every 1% rise in interest rates. The longer a bond’s duration, the higher its price exposure to changes in interest rates;

- Convexity: This is a measure of the curvature in the relationship between bond prices and bond yields, demonstrating how the duration of a bond changes as the interest rate changes;

- Rating: Rating agencies assign ratings to bonds and bond issuers based on their creditworthiness. These help investors understand the risk of particular bonds. Typically, investment-grade bonds carry ratings of BBB or greater;

- Yield: The return an investor realizes on a bond. The current yield is the bond’s coupon rate divided by its market price. Price has an inverse relationship to yield, i.e., as the price of a bond goes up, its yield goes down;

- Principal: The amount of money the bond issuer agrees to pay the bondholder when the bond matures.

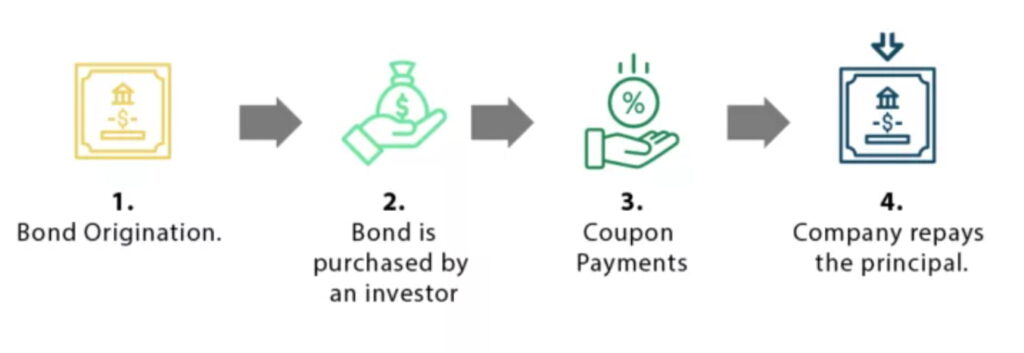

How do bonds work?

When governments and other entities need to raise capital to finance new projects, support ongoing operations, or refinance existing loans, they may issue bonds to investors. The bonds issued include the terms of the loan, coupon payments, and the maturity date at which the principal must be returned. The coupon payments are part of the bondholders’ return for loaning their funds to the issuer.

The initial price of most bonds is usually set at par, or $1,000 face value for an individual bond. The current market price of a bond depends on several factors, including the issuer’s credit quality, the length until maturity, and the coupon rate compared to the current interest rate environment. The face value of the bond is what will be returned to the borrower once the bond matures.

The initial bondholder can sell most bonds to other investors after they have been issued. In short, a bond investor does not have to hold a bond until its maturity date. It is also typical for bonds to be repurchased by the issuer if interest rates decline or if their credit has improved, and they (issuer) can reissue new bonds at a lower cost.

Different types of bonds by the issuer

There are a variety of bond types. In the U.S., depending on the entity that issues them, investment-grade bonds can be broadly classified into four primary categories:

- U.S. Treasury bonds;

- Agency bonds;

- Municipal bonds;

- Corporate bonds.

These four types of bonds also feature differing tax treatments, which is a crucial consideration for bond investors. However, investors may also encounter foreign bonds issued by global corporations and governments on some platforms.

#1 U.S. Treasury bonds

U.S. Treasury bonds (Treasuries) are considered the safest possible bond investments. They are the safest since the United States government guarantees them, which unfortunately also means they offer the lowest return, and payments may not keep pace with inflation.

These bonds are used to set the rates for all other long-term, fixed-rate bonds. The Treasury sells them at auction to fund the federal government’s operations. These securities are also resold on the secondary market.

Treasuries are owned by almost every institutional investor, corporation, and sovereign wealth fund. Investors have to pay federal income tax on interest from treasuries, but the interest is generally exempt from state tax.

