As the majority of assets in the cryptocurrency sector are making significant strides that have pushed its total market capitalization back above $2 trillion, its representative, Bitcoin (BTC), is leading the charge with the highest price since December 2021 and more massive gains incoming.

Indeed, at $1.11 trillion, Bitcoin alone accounts for nearly half of the industry’s market cap and is on the “parabolic trajectory” toward its price hitting $200,000 rather soon, according to the observations shared by crypto and stocks analyst Gert van Lagen in an X post published on February 27.

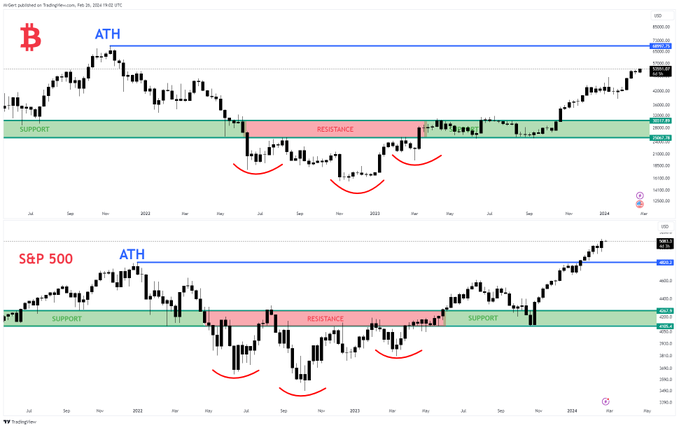

Specifically, van Lagen explained that the flagship decentralized finance (DeFi) asset has been on this bullish trajectory since November 2022, following all of the five steps, i.e., “subwaves,” historically consistent with its previous parabolic moves, and toward a sell point at $210,000 after its next halving.

Furthermore, the expert noted that the price of Bitcoin “has already surged significantly beyond the 78.6% Fibonacci retracement level of the previous bear market, which only occurred post-halving in the past,” adding that breaching this point typically leads to an immediate parabolic take-off.

In other words, the maiden digital asset might not even wait for its halving event sometime in April 2024 in order to make this massive move upward and reach the new all-time high (ATH) well beyond its previous record of $69,000 it hit in November 2021.

Bitcoin vs. stocks

On top of that, van Lagen noted that the price movement of the currently largest asset in the crypto sector by market cap “also neatly aligns with the escalating risk-on sentiment, which is approaching [‘fear of missing out’ (FOMO)] levels in the stock market atm.”

As he highlighted, there has been a strong structural correlation between Bitcoin and the S&P 500 since the end of 2021, and the stock index has been making its ATHs “already for several weeks in a row,” illustrating his point at side-by-side chart patterns of both.

Bitcoin price analysis

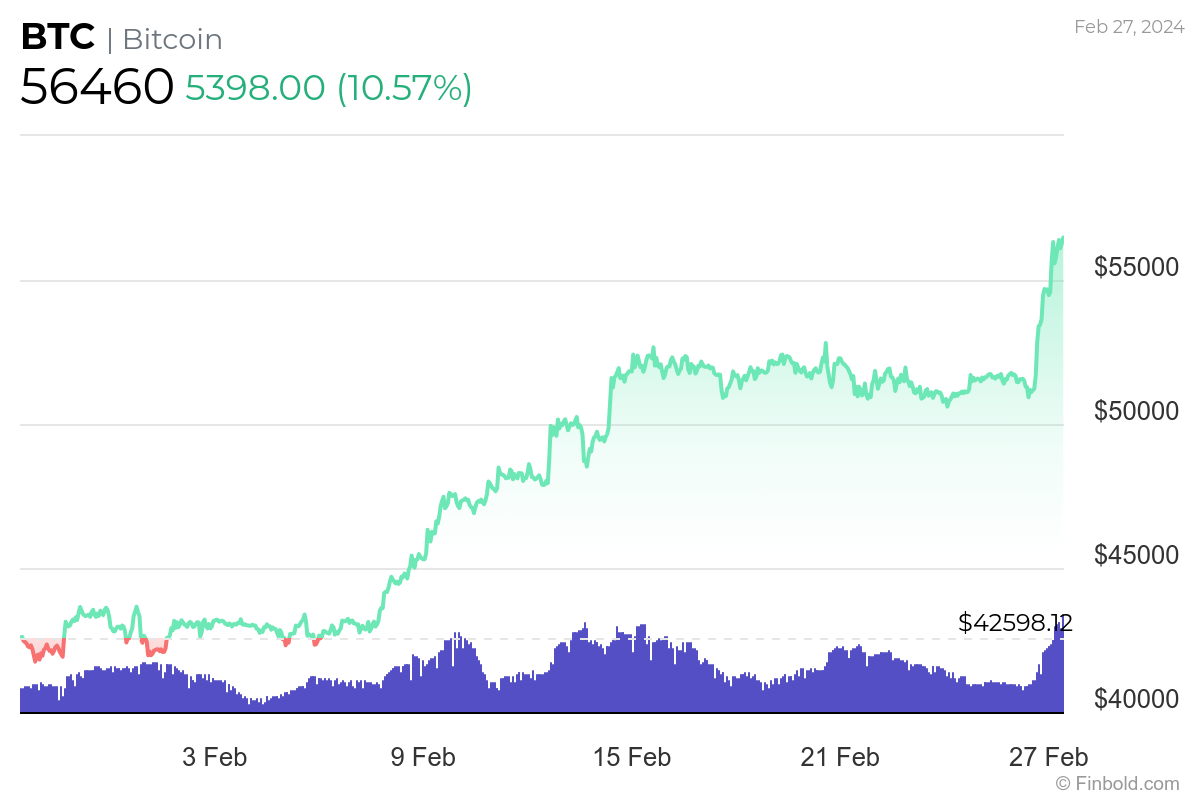

Meanwhile, Bitcoin was at press time trading at $56,460, up 10.57% on the day, as well as recording a gain of 9.03% across the past week, adding up to the accumulated advance of 32.93% in the last month, as per the most recent data retrieved by Finbold.

All things considered, numerous indicators suggest Bitcoin is in for a massive rally in the next few months, perhaps even surpassing the $200,000 price point and proving the expert right. However, it is important to keep in mind that things in this sphere can change on a whim, so caution is warranted.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.