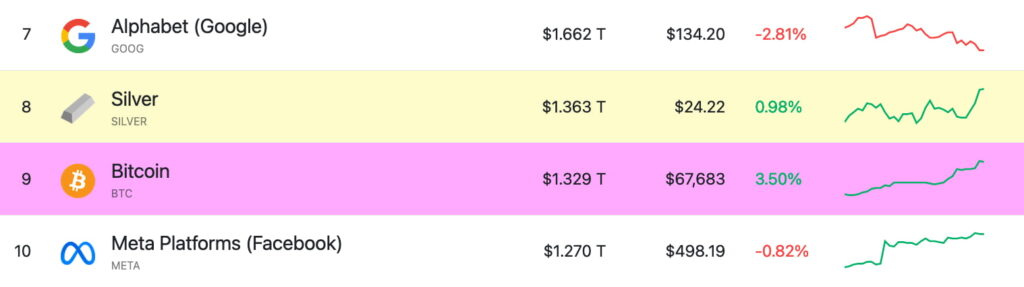

Bitcoin (BTC) is on a rally, nearing its all-time high price of $69,000 while ranking among the top 10 highest capitalization just behind Silver.

On that note, Bitcoin and Silver are the 8th and 9th most valuable assets globally, according to CompaniesMarketCap data. Notably, they have a $1.363 trillion and $1.329 trillion market cap, respectively. Just behind Google’s parent company, Alphabet Inc (NASDAQ: GOOG) with $1.662 trillion.

Silver’s market cap: A look at the second-largest commodity

Besides being the 8th most valuable asset in the world, Silver is also the second-largest commodity, losing only to Gold. However, Bitcoin threatens this position, which many experts consider a digital commodity.

Interestingly, Silver has been trading in a consolidation range since October 2022. The commodity lost a local high at $30.09 per ounce in 2021, showing a neutral momentum since then.

Previously, it reached an all-time high at $49.83 per ounce in 2011, breaking the $48 price record from 1980.

Silver Institute forecasts the commodity will reach a demand of 1.2 billion ounces in 2024, the second-highest level recorded. Meanwhile, the artificial intelligence (AI) Grok predicts Silver will trade between $28 and $32 by the end of 2024. This would result in 15% to 32% gains from the current price of $24.22 per ounce.

On Tuesday, silver attracted some dip-buying between $23.65-$23.60 and flirted with its year-to-date top after recovering from an intraday fall. The technical situation favors optimistic traders and provides hope for more increases. However, a sustained decline below $23.00 will invalidate the optimistic outlook.

Bitcoin all-time high: Can BTC surpass Silver’s market cap?

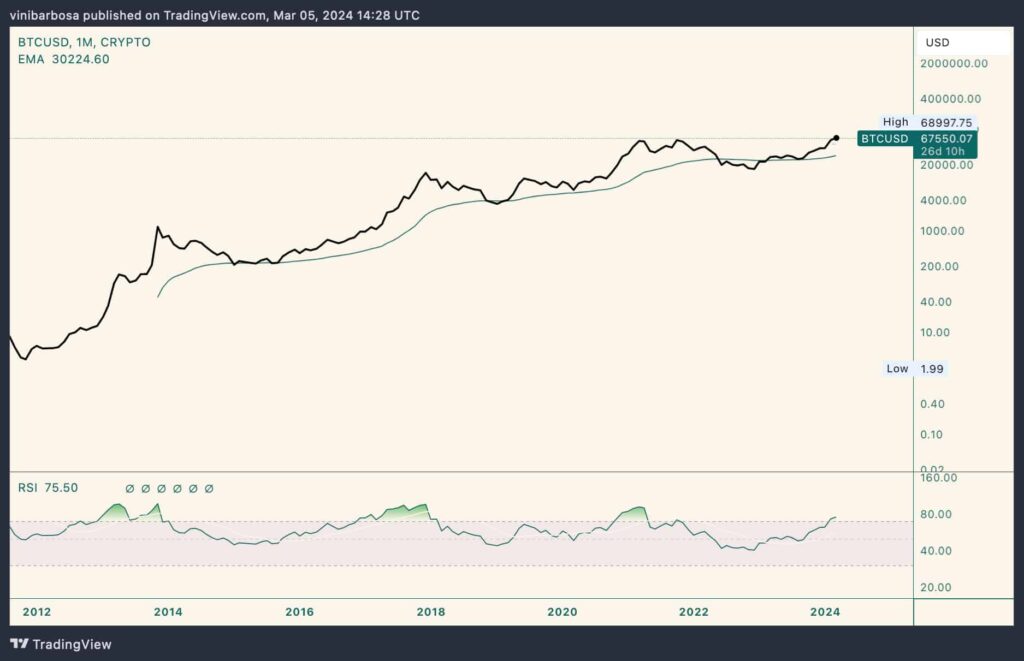

On the other hand, Bitcoin flirts with its all-time high price of $69,000, just slightly below the strong resistance.

It is worth noting that Bitcoin’s circulating supply has increased since the record price in 2021. Therefore, a $69,000 unitary price would result in a higher capitalization than before. In particular, the cryptocurrency would see a $1.355 trillion market cap at these prices, considering a 19.645 million BTC.

All things considered, Bitcoin would need to break from its all-time high to take Silver’s place as the second-largest commodity and 8th most valuable asset in the world. Nevertheless, BTC’s open interest and funding rates are reaching record highs, which could threaten a correction in the short term.

As usual, investors must be cautious and understand the inherent volatility of speculative assets like cryptocurrencies and commodities.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.