Basic features of Treasury securities:

- Treasury bills (T-bills) have maturities of 1 year or less. Unlike most other bonds, T-bills don’t have coupon payments. Instead, they’re sold at a discount, i.e., investors purchase them for less than face value but get the total face value back when the bond reaches its maturity date;

- Treasury notes (T-notes) have maturities between 2 years and ten years;

- Treasury bonds (T-bonds), also referred to as the long bond, typically mature in 30 years;

- Treasury Inflation-Protected Securities (TIPS) have returns that fluctuate with inflation in order to maintain their real value;

- Saving bonds are issued at a discount and do not pay regular coupon interest.

#2 Government agency bonds

Government agency bonds are issued by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac. These bonds are generally high-quality and very liquid, although returns may not keep up with inflation. In addition, since the U.S. government fully backs agency bonds, they are almost as safe as treasuries.

Most government agency bonds are taxable at the federal as well as state levels.

#3 Municipal bonds

Municipal bonds (also known as “munis” or “muni bonds”) are issued by states and other municipalities. They’re generally safe because the issuer can raise money through taxes, but they are not as secure as U.S. government bonds, and the issuer can default.

Interest from municipal bonds is free from federal income tax as well as state tax in the issuer state. As a result, yields are typically lower than those of federally taxable bonds.

#4 Corporate bonds

Corporate bonds are issued by companies. In many cases, companies issue bonds rather than seek bank loans for debt financing because bond markets offer more profitable terms and lower interest rates. Because they are riskier than government-backed bonds, their yields are typically higher.

Interest from corporate bonds is taxable at both the federal and state levels.

There are three types of corporate bonds:

- Junk bonds: Corporate bonds from companies with a significant chance of defaulting. They offer beefier interest rates to offset the risk;

- Preferred stocks: A class of stock that acts like bonds because they pay investors a fixed dividend at regular intervals. Additionally, they are slightly safer than stocks in case of insolvency. Preferred stockholders get reimbursed before common stockholders but after bondholders;

- Certificates of deposit (CD): A savings product that is similar to bonds issued by your bank. Essentially, you are lending the bank your money for a specific time for a guaranteed fixed rate of return.

Different types of bonds by features

Bonds can be further classified by the rate or type of interest or coupon payment, by being recalled by the issuer, or by certain other features. These types of bonds are some of the most common variations:

Zero-Coupon Bonds

Zero-coupon bonds (Z-bonds) type bonds do not make periodic coupon payments and instead are issued at a discount to their par value and repaid the total face value at maturity. For example, U.S. Treasury bills are zero-coupon bonds.

Convertible Bonds

Convertible bonds pay fixed-income interest payments but can also be converted into shares of the issuing company’s stock. The conversion from the bond to stock happens at specific times during the bond’s life and is usually at the bondholder’s discretion. It is a type of hybrid security with features of a bond, such as interest payments, as well as the option to own the underlying stock.

Callable Bonds

A callable bond, also known as a redeemable bond, is a bond that the issuer may redeem before maturity. This type of bond allows the issuing company to pay off its debt early and benefit from favorable interest rate drops (if market interest rates move lower, the company can re-borrow at a more beneficial rate). If a callable bond is called, the bond will have a lower overall income for the holder. As a result, investors of these bonds are compensated with more attractive coupon rates than on otherwise similar non-callable bonds.

Puttable Bond

A puttable bond allows bondholders to demand early principal repayment from the issuer, which is valuable for investors worried that a bond may decline in value in the case of rising interest rates.

The embedded put option incentivizes bondholders to purchase a bond with a lower coupon rate. A puttable bond typically trades at a higher cost than a bond without a put option but with the same maturity, credit rating, and coupon payments since it is more valuable to the investors.

What is a bond rating?

