Despite prevailing bearish sentiments surrounding Bitcoin (BTC), a trading expert has noted that there remains a chance for the asset to rally in the short term.

In an insightful analysis shared on June 21 on TradingView, Alan Santana examined the Bitcoin monthly chart, revealing mixed signals for investors.

Despite previous bullish trends, recent movements have shown concerning signs. Last month, Bitcoin’s price closed below the peak of November 2021, suggesting a struggle to surpass previous highs.

The expert noted that this month started bullishly, evident from the long upper shadow on the session, but it has turned bearish in the second half. At the same time, Bitcoin has been plagued by low trading volume, indicating a lack of new players entering the market, which could imply reduced enthusiasm.

Next step for Bitcoin price movement

Santana’s analysis further highlighted the unprecedented nature of Bitcoin’s three-month sideways period following an all-time high. This deviation from past patterns suggests the market could swing in any direction. Santana estimated an 80% probability that Bitcoin will face a correction before reaching new highs, indicating limited room for growth in the near term.

However, despite the bearish signals, Santana noted a 20% chance that Bitcoin could defy the odds and surge to $100,000 or even $150,000. He emphasized the importance of being prepared for all outcomes rather than relying solely on hope.

“The chart shows little room for growth yet it is still a possibility. We would say 80 percent probability for a correction before a new high, with a 20% a probability to continue forever up; 100K, 150K,” the analyst said.

Although dominated by bearish sentiments, the general market consensus is that Bitcoin is likely to rally, with $100,000 remaining a possible target. In the meantime, bearish sentiments are also reflected in the asset’s on-chain data.

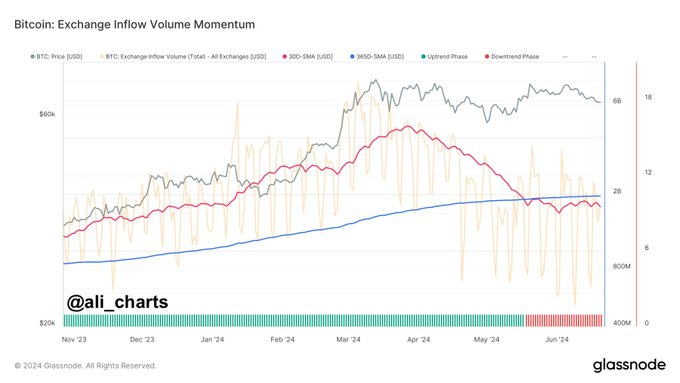

For instance, data shared by crypto analyst Ali Martinez on June 21 indicated a significant downturn in exchange-related on-chain activity for Bitcoin, signaling a drop in investor interest.

Overall, Bitcoin’s volatility is influenced by significant market events, such as the German government’s Bitcoin movement. Earlier in the week, Bitcoin showed stability around $66,000, followed by a sharp decline below $63,000.

Bitcoin price analysis

As of press time, Bitcoin was trading at $64,267, having gained almost 1% in the last 24 hours. On the weekly chart, Bitcoin is down over 3%.

Currently, $64,000 is a crucial support for cryptocurrency. The next possible target is the $65,000 resistance mark, which could anchor the next high. Conversely, dropping below $64,000 could lead Bitcoin to fall to $60,000.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk. Like (166)