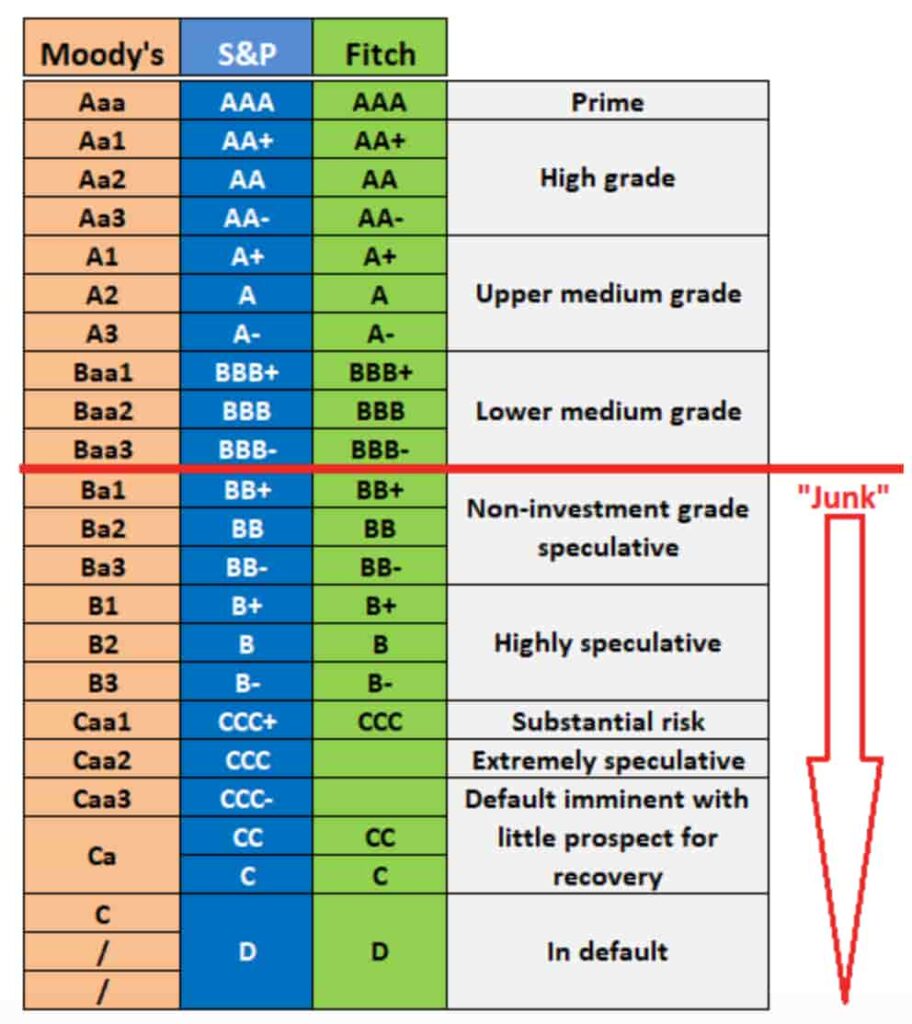

The credit quality of bonds is assessed through bond ratings. These ratings typically allocate a letter grade to bonds indicating their credit quality.

Bond credit rating scales help investors understand the default risk involved with their bond investments. They also indicate the likelihood that the issuer can reliably pay investors the bond’s coupon rate.

Bond ratings

Higher-rated bonds, referred to as investment grade bonds, are considered safer investments and include debt issued by the U.S. government and other stable corporations, such as many utilities.

These bonds come with “AAA” to “BBB-“ratings from Standard and Poor’s and “Aaa” to “Baa3” ratings from Moody’s. For example, U.S. Treasury bonds (T-bonds) are the most common AAA-rated bond securities. Typically, the higher a bond’s rating, the lower the coupon needs to be because of the lower risk of default by the issuer.

Non-investment grade bonds (also known as junk or high-yield bonds) usually carry Standard and Poor’s ratings of “BB+” to “D” or “Baa1” to “C” for Moody’s. Since these bonds have a higher risk of default, investors demand a higher coupon payment to compensate them for that risk. In addition, bonds with a very long maturity date usually pay a higher coupon rate since the bondholder is more exposed to interest rates and inflation hikes for an extended period.

Although bonds carrying these ratings are deemed speculative investments, they attract particular investors drawn to the high yields they offer.

In fact, the bonds the agencies gave their highest ratings to included over three trillion dollars of mortgages to lenders with bad credit and undocumented incomes through 2007. For example, in 2008, Moody’s downgraded 83% of $869 billion in MBSs, which were given a rating of “AAA” just the year before.

Understanding bond pricing

The leading influences on the price of a bond on the open market are supply and demand, maturity date, and credit quality.

Supply and demand

Supply and demand influence the prices of all securities, including bonds. Bonds are allocated a set face value and trade at par when the current price equals the face value. Bonds priced above face value are considered to trade at a premium, while bonds priced below their face value are said to trade at a discount. For example, a $900 face value bond selling at $800 is trading at a discount.

Because the interest paid on bonds is fixed, those priced lower have heftier yields. Therefore, they are more attractive to investors if all other factors are similar. For instance, a $1,000 par value bond with an 8% interest rate pays $80 in annual interest regardless of the current trading price because interest payments are fixed. When that bond trades at $800, that $80 interest payment creates a present yield of 10%.

Maturity date

The lifetime of a bond relative to its maturity also influences pricing. Generally, bonds are paid in full when they mature, although some may be called and others default. Because the investor is closer to obtaining the face value as the maturity date nears, the bond’s price moves toward par as it ages.

When the yield curve is normal, long-term bonds have a higher yield (higher interest rates and lower prices) than short-term bonds of the same credit quality. The leading reason is that longer-term bonds are exposed to more risk, such as changes in interest rates and increased exposure to potential defaults, since there is more time for drops in credit quality and firms to default.

Credit quality

A bond issuer’s overall credit quality considerably influences bond prices during and after issuance. Initially, companies with lower credit quality will have to offer higher coupon payments to compensate for higher default risk.

After the bond is issued, however, inferior creditworthiness will also generate a fall in price on the secondary market. Ultimately, as mentioned above, lower bond prices mean higher bond yields, neutralizing the increased default risk indicated by lower credit quality.

Investors rely on bond ratings to measure the creditworthiness and safety of the bonds. For example, because bonds with low ratings have less chance of repayment by the issuer, the prices for these bonds are also lower.

Bond prices and interest rates

Bonds are inversely correlated to interest rates, i.e., once interest rates rise, bond prices typically fall, and vice-versa.

Most bonds offer a fixed interest rate which becomes more attractive if interest rates decline, pushing up demand and the bond’s price. On the other hand, once interest rates increase, investors will no longer favor the lower fixed interest rate offered by a bond, resulting in a fall in its price.

Recommended video: How the Fed Steers Interest Rates to Guide the Entire Economy

Example of how interest rates affect bond prices

However, the original bond becomes more valuable if interest rates drop and similar bonds get listed for a 3% coupon. As a result, investors who want a better coupon rate will have to pay more for the security to incentivize the original bondholder to sell. The inflated value will bring the bond’s total yield down to 3% for new investors since they will have to pay an amount higher than the par value to acquire the bond.

Conversely, if interest rates increase and the coupon rate for bonds like this rises to 5%, the 4% coupon is no longer attractive. Instead, the bond’s price will decrease and sell at a discount compared to the par value until its effective return is 5%.

How to buy bonds?

If you are wondering how to buy bonds, investors can invest in bonds by buying new issues, purchasing bonds on the secondary market, or buying bond mutual funds or exchange-traded funds (ETFs).

Here are the main ways to purchase bonds:

- Through a broker: Bonds can be purchased through an online broker. Through this approach, you’ll buy bonds from the secondary market, i.e., from other investors looking to sell. That’s why, when buying individual bonds, you should buy new issues directly from the underwriting investment bank in an initial bond offering whenever possible since you’re getting them wholesale;

- Through an exchange-traded fund: Bond ETFs generally buy bonds from various companies, and investors can choose from funds focused on short-, medium-, and long-term bonds or funds that provide exposure to particular industries or markets. A fund is an excellent option for individual investors because it allows immediate diversification, and an opportunity to invest in small increments;

- Straight from the U.S. government: The federal government has set up a program on the Treasury Direct website so investors can buy government bonds directly without paying a fee to a broker or intermediary.

How are bonds taxed?

When investing in bonds, it’s important to keep an eye on the tax implications, as they can have a big impact on your overall returns. Here are key points to keep in mind:

- Interest income: The interest income from most bonds, such as corporate bonds, is typically subject to federal income tax and, in some cases, state and local taxes. However, municipal bonds are generally exempt from federal taxes, and if purchased in your home state, they may also be exempt from state and local taxes;

- Capital gains: If you sell a bond before it matures at a profit, the gain is subject to capital gains tax. The tax rate depends on how long you held the bond: short-term capital gains (for bonds held less than a year) are taxed at your ordinary income rate, while long-term gains (for bonds held over a year) are taxed at a lower rate;

- Original issue discount (OID): Bonds issued at a discount, such as zero-coupon bonds, involve a special tax consideration called Original Issue Discount. The difference between the bond’s issue price and its face value is taxable income, even though you don’t receive the payment until the bond matures. This tax treatment can be complex, so consulting a tax professional is advisable.

Bonds investment strategies

The primary concern in purchasing bonds is whether interest rates are going up or down. If they rise, then the value of your bonds falls. If rates decrease, the value of your bonds increases. Additionally, bondholders are concerned with reinvestment risk, i.e., if they’ll be able to earn a handsome return once their bond matures.

There are various bond investment strategies to optimize your income from your portfolio and tailor it to your anticipated needs. The following are among the most popular:

Bond ladder strategy

With this method; investors buy bonds with staggered maturities (e.g., bonds that mature in one, two, three, four, and five years).

Consequently, once a bond matures, it’s reinvested in a longer maturity at the top of the ladder. Bond ladder strategy helps minimize reinvestment risk without giving up too much return today. So, if rates rise in the future, investors can seize some of that rise.

Bond barbell strategy

With bond barbell strategy, an investor buys short-term and long-term bonds but doesn’t buy medium-term bonds. This method allows the investor to capture the higher yields on long-term bonds while preserving their access to cash with lower-return short-term bonds. However, investors should remember that long-term bonds fluctuate considerably when interest rates increase.

Bullet bond strategy

By the bullet bond method, the investor buys bonds that have roughly simultaneous maturities. So, for instance, if an investor knows they have a significant expense in five years, they can purchase a five-year bond now and then a four-year bond when they have more cash next year. Then, in three years, they can add a two-year bond. And so, at the end of the original five-year period, they’ll have all the money available at the time when they require it.

Are bonds a good investment?

When looking for long-term and relatively low-risk investments, bonds can be your answer, yet there are certain risks involved. So if you are wondering if bonds are a good investment, here are some of the main pros and cons of investing in bonds:

Pros

- Low-risk: Bonds are relatively safe investments, and their values don’t fluctuate like stock prices. Furthermore, you can’t lose your investment unless the issuer defaults;

- Stable income: Bonds offer a predictable income stream through the repayment of your principal at maturity and fixed interest payments;

- Potential for resale profit: Sometimes, bond traders bid up the bond’s price beyond its face value, giving you the chance to sell the bond at a higher price than you bought it;

- Diversification: Bonds perform differently as investments than stocks, which helps reduce a portfolio’s long-term volatility. Holding a variety of securities in your portfolio reduces your financial risk.

Cons

- Low return: The trade-off for less risk is less return. The return on investment you’ll get from bonds is substantially lower than what you’ll get with stocks;

- Dependency on interest rates: Because bonds are a relatively long-term investment, you’ll face the risk of interest rate changes. For example, if interest rates rise, the value of your bonds falls;

- Risk of issuer default: Companies can default on bonds. Precisely why it’s imperative to check the issuer’s credit ratings;

- May not outperform inflation: Because bonds pay a fixed return, their value can decline if inflation moves up substantially.

In conclusion

Bonds can deliver an attractive return without requiring that you take on the same level of risk as investing in the stock market. However, while bonds are relatively low risk, they have some weak areas, particularly when inflation and interest rates increase. But employing some innovative investing strategies can help mitigate these risks.

If you’re the risk-averse type, bonds might be a more suitable investment for you than stocks. But, at the same time, if you’re heavily invested in stocks, bonds are an excellent way to diversify your portfolio and protect it from market volatility.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about bonds

What are bonds?

Bonds are debt instruments issued by companies or governments converted into tradable assets. An individual bond is a fragment of a massive loan. Essentially, bonds are a way for companies and governments to raise capital. When investors buy bonds, they lend to the issuer, who, in return, promises to pay the lender a specified interest rate during the bond’s life and to repay the principal at an agreed-upon time.

What's the difference between bonds and stocks?

Stocks give shares of ownership in a company, while bonds are a loan from you to a corporation or government. The most significant difference is how they generate profit. Stocks must appreciate in value and be sold later on the stock market. At the same time, bonds generate money for holders by paying a fixed interest amount semi-annually, plus the principal, which is paid at maturity.

Who are bond issuers?

Bonds are issued by federal, state, and local governments, agencies of the U.S. government, and corporations. Investment-grade bonds can be broadly classified by their issuers into four primary categories: U.S. Treasury, agency, municipal, and corporate.

Are bonds a good investment?

Investment grade bonds can be excellent for risk-averse investors looking for stability and a reliable income stream in the form of a fixed rate of interest that’s paid semiannually until the bond matures. Importantly, bonds are an essential component of an investment portfolio’s asset allocation, helping absorb some of the uncertainty and volatility of equity markets. But ultimately, the percentage you sign for bonds in your portfolio will depend on your risk tolerance and particular situation.

What are the risks involved with investing in bonds?

Bonds are generally considered safe, particularly those of investment grade, but they do carry risks. Interest rate risk affects bond prices negatively when interest rates rise, diminishing the appeal of older bonds. Inflation can erode the actual value of bond payments. Reinvestment risk emerges when bond income has to be reinvested at a lower return. Additionally, call risk arises when issuers prematurely redeem bonds, possibly leading to lower future interest payments. Finally, default risk, the chance of an issuer failing to meet bond payments, necessitates careful risk assessment in bond investment strategies.

How to cash in savings bonds?

To cash in savings bonds, you can either redeem electronic bonds via your TreasuryDirect account or cash paper bonds at a bank where you have an account. It’s important to note that cashing bonds within five years of issuance results in losing the last three months of interest. Bonds earn interest for up to 30 years, so consider the timing of redemption. For more detailed information, visit TreasuryDirect or consult your bank.

How much is a $100 savings bond worth after 30 years?

A $100 Series EE savings bond, assuming it was issued after May 2005 with a fixed interest rate of approximately 0.10%, would be worth around $202 after 30 years. The value doubles after the first 20 years, as guaranteed by the U.S. Treasury for these bonds, and then continues to accrue interest at the fixed rate for the next 10 years.

Are treasury bonds better than CDs?

Choosing between Treasury bonds and CDs depends on your financial goals and risk tolerance. Treasury bonds, backed by the U.S. government, offer higher safety and potential for better yields, especially for longer terms, and have tax advantages on state and local taxes. CDs, insured by the FDIC, provide fixed, stable returns with flexible terms but include penalties for early withdrawal and are fully taxable. While Treasury bonds are suitable for long-term, low-risk investments, CDs are preferable for short-term goals with guaranteed returns.

What are the 5 types of bonds?

Bonds come in various types, each offering different risk, return, and purpose. The 5 most common types of bonds are Government Bonds issued by national governments, Municipal Bonds from local entities offering tax advantages, Corporate Bonds with higher yields from companies, Agency Bonds from government-affiliated organizations, and Savings Bonds, which are safe, non-marketable U.S. government securities.

How to calculate interest expense on bonds?

To calculate interest expense on bonds, multiply the bond’s face value by its coupon rate. For example, a $1,000 bond with a 5% coupon rate would incur a yearly interest expense of $50 ($1,000 x 0.05). For semi-annual payments, divide this amount by two.

Why are my bonds losing money?

Your bonds might be losing money due to rising interest rates, which can decrease bond prices. Additionally, if you sell bonds before they mature, you could face losses if market prices have dropped. Inflation and credit risk can also impact bond values.

Can you lose money on bonds if held to maturity?

No, if you hold bonds to maturity, you generally won’t lose money on the principal unless the issuer defaults. However, if the bond is inflation-adjusted or tied to variable interest rates, its value may be impacted over time.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.